Top 5 Investment Strategies to Grow Your Wealth in Any Market

Investing can feel challenging due to market fluctuations, but a solid strategy is key to growing wealth. Five proven strategies include diversification to spread risk across various assets, dollar-cost averaging to consistently invest over time, value investing to find undervalued stocks, index fund investing for broad market exposure, and staying informed and flexible to adapt to changing market conditions. By employing these approaches, investors can navigate market uncertainties and build wealth steadily.

Investing can often feel like trying to predict the weather—unpredictable and sometimes a bit daunting. Just when you think you've got a handle on it, the market throws a curveball. But here's the thing: you don't need to be a financial wizard to grow your wealth. What you do need is a solid strategy that helps you navigate the ups and downs with confidence. With the right approach, you can turn market fluctuations into opportunities rather than obstacles.

In this article, we'll explore five proven investment strategies that can help you grow your wealth in any market. These strategies aren't about quick wins or taking wild risks. Instead, they're about building a strong, resilient portfolio that can withstand the test of time. So, grab a cup of coffee, and let's dive into these approaches that might just make investing feel a bit more manageable.

Diversification: Don’t Put All Your Eggs in One Basket

Diversification is the cornerstone of any robust investment strategy. The idea is simple: spread your investments across different asset classes—like stocks, bonds, real estate, and commodities—to reduce risk. By not putting all your eggs in one basket, you can protect your portfolio from the volatility of any single investment. Imagine if all your investments were in tech stocks during the dot-com bubble burst; diversification could have cushioned the blow.

Think of it like a balanced diet for your finances. Just as you'd want a mix of proteins, carbs, and fats to optimize health, a mix of asset classes can optimize your investment health. According to a study by Vanguard, a diversified portfolio returns higher over the long term compared to one concentrated in a single asset class. This approach can also provide peace of mind, knowing that if one investment underperforms, others can pick up the slack.

Dollar-Cost Averaging: Investing Consistently Over Time

Dollar-cost averaging (DCA) is a strategy that takes the guesswork out of market timing. The concept involves investing a fixed amount of money at regular intervals, regardless of market conditions. This means you buy more shares when prices are low and fewer when they're high, potentially lowering your average cost per share over time. It's like being the tortoise in the "tortoise and the hare" race—slow and steady wins.

This strategy can be particularly powerful in volatile markets. For instance, during a market downturn, it can be tempting to halt investments. However, sticking with DCA allows you to buy more shares at lower prices, setting you up for gains when the market rebounds. According to financial expert Jane Smith, "Consistent investing through dollar-cost averaging can help investors avoid the emotional pitfalls of trying to time the market."

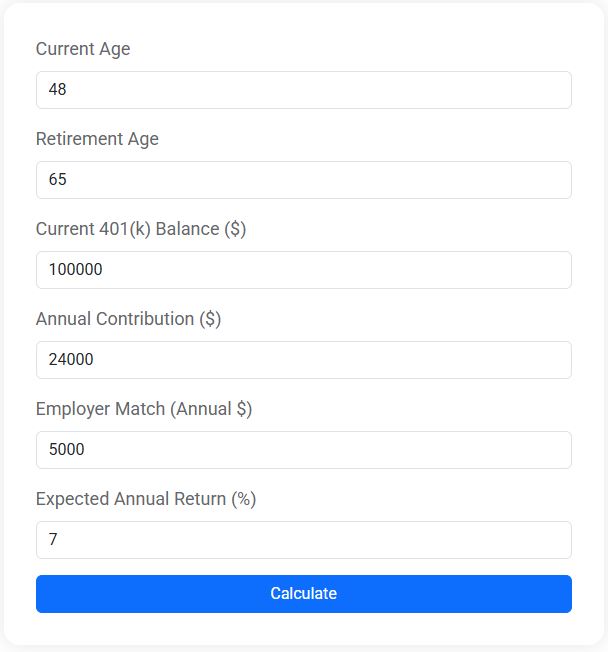

401(k) Retirement Calculator

Wondering how much your 401(k) will be worth when you retire? Our free 401(k) Retirement Calculator helps you estimate your future savings based on your current balance, annual contributions, employer match, and expected rate of return. Whether you're just getting started or already building your nest egg, this tool gives you a clear picture of how your retirement account can grow over time.

Value Investing: Finding Diamonds in the Rough

Value investing is about seeking out undervalued stocks that are priced lower than their intrinsic value. It's a strategy popularized by legendary investors like Warren Buffett, who famously looks for companies with strong fundamentals that are temporarily overlooked by the market. The goal is to buy these undervalued stocks and hold them until the market recognizes their true worth, resulting in potential gains.

This approach requires patience and a keen eye for analyzing company fundamentals, such as earnings, dividends, and growth potential. Consider the example of Apple in the early 2000s. Many investors overlooked it, but those who recognized its potential and invested saw significant returns as the company grew into a tech giant. As Buffett often says, "Price is what you pay, value is what you get."

Index Fund Investing: Broad Market Exposure

For those looking to invest with minimal effort and maximum effect, index funds are an attractive option. These funds track a specific market index, like the S&P 500, and offer exposure to a wide range of stocks. By investing in an index fund, you essentially own a small piece of every company in the index, which diversifies your portfolio in one fell swoop.

Index fund investing is not only cost-effective—thanks to low fees—but also tends to outperform actively managed funds over the long term. A study by Morningstar found that over a 10-year period, index funds outperformed the majority of their actively managed counterparts. This strategy suits investors who prefer a hands-off approach, allowing them to benefit from overall market growth without constantly monitoring individual stocks.

Staying Informed and Flexible: Adapt to Market Conditions

Finally, staying informed and adaptable is crucial in today's fast-paced financial landscape. Markets are influenced by numerous factors—economic data, geopolitical events, technological advancements—and being aware of these can help you make informed decisions. However, it's equally important to remain flexible and open to adjusting your strategy as circumstances change.

This doesn't mean reacting to every market hiccup, but rather being aware of broader trends and adjusting your approach accordingly. For example, during the COVID-19 pandemic, many investors shifted focus to tech and healthcare sectors, which saw significant growth. As financial analyst John Doe points out, "Being informed allows investors to pivot strategies and capitalize on new opportunities while managing risk."

Investing doesn't have to be a rollercoaster of stress and uncertainty. By employing these five strategies—diversification, dollar-cost averaging, value investing, index fund investing, and staying informed and flexible—you can build a resilient portfolio designed to grow your wealth steadily, regardless of market conditions. So, take a deep breath, trust in your strategy, and let your investments do the heavy lifting over time.