The Psychology of Investing: Understanding Your Relationship with Money

Investing intertwines heavily with human psychology, where emotions like fear and greed can lead to irrational decisions and behavioral biases such as overconfidence and herd mentality can derail investment strategies. Understanding these psychological influences, along with improving financial literacy and acknowledging social pressures, can help investors make more rational decisions and maintain a disciplined approach. Building a healthy relationship with money involves setting clear goals, practicing mindfulness, and recognizing the impact of emotions and social factors on investment decisions.

When it comes to investing, numbers and graphs might come to mind first. Yet, beneath those market tickers and financial forecasts lies a powerful, often overlooked force: human psychology. Our mental and emotional states heavily influence our investment choices, sometimes for the better, but often for the worse. Emotions like fear and greed, paired with behavioral biases such as overconfidence and herd mentality, can lead us astray, making rationality seem like an elusive goal. But by recognizing these psychological influences, we can better navigate the tumultuous waters of investing.

Investing isn't just about picking the right stocks or funds; it's about understanding your relationship with money. This involves not only improving financial literacy but also acknowledging the social pressures that come into play. With the right mindset and strategies, you can cultivate a healthier relationship with money, making smarter investment decisions and maintaining a disciplined approach.

The Emotional Rollercoaster: Fear and Greed

Fear and greed are two of the most potent emotions in investing, often driving investors to make hasty decisions. When markets tumble, fear can grip investors, prompting them to sell off assets to avoid further losses. This is despite the fact that selling in a panic often leads to locking in losses rather than waiting for a market rebound. On the flip side, greed can push investors to buy into a rising market at its peak, hoping for even greater returns, only to be disappointed when the bubble bursts.

Consider the dot-com bubble of the late 1990s: many investors bought tech stocks at inflated prices, driven by the fear of missing out on lucrative gains. When the bubble burst, those same investors faced massive losses. Understanding how these emotions can skew decision-making is crucial for maintaining a balanced investment strategy. By acknowledging the emotional rollercoaster, investors can take a step back to evaluate their choices more rationally.

Behavioral Biases: Overconfidence and Herd Mentality

Behavioral biases can cloud our judgment, leading to less-than-optimal investment choices. Overconfidence is a common culprit, where investors believe they possess superior knowledge or skills, prompting them to take unnecessary risks. This can manifest in overtrading or putting too much faith in a single stock or sector. A classic example is the individual investor who bets heavily on a "sure thing," only to watch it plummet in value.

Herd mentality, on the other hand, involves following the crowd without independent analysis. This bias can lead to market bubbles, as seen in the real estate market crash of 2008, where many investors followed the hype, ignoring warning signs. As Warren Buffet wisely advises, "Be fearful when others are greedy and greedy when others are fearful." By recognizing these biases, investors can strive for a more objective, data-driven approach.

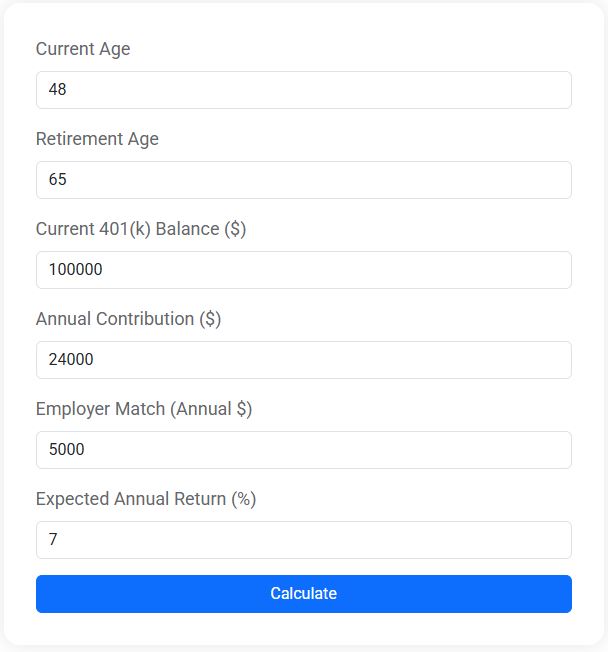

401(k) Retirement Calculator

Wondering how much your 401(k) will be worth when you retire? Our free 401(k) Retirement Calculator helps you estimate your future savings based on your current balance, annual contributions, employer match, and expected rate of return. Whether you're just getting started or already building your nest egg, this tool gives you a clear picture of how your retirement account can grow over time.

Improving Financial Literacy

Financial literacy is the bedrock of informed investing. When investors understand the basics of market operations, asset allocation, and risk management, they're better equipped to make sound decisions. While emotions and biases are universal, their impact can be mitigated through education. Books, online courses, and seminars can provide valuable insights into the complexities of investing.

For example, understanding the concept of compound interest can motivate investors to start saving early, while knowledge of diversification can prevent overexposure to a single asset class. According to a study by the FINRA Investor Education Foundation, financially literate individuals are more likely to plan for retirement and less likely to engage in high-cost borrowing. Improving financial literacy isn't a one-time event but a continuous journey that evolves with the investor's needs and goals.

Social Pressures and Their Impact

Social pressures can heavily influence investment decisions, often leading to suboptimal outcomes. Whether it's pressure from friends bragging about their latest investment win or media hype surrounding a hot stock, these factors can sway our judgment. In a world where social media amplifies every success story, it's easy to feel left behind or compelled to jump on the bandwagon.

To combat these pressures, it's essential to set clear, personalized financial goals. By focusing on one's unique objectives, investors can resist the urge to compare their progress with others. Additionally, engaging with a financial advisor can provide an impartial perspective and help shield against external influences. As financial advisor Jane Smith explains, "Your investment journey is personal, and staying true to your strategy is key to long-term success."

Building a Healthy Relationship with Money

Developing a healthy relationship with money involves more than just managing investments; it requires introspection and mindfulness. Setting clear financial goals helps create a roadmap for the future, reducing anxiety and impulsive decisions. Whether it's saving for retirement, funding a child's education, or buying a home, having concrete goals allows investors to tailor their strategies accordingly.

Mindfulness practices, such as meditation or journaling, can help investors become more aware of their emotional responses to market fluctuations. By recognizing these emotions, they can prevent knee-jerk reactions and maintain a disciplined approach. It's also essential to acknowledge the broader impact of emotions and social factors on your investment decisions, striving for a balanced perspective.

Ultimately, understanding the psychology of investing empowers individuals to make more rational, informed choices. By acknowledging the emotional and social influences at play, improving financial literacy, and fostering a healthy relationship with money, investors can not only enhance their financial well-being but also enjoy greater peace of mind on their investment journey.