Maximizing Your 401(k): Tips for Retirement Savings Success

To maximize your 401(k), start by understanding your employer's match to boost your savings with essentially free money, and choose the right investment mix based on your risk tolerance and retirement timeline. Gradually increase your contributions, aim to meet IRS limits, and stay informed about fees to enhance returns. Additionally, plan your withdrawals strategically to avoid penalties and ensure long-term financial security in retirement.

Ah, the 401(k) — that magic number that stands between you and a comfortable retirement. If you’re like most people, you've heard about the importance of saving for retirement and maybe even have a 401(k) through your employer. But are you truly making the most of it? Think of your 401(k) as a garden. It needs regular attention and care to flourish. Luckily, with a few strategic moves, you can maximize your 401(k) and turn it into a robust resource for your golden years.

Whether you’re just starting out or you’ve been contributing for years, there are always ways to enhance your 401(k) strategy. From understanding employer matches to choosing the right investment mix, each decision can make a significant impact on your financial future. So, grab a cup of coffee, and let’s dive into some practical tips that can help you secure that cushy retirement you’ve been dreaming about.

Understand Your Employer's Match

Your employer's match is like finding a hundred-dollar bill on the sidewalk — it’s essentially free money. Many employers offer a matching contribution to your 401(k), often matching a percentage of what you contribute up to a certain limit. For example, your employer might match 50% of your contributions up to 6% of your salary. If you’re not contributing enough to get the full match, you’re leaving money on the table.

Take John, a 35-year-old project manager. He originally contributed just 3% of his salary because he felt he couldn’t afford more. He didn’t realize until a financial wellness seminar that by not contributing at least 6%, he was missing out on his company’s full match. By increasing his contribution, John effectively received a 3% pay raise, courtesy of his employer. A smart move, indeed!

If you’re unsure about your company’s policy, ask your HR department or check your benefits portal. Knowing exactly how much your employer will match can help you plan your contributions to maximize this benefit. Remember, it’s one of the best returns on investment you’ll ever get.

Choose the Right Investment Mix

Investing your 401(k) funds isn’t just about picking stocks, bonds, or mutual funds at random. It’s about finding the right balance that aligns with your risk tolerance and timeline to retirement. A 25-year-old might lean towards a more aggressive portfolio, with a higher concentration of stocks, given their longer timeline. In contrast, someone nearing retirement might prefer a more conservative approach, favoring bonds and other low-risk investments.

According to a report by Fidelity Investments, the average 401(k) account balance varies significantly based on the asset allocation. More aggressive portfolios tend to see higher growth over the long term, but they also come with increased volatility. That’s why it’s crucial to review your investment options and periodically rebalance your portfolio to ensure it aligns with your evolving financial situation and market conditions.

Consider consulting with a financial advisor or using online tools to assess your risk tolerance. It’s like choosing a spice level at a restaurant — some people can handle the heat, while others prefer it mild. Your 401(k) should reflect your personal comfort with risk.

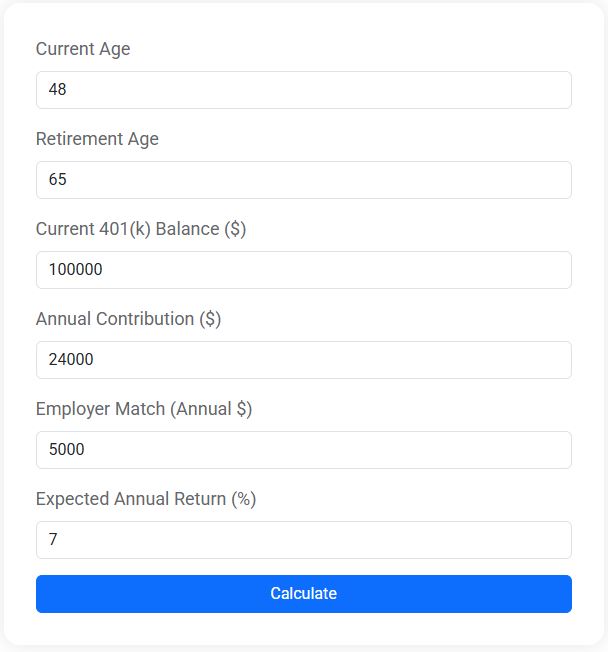

401(k) Retirement Calculator

Wondering how much your 401(k) will be worth when you retire? Our free 401(k) Retirement Calculator helps you estimate your future savings based on your current balance, annual contributions, employer match, and expected rate of return. Whether you're just getting started or already building your nest egg, this tool gives you a clear picture of how your retirement account can grow over time.

Gradually Increase Your Contributions

Life happens, and sometimes it feels like there’s never enough money to go around. But even small increases in your 401(k) contributions can have a big impact over time. Consider implementing an automatic escalation feature if your plan offers it. This feature gradually increases your contribution rate annually, often in conjunction with a salary raise, making it less noticeable in your paycheck.

Take, for example, Lisa, a 28-year-old teacher. She started by contributing 4% of her salary to her 401(k) and set her plan to increase by 1% each year. By the time she reached her mid-30s, she was contributing over 10%, and she didn’t feel the pinch because it happened gradually. Plus, with compounding interest, those extra percentages added up significantly over time.

Also, aim to contribute up to the IRS limit if you can swing it. As of 2023, the limit is $22,500 for those under 50, with an additional $7,500 catch-up contribution allowed for those 50 and older. Stretching to meet these limits might seem daunting, but it’s an excellent goal to strive for as your income grows.

Stay Informed About Fees

Fees can quietly eat away at your retirement savings like termites in a wooden beam. They often hide in expense ratios, administrative costs, and transaction fees. According to a study by the Center for American Progress, even a 1% increase in fees can reduce your retirement savings by tens of thousands of dollars over a lifetime. Therefore, it’s crucial to understand what you’re being charged and to seek lower-cost investment options when possible.

For instance, index funds typically have lower fees compared to actively managed funds. They track a specific index, like the S&P 500, which means less frequent trading and lower management costs. If your 401(k) plan offers index funds, consider them as a cost-effective way to invest.

Regularly review your account statements and reach out to your plan administrator if you have questions about specific fees. An informed investor is a savvy investor, after all.

Plan Your Withdrawals Strategically

Once you reach retirement, it’s time to reap the rewards of your hard work. But withdrawing from your 401(k) isn’t as simple as pulling money from an ATM. Withdrawals are subject to taxes, and taking money out too early can trigger penalties. For instance, if you withdraw funds before age 59½, you’ll generally face a 10% penalty in addition to income taxes.

Think of your 401(k) as a reservoir — you want to draw from it wisely to ensure it lasts throughout your retirement. Financial advisor Jane Smith suggests creating a withdrawal strategy that accounts for required minimum distributions (RMDs), which typically start at age 73. RMDs ensure that you’re not hoarding tax-deferred funds indefinitely but withdrawing too much too soon can deplete your savings quicker than anticipated.

Consider diversifying your income sources in retirement. If you have a Roth IRA, for example, you can withdraw contributions tax-free, potentially reducing your overall tax burden. Planning your withdrawals strategically can help you maintain financial security throughout retirement, allowing you to focus on enjoying life rather than worrying about money.

Maximizing your 401(k) takes some effort, but the payoff is worth it. By understanding your employer’s match, selecting the right investment mix, increasing your contributions, staying vigilant about fees, and planning your withdrawals wisely, you’re setting yourself up for a financially secure retirement. So take these tips to heart and watch your 401(k) garden grow. Your future self will thank you!