How to Choose the Right Investment Advisor for Your Financial Goals

Choosing the right investment advisor is crucial for your financial future, and involves clearly defining your financial goals, such as retirement or education savings, to find a specialist who aligns with your needs. Key considerations include checking credentials like CFP or CFA, assessing communication and compatibility, understanding fee structures to avoid conflicts of interest, and conducting thorough interviews and reference checks to ensure trust and competence. By taking these steps, you can select an advisor who empowers you to achieve your financial dreams while providing peace of mind.

Choosing the right investment advisor is akin to selecting a partner for a long journey. This decision can significantly shape your financial future, helping you glide through market highs and lows while staying aligned with your goals. Whether you're planning for a comfortable retirement, saving for your child's education, or looking to build a diverse investment portfolio, a knowledgeable advisor can be an invaluable ally. However, with so many options and varying levels of expertise, finding the right advisor can be daunting. It's essential to approach this process with a clear strategy.

Investors often underestimate the importance of matching their unique financial needs with an advisor's skills and expertise. A good starting point is to clearly define your financial goals. Are you looking to grow your wealth aggressively, or are you more focused on preserving what you have? Understanding your objectives will guide you in identifying an advisor who specializes in areas that matter most to you.

Define Your Financial Goals

Before you even start looking for an advisor, spend some time thinking about what you want to achieve financially. Are you aiming to retire early, or do you want to secure a college fund for your kids? Perhaps a mix of both? Knowing your priorities will help you find an advisor whose expertise aligns with your needs. For instance, if retirement planning is your main focus, an advisor with a solid track record in retirement strategies would be beneficial.

Take the time to write down your goals and categorize them by timeline and importance. This exercise not only clarifies your needs but also provides a basis for discussions with potential advisors. As personal finance expert Suze Orman often says, “People first, then money, then things.” Make sure any advisor you consider understands this hierarchy and respects your life goals over mere financial gains.

Check Credentials and Experience

Credentials matter, and in the world of finance, they speak volumes about an advisor's qualifications and expertise. Look for designations like Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). These certifications ensure that the advisor has undergone rigorous training and adheres to ethical standards. A CFP, for instance, is equipped to provide comprehensive financial planning advice, while a CFA has deep insights into investment management.

Experience is another crucial factor. An advisor who has weathered multiple market cycles brings invaluable perspective. Ask potential advisors about their experience, especially in dealing with financial situations similar to yours. For example, if you're a small business owner, find an advisor with experience in managing business finances alongside personal investments. According to a 2022 study by the Financial Planning Association, clients who work with experienced advisors are more likely to achieve their financial goals.

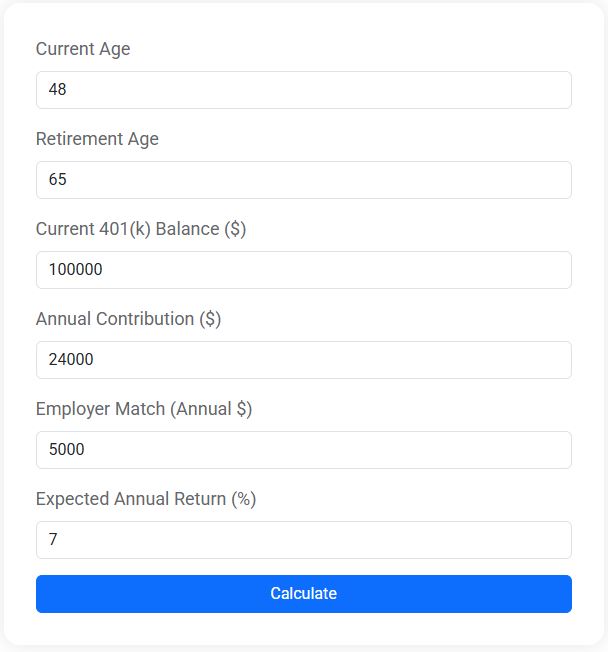

401(k) Retirement Calculator

Wondering how much your 401(k) will be worth when you retire? Our free 401(k) Retirement Calculator helps you estimate your future savings based on your current balance, annual contributions, employer match, and expected rate of return. Whether you're just getting started or already building your nest egg, this tool gives you a clear picture of how your retirement account can grow over time.

Assess Communication and Compatibility

Financial advising is as much about relationships as it is about numbers. You'll want an advisor who communicates clearly and listens intently. During initial meetings, pay attention to how they explain complex concepts. Do they use jargon, or do they break things down in a way that makes sense to you?

Compatibility is another key aspect. Your advisor should understand your risk tolerance, financial habits, and future aspirations. Think of it like finding a doctor who understands your health preferences and lifestyle. A good advisor should be someone you’re comfortable discussing your finances with, and someone who respects your values and decision-making style.

Understand Fee Structures

Advisors come with different fee structures, and understanding these is crucial to avoiding conflicts of interest. Some advisors charge a flat fee, while others earn commissions on the products they sell. Fee-only advisors, for instance, are compensated solely through client fees, avoiding potential conflicts that commission-based models might present.

Ask for a detailed explanation of their fee structure upfront. Make sure you understand how they get paid and what services are included. A transparent advisor will gladly walk you through this. As financial journalist Jason Zweig points out, "If you can't understand the fees, don't sign the agreement." Transparency in fees not only builds trust but also ensures that your advisor’s recommendations are truly in your best interest.

Conduct Interviews and Reference Checks

Once you have a shortlist of potential advisors, conduct thorough interviews. Prepare a list of questions that address your specific concerns, such as their investment philosophy, client communication frequency, and past performance. This is your opportunity to gauge their expertise and whether they’re a good fit for your needs.

Don’t hesitate to ask for references from current or past clients. Talking to someone who has worked with the advisor can provide insights into their strengths and weaknesses. According to a survey by Investor Junkie, 83% of investors view referrals from trusted sources as the most reliable way to find a financial advisor. This step can be the difference between choosing an advisor who is merely competent and one who is truly exceptional.

Look for a Fiduciary

Ideally, you want an advisor who operates as a fiduciary, meaning they are legally obligated to act in your best interest. This is a crucial distinction that can't be overlooked. Fiduciaries are bound to prioritize your needs above their own, offering peace of mind that their advice is unbiased and aligned with your goals.

Ask potential advisors outright if they are fiduciaries. As the National Association of Personal Financial Advisors (NAPFA) emphasizes, working with a fiduciary ensures you're receiving advice that is solely intended to benefit you. This level of trust can’t be understated when it comes to managing your financial future.

Trust Your Instincts

Finally, trust your gut feeling. If something feels off about an advisor, it probably is. You’re entrusting this person with your financial future, so you should feel confident and comfortable in their ability to guide you. Remember, the right advisor is not just a financial guide but a partner in your journey toward your financial dreams.

Choosing the right investment advisor can be a game-changer for your financial journey. By taking the time to carefully evaluate your options, you’ll not only find an advisor who aligns with your goals but also gain a trusted ally who empowers you to achieve financial peace of mind. In the end, it’s about building a relationship that provides both expertise and a sense of security, allowing you to focus on what truly matters in life.