Understanding Risk vs. Reward in Investing: Finding the Right Balance

Investing is key to building wealth, but understanding the balance between risk and reward is crucial for creating a successful strategy. By comprehending different types of risks and evaluating potential rewards, investors can align their portfolios with their risk tolerance and financial goals. Employing strategies like diversification and asset allocation, alongside professional guidance, can help investors optimize the trade-off between risk and reward, ultimately aiding in achieving long-term financial success.

Investing is a dance with the unknown, a journey that requires both courage and caution. It’s all about finding that sweet spot where risk meets reward, helping you build wealth without losing sleep. Whether you’re a seasoned investor or just starting out, understanding how to balance risk and reward is fundamental to crafting a strategy that aligns with your financial dreams. The goal is not just to grow your money but to do so in a way that feels comfortable and sustainable.

Imagine you're planting a garden. You wouldn't throw all your seeds into one patch of soil and hope for the best. Instead, you'd consider the climate, the types of plants, and how much sunlight each area gets, then spread your seeds accordingly. Investing is much the same. By understanding different types of risks and evaluating potential rewards, you can align your portfolio with your risk tolerance and financial goals. Strategies like diversification and asset allocation, along with a touch of professional guidance, can help optimize this delicate balance, ultimately aiding in achieving long-term financial success.

Understanding Different Types of Risks

Risk in investing isn't just a singular concept; it’s a multifaceted beast. Market risk, for example, refers to the possibility that you’ll lose money due to changes in the market as a whole. Think of the 2008 financial crisis when stock markets around the world took a nosedive. Interest rate risk, on the other hand, involves the potential for investment losses due to changes in interest rates. This is particularly relevant for bond investors, as prices of bonds typically fall when interest rates rise.

Then there's inflation risk, the silent thief that erodes your purchasing power over time. If your investments don’t grow at a rate that outpaces inflation, you’re effectively losing money. Finally, there's specific risk, also known as unsystematic risk, which pertains to individual investments. This could be anything from a company scandal to a technological breakthrough that renders a product obsolete.

By recognizing these risks, you can better anticipate potential pitfalls and strategize accordingly. It’s like knowing the weather forecast before you head out for a hike—you can pack the right gear and plan your route to avoid getting caught in the rain.

Evaluating Potential Rewards

On the flip side of risk is reward. The potential returns on your investments are what make the game worth playing. Generally, the higher the risk, the higher the potential reward. Stocks, for instance, are known for their volatility but also for their potential to deliver substantial returns over the long term. According to historical data, the average annual return of the S&P 500 index is around 7% after adjusting for inflation.

Bonds, while generally less volatile than stocks, offer lower returns. They're like the dependable friend who’s always there for you, providing regular, albeit modest, interest payments. Real estate and commodities add another layer of diversification, often moving independently of stocks and bonds, which can be beneficial during certain economic cycles.

Evaluating potential rewards involves more than just looking at historical returns. It requires a thoughtful consideration of future economic conditions, company performance, and global trends. As Warren Buffett famously advises, "Predicting rain doesn’t count. Building arks does." It's about preparing for opportunity as much as for adversity.

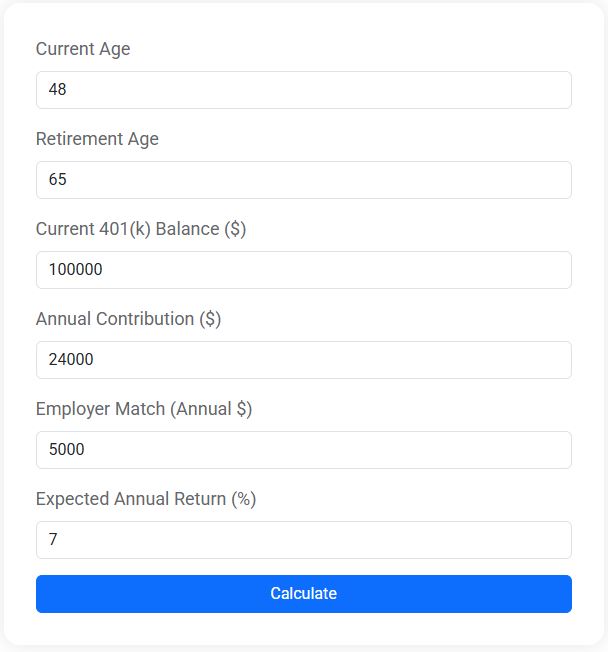

401(k) Retirement Calculator

Wondering how much your 401(k) will be worth when you retire? Our free 401(k) Retirement Calculator helps you estimate your future savings based on your current balance, annual contributions, employer match, and expected rate of return. Whether you're just getting started or already building your nest egg, this tool gives you a clear picture of how your retirement account can grow over time.

Aligning Investments with Risk Tolerance and Financial Goals

Finding the right balance between risk and reward means aligning your investments with your personal risk tolerance and financial goals. Risk tolerance is highly personal and can be influenced by factors such as age, income, and life circumstances. For instance, a young professional with a steady income might be more comfortable taking on higher risk for higher returns, while a retiree might prioritize preserving capital over aggressive growth.

Your financial goals also play a crucial role. Are you saving for a down payment on a house in the next five years, or is your focus on building a retirement nest egg over the next 30? Short-term goals generally require more conservative investments, while long-term goals can often withstand more risk.

By understanding your own comfort level with risk and clearly defining your financial goals, you can better tailor your investment strategy. It’s about crafting a portfolio that feels like a well-fitted suit—comfortable, suitable for your needs, and adaptable as you move through different stages of life.

Strategies for Optimizing Risk and Reward

The art of balancing risk and reward involves strategic planning and execution. Diversification is a key strategy, often described as not putting all your eggs in one basket. By spreading investments across different asset classes, sectors, and geographies, you can mitigate specific risks and smooth out potential volatility.

Asset allocation goes hand-in-hand with diversification. It’s about deciding what portion of your portfolio to invest in various asset categories, such as stocks, bonds, and real estate, based on your risk tolerance and investment goals. According to Vanguard, asset allocation is one of the most important decisions investors make, as it has a significant impact on a portfolio's long-term performance.

Professional guidance can also be invaluable. Whether it’s through a financial advisor or a robo-advisor, having expert input can provide peace of mind and help you make informed decisions. As financial advisor Jane Smith explains, "A good advisor helps you see the forest through the trees, ensuring your strategy remains aligned with your goals even when the market gets choppy."

The Role of Professional Guidance

While many investors choose a DIY approach, professional guidance can be a game-changer, especially in navigating the complexities of risk and reward. Financial advisors bring expertise to the table, helping you identify blind spots and explore opportunities you might not have considered. They can assist in stress-testing your portfolio against various economic scenarios, ensuring it’s resilient enough to weather market downturns.

Moreover, advisors can provide an emotional buffer, helping you stay disciplined and avoid knee-jerk reactions during market turbulence. According to a study by Vanguard, working with an advisor can potentially add about 3% in net returns through behavioral coaching, asset allocation, and cost-effective strategies.

Whether you choose to work with a professional or go it alone, the key is to remain informed and reflective about your investment choices. Investing isn’t a set-it-and-forget-it endeavor; it’s an ongoing process that requires monitoring and adjustments as your life and the market evolve.

Investing is indeed about taking risks, but it’s about taking smart risks. By understanding the balance between risk and reward, and employing strategies like diversification and asset allocation, you can build a portfolio that not only grows your wealth but also lets you sleep soundly at night. Remember, it’s not just about the destination but the journey—one that should be as rewarding as it is informed.