Navigating the Stock Market: Tips for New Investors

The stock market may seem intimidating to new investors, but with the right approach, it's possible to make informed decisions and build wealth over time. Key strategies include understanding market basics, setting clear investment goals, diversifying portfolios, adopting a long-term mindset, and staying informed through continuous learning. By following these essential tips, new investors can confidently navigate the stock market and work towards achieving their financial objectives.

The stock market can feel like an enigmatic beast to new investors. Between the dizzying array of jargon and the relentless fluctuations of stock prices, it's no wonder many beginners find themselves overwhelmed. But here's the good news: with a thoughtful approach and some basic knowledge, the stock market can be a powerful tool for building wealth over time. It's much like learning to ride a bike. Once you understand the mechanics and practice a bit, you’ll find yourself cruising with confidence.

In this article, we'll break down some essential strategies that can help you navigate the stock market. From understanding the basics to setting investment goals and diversifying your portfolio, we’ll walk you through the steps to becoming a savvy investor. So grab a cup of coffee, settle in, and let's demystify the world of stock investing together.

Understanding Market Basics

Before diving headfirst into the market, it's crucial to grasp the basics. At its core, the stock market is a platform where investors buy and sell shares of publicly traded companies. The prices of these shares are determined by supply and demand dynamics, which are influenced by a myriad of factors, including economic indicators, company performance, and investor sentiment.

One of the first things to understand is the difference between stocks and other types of investments like bonds or mutual funds. Stocks represent ownership in a company and come with the potential for high returns, but also higher risk. Bonds, on the other hand, are essentially loans made to a company or government, offering more stability but generally lower returns.

It's also important to familiarize yourself with key financial metrics like P/E ratios, dividends, and market capitalization. These terms can provide a snapshot of a company's financial health and help inform your investment decisions. As the investor Warren Buffett famously advises, "Risk comes from not knowing what you're doing." Understanding these basic concepts is the first step in mitigating that risk.

Setting Clear Investment Goals

Investment success isn't just about picking the right stocks; it's also about having clear, well-defined goals. Before you even think about buying your first share, take some time to reflect on what you're hoping to achieve. Are you saving for retirement, building a college fund, or looking to generate additional income?

By setting specific goals, you can tailor your investment strategy to match your time horizon and risk tolerance. For instance, if you're investing for retirement 30 years down the road, you might be more inclined to take on higher-risk investments with the potential for greater returns. Conversely, if you're aiming to buy a house in the next five years, you might opt for a more conservative approach to protect your capital.

Goal setting also involves understanding your personal risk tolerance. Some investors are comfortable with the ups and downs of the market, while others prefer a steady, more predictable path. As financial advisor Jane Smith explains, "Knowing your risk tolerance is like understanding your spice level at a restaurant — it helps ensure you have a satisfying experience without any nasty surprises."

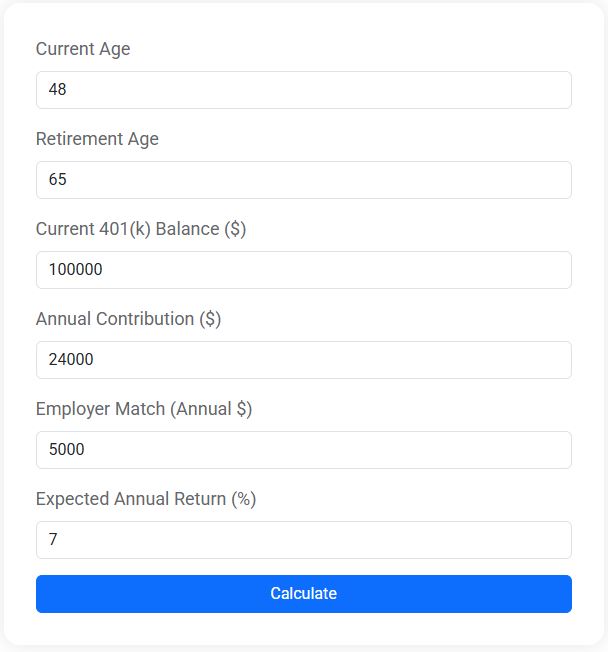

401(k) Retirement Calculator

Wondering how much your 401(k) will be worth when you retire? Our free 401(k) Retirement Calculator helps you estimate your future savings based on your current balance, annual contributions, employer match, and expected rate of return. Whether you're just getting started or already building your nest egg, this tool gives you a clear picture of how your retirement account can grow over time.

Diversifying Your Portfolio

You've likely heard the adage "don't put all your eggs in one basket." This wisdom holds particularly true in investing. Diversification is the practice of spreading your investments across various asset classes, industries, and geographies to reduce risk.

By owning a mix of stocks, bonds, and other securities, you can cushion the blow of a downturn in any single asset. For example, if the tech sector takes a hit, your investments in healthcare or consumer goods might still perform well, balancing out your overall portfolio.

Consider exchange-traded funds (ETFs) or mutual funds as effective tools for diversification. These investment vehicles pool money from many investors to buy a broad range of assets, offering instant diversification. According to a report by CNBC, many new investors find ETFs appealing because they offer exposure to a wide array of stocks without the need to pick individual companies.

Diversification doesn't eliminate risk entirely, but it can significantly reduce it. Think of it as a financial safety net that allows you to sleep a little easier at night.

Adopting a Long-Term Mindset

Investing in the stock market is not a get-rich-quick scheme; it's a journey that requires patience and discipline. Markets will have their ups and downs, and it's important to resist the urge to make impulsive decisions based on short-term volatility.

Adopting a long-term mindset means staying the course even when the market experiences turbulence. Historically, the stock market has trended upward over the long term, despite periodic downturns. For example, after the financial crisis of 2008, the market eventually recovered and reached new heights.

One way to maintain a long-term perspective is to focus on your original investment goals and time horizon. Regularly remind yourself why you started investing in the first place. This approach not only helps you weather market fluctuations but also reduces the emotional stress associated with investing.

As legendary investor Benjamin Graham once said, "The stock market is a device for transferring money from the impatient to the patient." By cultivating patience, you can position yourself to reap the rewards of long-term investing.

Staying Informed Through Continuous Learning

The world of investing is dynamic, with new trends, technologies, and economic developments constantly emerging. Staying informed is key to making sound investment decisions and adapting to changing market conditions.

Make it a habit to read financial news, follow market analysts, and educate yourself on investment strategies. Books, podcasts, and online courses can also be valuable resources. The more you learn, the better equipped you'll be to navigate the complexities of the stock market.

Engaging with a community of fellow investors can also provide support and insight. Online forums, investment clubs, or social media groups offer opportunities to share experiences and gain different perspectives. As the saying goes, "Two heads are better than one." By connecting with others, you can expand your knowledge and make more informed decisions.

Remember, investing is a journey of lifelong learning. Embrace curiosity, ask questions, and never stop seeking knowledge. With time and experience, you'll become a more confident and capable investor.

By understanding market basics, setting clear goals, diversifying your portfolio, adopting a long-term mindset, and staying informed, you can navigate the stock market with confidence. These strategies are not about guaranteeing success, but about equipping you with the tools to make informed decisions and work towards your financial objectives. So, take a deep breath, trust the process, and enjoy the journey of stock market investing.