7 Smart Ways to Invest Your Tax Refund for Future Financial Security

As tax refund season rolls around, instead of indulging in immediate pleasures, consider using the refund to bolster your financial future. Paying off high-interest debt, building an emergency fund, contributing to retirement accounts, starting or enhancing an investment portfolio, or investing in personal development are all smart strategies to secure long-term financial stability. These choices can significantly enhance your financial well-being and help you achieve your long-term financial goals.

As tax season approaches, many of us are anticipating that magical moment when a tax refund lands in our bank accounts. It's like a mini windfall, a chance to treat ourselves to something special. But before you hit "add to cart" on that impulse purchase, consider this: your tax refund could be a powerful tool for securing your financial future. Investing it wisely can set you on a path to long-term financial stability and peace of mind.

Imagine being debt-free, or having a robust emergency fund that lets you sleep soundly at night. Picture yourself enjoying a comfortable retirement, or even pursuing a passion project thanks to a solid financial foundation. These aren't just dreams—they're achievable goals with the right strategy. Let's explore seven smart ways to invest your tax refund to bolster your future financial security.

1. Pay Off High-Interest Debt

High-interest debt is like a financial ball and chain. Whether it's from credit cards or personal loans, the interest rates can be crippling. According to the Federal Reserve, the average credit card interest rate in the U.S. was around 20% as of 2023. If you're carrying a balance, a significant portion of your monthly payment goes straight to interest, not to whittling down the principal. Using your tax refund to pay off—or at least pay down—high-interest debt can free up cash flow and save you money in the long run.

Consider this: if you have a $3,000 balance at a 20% interest rate and you're making only the minimum payments, it could take over fifteen years to pay off, and you'll end up paying thousands in interest. By using your tax refund to eliminate that debt, you’re effectively earning a guaranteed return equal to the interest rate. Financial advisor Jane Smith notes that "eliminating high-interest debt is one of the smartest moves you can make with extra cash, as it immediately improves your net worth."

2. Build an Emergency Fund

Life is unpredictable, and having a financial cushion can keep a minor setback from turning into a major crisis. An emergency fund acts as a financial safety net, covering unexpected expenses like car repairs, medical bills, or job loss. Most experts recommend saving three to six months of living expenses. If you're starting from scratch, your tax refund can be a great seed for your emergency fund.

Think of it this way: an emergency fund is like an insurance policy for your peace of mind. Without it, unexpected expenses can force you into debt or derail your financial plans. According to a 2023 survey by Bankrate, only 44% of Americans could cover a $1,000 emergency with savings. By setting up or boosting your emergency fund, you're not just safeguarding your finances—you're investing in peace of mind.

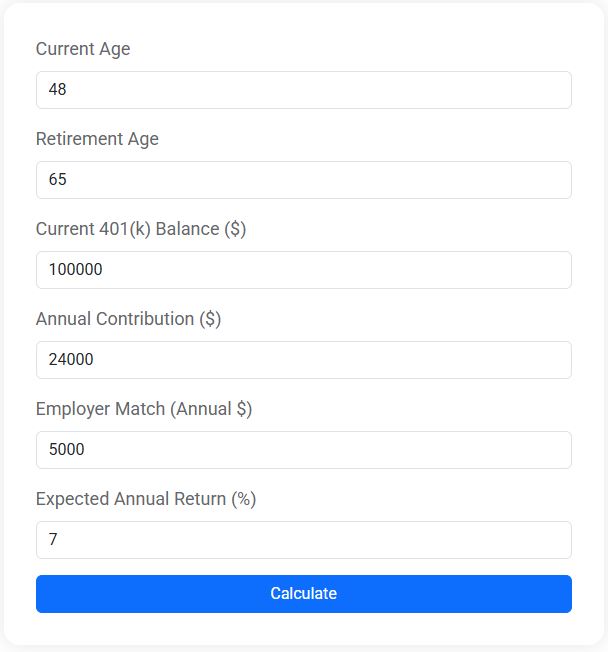

401(k) Retirement Calculator

Wondering how much your 401(k) will be worth when you retire? Our free 401(k) Retirement Calculator helps you estimate your future savings based on your current balance, annual contributions, employer match, and expected rate of return. Whether you're just getting started or already building your nest egg, this tool gives you a clear picture of how your retirement account can grow over time.

3. Contribute to Retirement Accounts

Retirement may seem far away, but the sooner you start saving, the better. Thanks to the power of compound interest, the money you invest now can grow significantly over time. If you haven’t maxed out contributions to your retirement accounts, like a 401(k) or an IRA, your tax refund can help you get there.

Consider this scenario: if you're 30 years old and invest a $2,000 tax refund into a Roth IRA with an average annual return of 7%, it could grow to over $30,000 by the time you're 65. That's the magic of compounding. As Albert Einstein supposedly said, "Compound interest is the eighth wonder of the world." If your employer offers a 401(k) match, contributing enough to get the full match is akin to receiving free money, effectively doubling the impact of your tax refund.

4. Enhance Your Investment Portfolio

If you’ve already tackled debt and have an emergency fund in place, consider using your tax refund to enhance your investment portfolio. Diversifying your investments can mitigate risk and increase potential returns. You might add to your stock holdings, explore bonds, or even dip your toes into real estate investment trusts (REITs) or index funds.

For example, index funds are known for their low fees and broad market exposure, making them a popular choice for investors seeking a hands-off approach. As Warren Buffett famously advises, "By periodically investing in an index fund, the know-nothing investor can actually outperform most investment professionals." Your tax refund can be the perfect opportunity to diversify and strengthen your portfolio, setting you on a path to long-term financial growth.

5. Invest in Education or Skills Development

Investing in yourself is often the best investment you can make. Whether it’s taking a course to advance your career, learning a new skill, or even pursuing a degree, education can open doors to higher earning potential and job satisfaction. Your tax refund can be the ticket to enrolling in that course you've been eyeing or starting a certification program.

Let's say you’re interested in coding, which is in high demand across numerous industries. A bootcamp or online course could be a game-changer, potentially leading to a lucrative career switch. According to the Bureau of Labor Statistics, tech jobs are projected to grow 13% from 2020 to 2030, much faster than the average for all occupations. By investing in your education, you're not just enhancing your skills; you're increasing your future earning power.

6. Start or Boost a Business

Have you ever dreamt of being your own boss? Your tax refund could be the seed money needed to start a business or breathe new life into an existing one. Whether it’s funding a side hustle or expanding your current operations, this investment can pay off in both financial and personal fulfillment.

Take inspiration from entrepreneurs who started small. For instance, Sara Blakely founded Spanx with just $5,000 in savings and turned it into a billion-dollar company. While not every business will hit the jackpot, starting small and scaling gradually can lead to significant rewards. Use your refund wisely on essential expenses like marketing, product development, or professional advice to increase your chances of success.

7. Give Back

Finally, consider using your tax refund to make a positive impact on others. Whether it’s donating to a charity, supporting a cause you care about, or helping a friend in need, giving back can be incredibly rewarding. Not only does it benefit the recipient, but it also enriches your own life through the joy of giving.

According to research by Harvard Business School, spending money on others can lead to greater happiness than spending on oneself. If you choose to donate, take advantage of potential tax deductions by ensuring the organization is a registered charity. Giving back is not just about money; it’s about making a difference in the world, and your tax refund can be a powerful tool for doing good.

In conclusion, while it’s tempting to spend your tax refund on immediate pleasures, investing it wisely can provide lasting benefits. Whether you choose to pay off debt, build an emergency fund, invest in retirement, enhance your portfolio, further your education, start a business, or give back, each option offers a path to greater financial security and personal fulfillment. Remember, the decisions you make today can shape the financial landscape of your future.