Investing in Gold: A Hedge Against Market Uncertainty

In times of economic uncertainty, gold is often seen as a safe haven due to its historical resilience, ability to hedge against inflation, and its low correlation with other asset classes, providing diversification benefits. Investors can incorporate gold into their portfolios through various means such as physical gold, ETFs, or gold mining stocks, each with its own risks and advantages. While offering stability and wealth preservation, gold investments require careful consideration of market dynamics and individual financial goals.

In times of economic turbulence, when markets ride a rollercoaster of volatility, many investors find themselves searching for a safe haven. Enter gold: the shiny metal that has dazzled humanity for millennia. Gold isn't just pretty to look at; it holds a special place in the financial world as a reliable store of value. But why, exactly, do investors flock to gold during uncertain times? And how can you make it part of your portfolio? Let's dive in to uncover the golden truths behind this investment choice.

Gold has long been considered a hedge against market uncertainty—think of it as the financial world's security blanket. When stock markets wobble and currencies fluctuate, gold often holds steady, providing a sense of stability. Its appeal lies in its historical resilience and unique properties, such as its ability to hedge against inflation and provide diversification. Unlike other assets that are tied closely to the ebbs and flows of the economy, gold tends to march to its own beat. But investing in gold isn't a one-size-fits-all endeavor. There are multiple ways to incorporate it into your financial strategy, each carrying its own set of risks and rewards.

The Historical Resilience of Gold

Gold's allure is deeply rooted in history. Civilizations from the ancient Egyptians to the Aztecs have prized this metal not just for its beauty but for its perceived permanence and value. Fast forward to modern times, and gold has maintained its stature as a symbol of wealth. During periods of economic downturn, such as the Great Depression or the 2008 financial crisis, gold prices have historically spiked. This isn't just a fluke; it's a pattern that reflects gold's role as a refuge in stormy financial seas.

For instance, during the 2008 crisis, while global equity markets were crashing, gold prices surged by approximately 25%. This wasn't just because people wanted to own something shiny. It was because investors were seeking a tangible asset that wouldn't lose its value overnight. Gold has this unique ability to inspire confidence when other investments falter, making it a go-to option for cautious investors.

Gold as an Inflation Hedge

Inflation can be a sneaky thief, eroding the purchasing power of our money over time. Enter gold, the time-tested inflation hedge. When inflation rises, the value of currency falls, but gold has a tendency to retain its value. This is because gold is priced globally, and its value isn't tied to any one currency. As inflation increases, investors often flock to gold to preserve their wealth.

Consider the 1970s—a decade marked by high inflation in the United States. During this period, gold prices soared from about $35 per ounce in 1971 to a staggering $850 by 1980. This dramatic increase wasn't driven by a sudden surge in gold's inherent worth but by its ability to hold value when the dollar was losing it. As financial advisor Jane Smith notes, "Gold is like an anchor in a stormy sea of inflation. It doesn't promise to make you rich, but it helps ensure you don't get poorer."

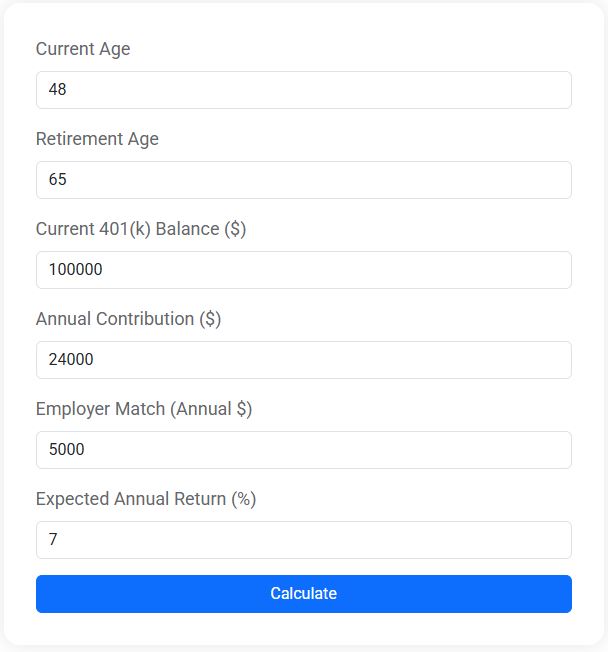

401(k) Retirement Calculator

Wondering how much your 401(k) will be worth when you retire? Our free 401(k) Retirement Calculator helps you estimate your future savings based on your current balance, annual contributions, employer match, and expected rate of return. Whether you're just getting started or already building your nest egg, this tool gives you a clear picture of how your retirement account can grow over time.

Diversification Benefits

If there's one mantra every investor should embrace, it's "don't put all your eggs in one basket." Diversification is key to a healthy portfolio, and gold offers an excellent way to achieve this. Gold's low correlation with other asset classes means it often moves independently from stocks and bonds. This characteristic can help smooth out the bumps in your portfolio's road.

For example, during times when equities are underperforming, gold may shine brightly, helping to offset losses elsewhere. This diversification benefit is particularly appealing to investors looking to balance risk and reward. As CNBC points out, "Gold can act as a counterbalance, providing stability when other investments are under pressure." By including gold in your portfolio, you can potentially reduce overall risk while enhancing returns.

Ways to Invest in Gold

Investing in gold isn't as simple as buying a shiny bar and stuffing it under your mattress—though that's certainly one option. There are several ways to gain exposure to gold, each with its own pros and cons. Let's explore these options to help you decide which might be right for you.

First, there's physical gold, which includes coins, bars, and jewelry. Owning physical gold gives you the satisfaction of holding a tangible asset. However, it also comes with challenges, such as storage and insurance costs. Then there are gold-backed Exchange-Traded Funds (ETFs). These offer a convenient way to invest in gold without the hassle of physical ownership. ETFs trade like stocks, providing liquidity and ease of trading.

Another option is investing in gold mining stocks. These stocks don't give you direct ownership of gold but offer exposure to companies that produce it. While these can offer growth potential, they also come with risks related to mining operations and management performance. As Morningstar suggests, "Gold mining stocks can be volatile, but they also offer a leveraged play on gold prices."

Considerations and Risks

Like any investment, gold isn't without its risks and considerations. While it can provide stability and preserve wealth, it's not immune to price fluctuations. Gold prices can be influenced by a range of factors, from geopolitical tensions to changes in monetary policy. It's crucial to understand these dynamics before diving in.

Additionally, gold doesn't generate income like dividends or interest. This means that while it can hold value, it won't provide regular cash flow. Investors need to weigh this against their financial goals and income needs. As financial planner Mike Lee advises, "Gold is a tool for preservation, not growth. It's important to know what role it should play in your portfolio."

Aligning Gold with Your Financial Goals

Ultimately, whether or not to invest in gold comes down to your individual financial goals and risk tolerance. Are you looking for a safety net during turbulent times? Or are you seeking high returns and willing to take on more risk? Understanding your objectives will guide your decision-making process.

Gold can be a valuable component of a diversified investment strategy, but it's not a magic bullet. It's essential to consider how it fits with your overall financial plan and to stay informed about market trends. Whether you're a seasoned investor or just starting, taking the time to educate yourself about gold can pay off in the long run.

In the end, gold's enduring appeal is rooted in its ability to offer a sense of security amidst the unknown. As markets continue to evolve, having a well-rounded portfolio that includes gold could provide the peace of mind that so many investors seek. After all, when it comes to safeguarding your financial future, a little gold can go a long way.