The Power of Dollar-Cost Averaging: Building Wealth Over Time

Dollar-cost averaging (DCA) is an investment strategy where you consistently invest a fixed amount of money at regular intervals, regardless of market conditions, which helps minimize risks and reduces the emotional stress of market volatility. This method allows investors to purchase more shares when prices are low and fewer when prices are high, smoothing out price fluctuations and encouraging a disciplined, long-term approach to wealth building. By automating contributions into a diversified portfolio, DCA not only fosters sound financial habits but also leverages the power of compounding for substantial growth over time, making it an effective strategy for both new and seasoned investors.

Investing can feel like walking a tightrope—one wrong move and you might find yourself financially off-balance. But what if there was a strategy that helped you stay steady, even when the market is full of ups and downs? Enter dollar-cost averaging (DCA). If you're new to investing or have been around the block a few times, this method might be your ticket to building wealth without the constant anxiety of trying to time the market.

Dollar-cost averaging is all about consistency. Instead of fretting over when to invest your money, you put a fixed amount into your investments at regular intervals, come rain or shine in the market. This might sound simple, but it’s a powerful tool for smoothing out the ride and fostering a disciplined approach to growing your nest egg over the long haul. Let’s dive into how DCA works, its benefits, and why it could be just the strategy you need to meet your financial goals.

Understanding the Mechanics of Dollar-Cost Averaging

At its core, dollar-cost averaging involves investing a set amount of money into a particular asset, such as stocks or mutual funds, on a regular schedule—say monthly or quarterly. The beauty of this approach is that it takes the guesswork out of investing. You don’t have to worry about whether the market is up or down; you’re investing consistently over time.

When prices are low, your fixed investment buys more shares, and when prices are high, it buys fewer. This methodical approach can result in purchasing shares at an average cost over time, potentially lowering the overall price you pay per share compared to buying all at once. For instance, if you invest $500 every month in a mutual fund, you'll naturally end up buying more shares when the market dips and fewer when it peaks.

Think of it as a way to embrace market volatility rather than fear it. By sticking to a regular investment schedule, you avoid the emotional rollercoaster that comes with trying to predict market movements, which, as studies show, even the experts get wrong more often than not.

Minimizing Risk and Emotional Stress

One of the standout benefits of dollar-cost averaging is its ability to reduce investment risk. Markets are notoriously unpredictable, and even seasoned investors can find themselves caught out by sudden downturns. DCA mitigates this risk by spreading your purchases over time, rather than making a lump-sum investment at possibly the wrong moment.

This strategy also helps keep your emotions in check. Let's face it, watching the market can be stressful. The constant flux can lead to impulsive decisions based on fear or greed—neither of which typically ends well. By committing to a regular investment schedule, you can sidestep the emotional pitfalls that trip up many investors and focus instead on the long-term growth of your portfolio.

As financial advisor Jane Smith notes, "Dollar-cost averaging is like setting your investments on autopilot. It allows you to focus on your life and long-term goals rather than daily market swings." This hands-off approach can be particularly beneficial for those new to investing, providing a framework that encourages patience and discipline.

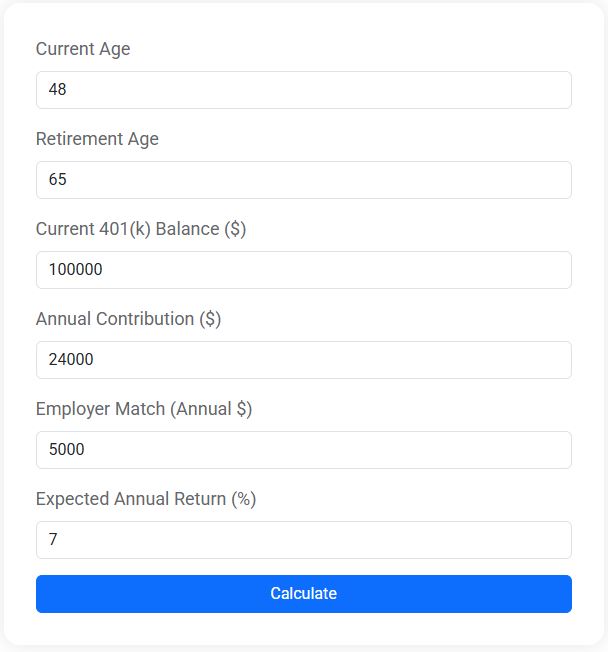

401(k) Retirement Calculator

Wondering how much your 401(k) will be worth when you retire? Our free 401(k) Retirement Calculator helps you estimate your future savings based on your current balance, annual contributions, employer match, and expected rate of return. Whether you're just getting started or already building your nest egg, this tool gives you a clear picture of how your retirement account can grow over time.

Harnessing the Power of Compounding

Beyond risk management and emotional stability, DCA leverages the magic of compounding to build wealth over time. By regularly investing, even modest amounts, you allow your money to grow exponentially. Each investment contributes to the base on which future returns are earned, effectively earning interest on your interest.

Consider this example: Suppose you start investing $200 a month at age 25 in an account that grows by an average of 7% per year. By the time you turn 65, you could have over $500,000, thanks to the power of compounding. The earlier you start, the more time your money has to grow, making DCA an excellent strategy for young investors looking to build a solid financial foundation.

This approach isn't just for the young or new to investing, either. Even seasoned investors can benefit from the discipline and growth potential that dollar-cost averaging offers, especially when paired with a diversified portfolio.

Implementing Dollar-Cost Averaging in Your Investment Strategy

So, how do you get started with dollar-cost averaging? First, decide on the amount you can comfortably invest at regular intervals. This should be a figure that doesn't strain your finances and allows you to continue contributing even during tougher times.

Next, choose your investments wisely. A diversified portfolio is key to weathering market fluctuations, so consider spreading your investments across different asset classes. Mutual funds, ETFs, and index funds are popular choices for those utilizing DCA due to their inherent diversification.

Finally, set up an automatic investment plan with your brokerage or financial institution. This automation ensures you stick to your plan, removing the temptation to skip contributions when the market appears unfavorable.

Remember, the goal of dollar-cost averaging isn't to beat the market but to ensure steady, disciplined contributions to your investment portfolio. Over time, this can lead to significant wealth accumulation, particularly when combined with the benefits of compounding.

Real-World Success Stories and Insights

To illustrate the impact of dollar-cost averaging, consider the story of Tom, a retired engineer who began investing in his company's 401(k) plan in his mid-20s. Tom allocated a portion of his paycheck to his investment account every month, regardless of market conditions. Over the years, Tom's consistent contributions and the compounding effect allowed him to retire comfortably with a seven-figure portfolio.

According to CNBC, many financial experts agree that the predictability of DCA can be a game-changer for investors who might otherwise be paralyzed by indecision or overwhelmed by market volatility. It promotes a habit of regular saving and investing, key components of financial success.

While DCA isn't a guarantee against loss, especially in a prolonged market downturn, it has proven to be a reliable strategy for mitigating risk and building wealth over time. As with any investment approach, it's essential to align your strategy with your individual financial goals and risk tolerance.

In the end, the true power of dollar-cost averaging lies in its simplicity and effectiveness. By committing to a regular investment schedule, you can navigate the markets with confidence, knowing that each contribution builds toward your financial future. Whether you're just starting on your investment journey or looking to refine your strategy, DCA offers a time-tested path to growing your wealth with less stress and more peace of mind.