The Rise of ESG Investing: What You Need to Know About Sustainable Investing

ESG investing, which focuses on Environmental, Social, and Governance criteria, is transforming the investment landscape by integrating non-financial factors into investment decisions, aiming for sustainable long-term returns while promoting positive social and environmental outcomes. Driven by increased awareness of climate change, social justice, and corporate governance issues, ESG investing has seen significant growth, particularly among millennials and Gen Z, reaching over $35 trillion in assets by 2020. While it offers benefits like better risk management and alignment with personal values, challenges such as "greenwashing" persist; however, the trend is expected to grow with regulatory support and technological advancements enhancing ESG performance tracking.

The concept of investing has undergone a significant transformation in recent years, driven by a growing awareness of the environmental, social, and governance (ESG) factors that impact our world. ESG investing, also known as sustainable investing, not only considers financial returns but also evaluates the ethical implications of investment choices. This approach seeks to achieve sustainable long-term returns while promoting positive societal and environmental outcomes. As awareness of climate change, social justice, and corporate governance issues increases, more investors are choosing to put their money into ESG-focused portfolios. By 2020, ESG investing had already amassed over $35 trillion in assets worldwide, a testament to its rising popularity, especially among millennials and Gen Z.

This emerging trend aligns with the evolving priorities of younger generations, who often prioritize sustainability and ethical considerations in their financial decisions. However, as with any investment strategy, ESG investing comes with its own set of challenges and opportunities. While it offers the promise of better risk management and alignment with personal values, the problem of "greenwashing" remains a significant hurdle. Despite these challenges, the ESG investing trend is expected to grow as regulatory support increases and technological advancements improve the ability to track ESG performance.

Understanding ESG Criteria

To fully grasp the concept of ESG investing, it's crucial to understand what each component represents. The "E" in ESG stands for environmental criteria, which consider how a company performs as a steward of nature. This may include its energy use, waste management, pollution, natural resource conservation, and treatment of animals. Evaluating these factors helps investors understand the environmental impact of their investments and encourages companies to adopt more sustainable practices.

The "S" represents social criteria, which examine how a company manages relationships with employees, suppliers, customers, and the communities where it operates. This includes a company's efforts to support diversity, human rights, consumer protection, and overall community relations. For instance, companies with strong social policies might have better employee engagement and customer loyalty, potentially leading to better financial performance.

Governance, the "G" in ESG, deals with a company’s leadership, executive pay, audits, internal controls, and shareholder rights. Strong governance practices can indicate a company's commitment to ethical business practices, transparency, and accountability. For example, companies with diverse boards and clear policies on executive compensation are often seen as more trustworthy and better managed.

The Growth of ESG Investing

The rise of ESG investing can be attributed to several key factors. A growing body of research suggests that companies with strong ESG performance may offer better risk-adjusted returns. According to a study by Morgan Stanley, sustainable funds consistently outperformed their traditional counterparts during times of market volatility. This finding has attracted the attention of investors seeking stable, long-term returns.

Moreover, societal shifts have played a significant role in the growth of ESG investing. Younger generations, particularly millennials and Gen Z, are not just passive observers of global issues—they are active participants in driving change. This demographic is more likely to support companies that align with their values on climate change, social justice, and corporate responsibility. As a result, these investors are increasingly demanding that their portfolios reflect their ethical standards.

Additionally, regulatory bodies around the world are beginning to recognize the importance of sustainable investing. The European Union, for example, has introduced the Sustainable Finance Disclosure Regulation (SFDR), which requires financial market participants to disclose how they integrate ESG factors into their investment processes. Such regulatory support is likely to further accelerate the adoption of ESG investments.

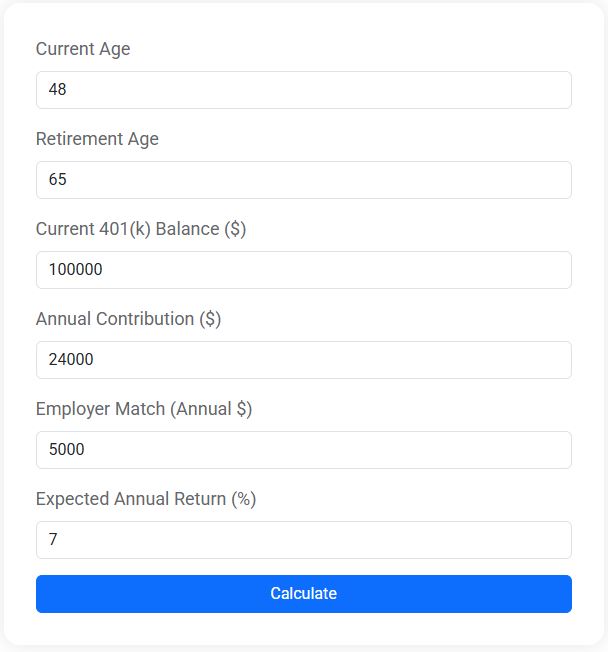

401(k) Retirement Calculator

Wondering how much your 401(k) will be worth when you retire? Our free 401(k) Retirement Calculator helps you estimate your future savings based on your current balance, annual contributions, employer match, and expected rate of return. Whether you're just getting started or already building your nest egg, this tool gives you a clear picture of how your retirement account can grow over time.

Challenges in ESG Investing

Despite its growing popularity, ESG investing is not without challenges. One of the most significant issues is "greenwashing," where companies exaggerate or falsely claim their products or practices are environmentally friendly. This can mislead investors and undermine the authenticity of ESG investments. As CNBC has reported, the lack of standardized reporting and metrics makes it difficult for investors to accurately assess a company's ESG performance.

Another challenge is the potential for lower short-term returns. While ESG investing aims for sustainable long-term gains, some investors may be deterred by the possibility of missing out on quick profits from companies that do not prioritize ESG factors. This can create a dilemma for investors who are trying to balance ethical considerations with financial performance.

Furthermore, the integration of ESG criteria into investment decisions can be complex and resource-intensive. It requires thorough research, data analysis, and continuous monitoring to ensure that investments are genuinely aligned with ESG principles. As financial advisor Jane Smith explains, "Investors have to be diligent about researching the funds they invest in and ensure they are truly ESG-compliant, rather than relying on labels."

The Future of ESG Investing

Despite these challenges, the future of ESG investing looks promising. Advances in technology are enhancing the ability to track and measure ESG performance, making it easier for investors to make informed decisions. Tools and platforms that aggregate ESG data are becoming more sophisticated, providing investors with clearer insights into the sustainability practices of potential investments.

Moreover, as more companies recognize the importance of ESG factors, they are beginning to incorporate these considerations into their business strategies. This shift not only meets the demands of conscientious investors but also positions companies for long-term success in a world that increasingly values sustainability.

In the coming years, we can expect to see continued growth in ESG investing, driven by a combination of regulatory pressure, technological advancements, and changing societal values. As investors become more educated about the benefits and challenges of sustainable investing, they will be better equipped to make choices that align with their financial goals and ethical standards.

In summary, ESG investing represents a significant shift in how we approach investment decisions, integrating non-financial factors to drive positive change. While there are obstacles to overcome, the momentum behind ESG investing is undeniable, and its impact on the investment landscape is likely to be profound and enduring. As the world continues to evolve, so too will the ways in which we invest in it, reflecting a growing commitment to sustainability and social responsibility.