Retiring Early: How to Achieve Financial Independence Through Strategic Investing

Retiring early and achieving financial independence, often through the FIRE (Financial Independence, Retire Early) movement, requires strategic planning and disciplined investing. Key strategies include setting clear financial goals, building a diversified investment portfolio, adopting a frugal lifestyle, and utilizing tax-advantaged accounts. By following these steps and remaining adaptable to life and market changes, you can create a solid path toward early retirement.

Retiring early may sound like a dream reserved for lottery winners or tech moguls, but for many people, it’s an attainable goal through strategic investing and disciplined financial planning. The movement known as FIRE—Financial Independence, Retire Early—has gained momentum over the past decade, inspiring countless individuals to rethink their approach to wealth and work. With the right strategies, you too can pursue a life where work is optional, and financial independence is a reality.

Achieving early retirement isn't about skipping your daily latte or living in a tiny home (although those choices might help). It’s about setting clear financial goals, embracing a lifestyle of intentionality, and investing wisely to grow your wealth over time. Let’s dive into the key strategies that can set you on the path to financial independence.

Setting Clear Financial Goals

The journey to early retirement begins with defining what financial independence means to you. This isn't a one-size-fits-all scenario. For some, it might mean having enough savings to travel the world at will, while for others, it's about spending more time with family without the pressure of a nine-to-five job. Start by calculating your "FIRE number"—the amount of money you need to live comfortably without working.

A popular guideline is the 4% rule, which suggests you can withdraw 4% of your portfolio annually in retirement without running out of money. For instance, if you determine that you need $40,000 a year to live comfortably, you’d aim for a portfolio of $1 million. But remember, this is more of a starting point than a hard-and-fast rule. Adjust based on your risk tolerance and lifestyle goals.

Setting intermediary goals can also help keep you motivated. These might include paying off debt, building an emergency fund, or reaching certain savings milestones. As financial advisor Jane Smith notes, “Breaking down your ultimate goal into smaller, achievable steps can make the daunting task of saving for early retirement feel much more manageable.”

Building a Diversified Investment Portfolio

Investing is the engine that powers your journey to financial independence. The goal is to grow your wealth while managing risk, and diversification is key. By spreading your investments across different asset classes—such as stocks, bonds, and real estate—you can protect your portfolio from market volatility.

Historically, the stock market has provided strong returns over the long term. A diversified portfolio might include a mix of domestic and international stocks, which can offer growth potential and hedge against economic downturns in specific regions. Bonds, on the other hand, provide stability and regular income, balancing the higher risk of stocks.

Real estate can also be a lucrative component of your investment strategy. Whether through rental properties or Real Estate Investment Trusts (REITs), real estate investments offer potential income and appreciation. As Warren Buffett famously advises, “Never put all your eggs in one basket.” Diversification is about balancing risk and return, which is crucial for achieving long-term financial goals.

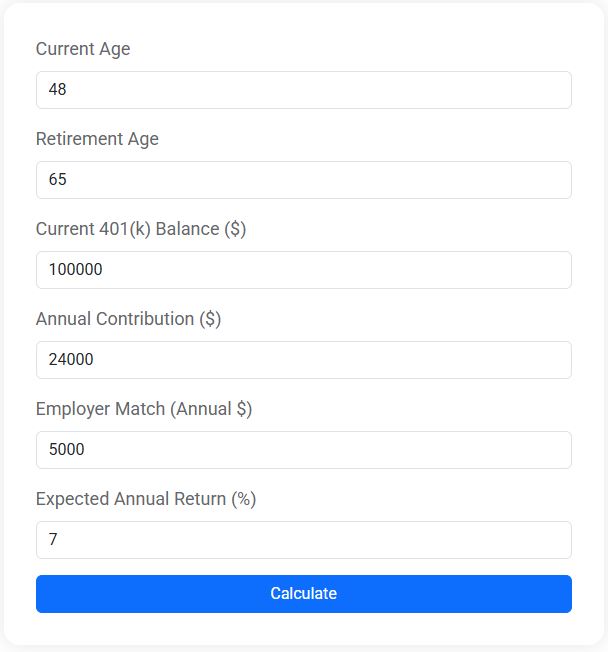

401(k) Retirement Calculator

Wondering how much your 401(k) will be worth when you retire? Our free 401(k) Retirement Calculator helps you estimate your future savings based on your current balance, annual contributions, employer match, and expected rate of return. Whether you're just getting started or already building your nest egg, this tool gives you a clear picture of how your retirement account can grow over time.

Adopting a Frugal Lifestyle

Living frugally doesn't mean adopting a deprivation mindset. It’s about making conscious choices that align with your values and long-term goals. By reducing expenses and avoiding lifestyle inflation, you can increase your savings rate—an essential factor in reaching financial independence sooner.

Consider tracking your spending to identify areas where you might cut back. Small changes, like cooking at home more often or canceling unused subscriptions, can add up over time. Also, embrace the "value over cost" mindset. Instead of buying the cheapest items, invest in quality products that will last longer and provide more value in the long run.

Frugality also extends to big-ticket items. For example, driving a reliable used car instead of a brand-new model can save you thousands. Remember, every dollar saved is a dollar that can be invested in your future. As financial blogger Mr. Money Mustache puts it, “The real secret to making money is not to spend it.”

Utilizing Tax-Advantaged Accounts

Tax-advantaged accounts like 401(k)s, IRAs, and HSAs are powerful tools in your early retirement arsenal. These accounts offer tax benefits that can accelerate your savings. Contributing to a 401(k) or IRA allows your investments to grow tax-deferred, potentially leading to substantial growth over the years.

Consider maxing out these accounts each year. For 2023, the contribution limit for a 401(k) is $22,500, with an additional $7,500 catch-up contribution for those over 50. Traditional IRAs offer a $6,500 limit, with a $1,000 catch-up. HSAs, often overlooked, can also be a great way to save for future medical expenses with triple tax advantages: contributions are pre-tax, growth is tax-free, and withdrawals for qualified medical expenses are tax-free.

Additionally, understanding the Roth conversion ladder strategy can be beneficial. This involves converting traditional IRA funds into a Roth IRA, allowing you to withdraw contributions tax-free in retirement, a strategy particularly useful for those planning to retire before 59½.

Remaining Adaptable to Life and Market Changes

While a well-laid plan is crucial, flexibility is equally important. Life is unpredictable, and markets can be volatile. Being adaptable means revisiting your financial goals and strategies regularly and making adjustments as needed.

For instance, if the market experiences a downturn, it might be wise to delay retirement by a year or two to allow your investments to recover. Alternatively, if you receive a windfall, such as an inheritance, you might adjust your timeline or strategy accordingly.

Moreover, staying informed about economic trends and financial news can help you make timely decisions. As CNBC highlights, “Staying engaged with your financial plan is key to navigating the ups and downs of the market.” By being proactive and adaptable, you can ensure that your path to early retirement remains steady, even in the face of uncertainty.

Achieving financial independence and retiring early is an ambitious goal, but with strategic planning and disciplined investing, it's within reach. By setting clear goals, building a diversified portfolio, living frugally, and utilizing tax-advantaged accounts, you can create a solid foundation for your financial future. Embrace the journey, remain adaptable, and who knows? You might find yourself enjoying your morning coffee on a beach somewhere, long before traditional retirement age.