10 Common Investment Mistakes to Avoid for Long-Term Wealth

Building wealth through investments requires discipline, knowledge, and avoiding common pitfalls such as ignoring diversification, attempting to time the market, neglecting research, emotional investing, and overlooking fees. By spreading investments across various asset classes, focusing on long-term strategies, conducting thorough research, maintaining a disciplined approach, and being mindful of costs, investors can enhance their strategies and increase their chances of long-term success. Successful investing is about informed, goal-aligned decisions rather than quick profits.

Building long-term wealth through investments can feel like navigating a complex maze. There's no shortage of advice out there, but the key lies in knowing which paths lead to success and which are common missteps. If you've ever found yourself overwhelmed by the plethora of investment choices, you're not alone. Many investors, both new and seasoned, stumble upon the same pitfalls. The good news? With a bit of guidance, these mistakes can be avoided, setting you on a clearer path to financial prosperity.

Let’s delve into the most common investment mistakes and how steering clear of these can significantly enhance your financial journey.

1. Ignoring Diversification

Diversification is akin to not putting all your eggs in one basket. While it might sound like a cliché, it’s a fundamental principle of investing. When you diversify, you spread your investments across various asset classes—like stocks, bonds, and real estate—reducing the risk of a single investment tanking your portfolio. Many investors, in pursuit of higher returns, often concentrate their investments in a few stocks or sectors. For instance, during the dot-com bubble, numerous investors poured money into tech stocks, only to face massive losses when the bubble burst. By diversifying, you’re not only managing risk but also positioning yourself to benefit from different market conditions.

2. Attempting to Time the Market

The allure of timing the market can be strong. Who wouldn’t want to buy low and sell high? However, even seasoned investors and professionals often struggle with predicting market movements accurately. As Warren Buffett famously advises, "The stock market is designed to transfer money from the Active to the Patient." Instead of trying to outsmart the market, focus on a long-term investment strategy. Historical data consistently shows that staying invested over the long haul, through market ups and downs, yields better returns than hopping in and out based on short-term predictions.

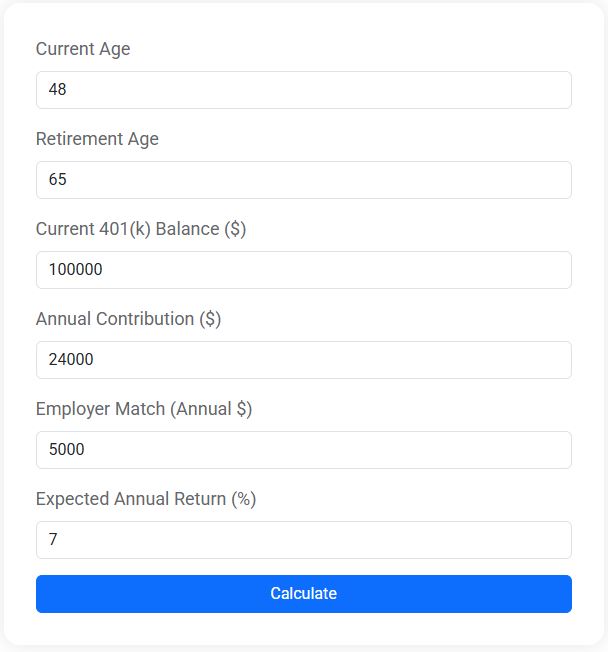

401(k) Retirement Calculator

Wondering how much your 401(k) will be worth when you retire? Our free 401(k) Retirement Calculator helps you estimate your future savings based on your current balance, annual contributions, employer match, and expected rate of return. Whether you're just getting started or already building your nest egg, this tool gives you a clear picture of how your retirement account can grow over time.

3. Neglecting Research

Investing without conducting thorough research is akin to setting sail without a map. It's crucial to understand what you're investing in, whether it's a company’s business model, financial health, or market position. Many investors make decisions based on hearsay or trending news without delving deeper into the fundamentals. Take the example of the GameStop frenzy in early 2021, where many got swept up in the hype without understanding the underlying business. While some profited, many others lost when the stock's value plummeted. A well-researched investment is more likely to align with your financial goals and risk tolerance.

4. Emotional Investing

Emotions can be an investor's worst enemy. Fear and greed often drive irrational decisions, leading to buying high out of excitement or selling low out of panic. According to a study by Dalbar, investor behavior, driven by emotional decisions, often leads to underperformance compared to the market. For instance, during the 2008 financial crisis, many panicked and sold off their investments, only to miss out on the subsequent recovery. Establishing a clear investment plan and sticking to it can help mitigate the influence of emotions.

5. Overlooking Fees

While fees might seem trivial in the grand scheme of investing, they can significantly erode your returns over time. Whether it's management fees for mutual funds or trading fees for stocks, these costs add up. For example, a seemingly small 1% management fee can reduce your portfolio's value by tens of thousands over decades. As Vanguard founder John Bogle emphasized, “The miracle of compounding returns is overwhelmed by the tyranny of compounding costs.” Always be mindful of the costs involved in your investments and opt for low-fee options where possible.

6. Failing to Rebalance

Your investment portfolio isn't a set-it-and-forget-it deal. Over time, some investments will outperform others, skewing your asset allocation. Regularly rebalancing your portfolio ensures that your investment mix remains aligned with your risk tolerance and financial goals. For example, if your stocks have grown significantly, your portfolio might be more risk-heavy than intended. Rebalancing involves selling some of the outperforming assets and buying underperforming ones to maintain your desired allocation.

7. Ignoring Inflation

Inflation is a silent wealth eroder. While a 2% annual inflation rate might not sound alarming, over time, it can significantly diminish your purchasing power. Many investors make the mistake of holding too much cash, thinking it's safe. However, if your returns don’t outpace inflation, you’re effectively losing money. Investing in assets like stocks, which historically outpace inflation, can help protect and grow your wealth over the long term.

8. Lack of a Clear Investment Strategy

Investing without a clear strategy is like driving without a destination. A well-defined investment plan considers your financial goals, risk tolerance, and time horizon. Many investors jump into the market without a clear direction, leading to disjointed and often unsuccessful investment choices. Having a strategy ensures that your investment decisions are purposeful and aligned with your life goals, whether it’s buying a home, funding education, or planning for retirement.

9. Ignoring Tax Implications

Taxes can have a significant impact on your investment returns. Many investors overlook tax-efficient strategies, such as utilizing tax-advantaged accounts like IRAs or 401(k)s, or engaging in tax-loss harvesting to offset gains. Understanding the tax implications of your investments can preserve more of your returns in the long run. For instance, holding investments for over a year can qualify you for lower capital gains tax rates, enhancing your net returns.

10. Not Reviewing Investments Regularly

The investment landscape is dynamic, with market conditions and personal circumstances evolving over time. Regularly reviewing your investments ensures that they remain aligned with your financial goals. This doesn’t mean making constant changes, but rather, assessing performance, checking alignment with your risk tolerance, and making informed adjustments when necessary. As financial advisor Jane Smith puts it, "Regular check-ins with your investments can prevent minor issues from becoming major setbacks."

By avoiding these common investment mistakes, you can create a more disciplined, informed, and effective approach to building long-term wealth. Remember, successful investing is less about chasing quick profits and more about making informed, goal-aligned decisions. Your future self will thank you for the foresight and diligence you invest today.