The Future of Investing: Trends and Technologies Shaping the Financial Landscape

The investment landscape is undergoing a significant transformation driven by technological advancements like AI and blockchain, along with trends such as sustainable investing and fintech innovations. These changes are making investing more accessible and aligned with personal values, especially for younger, tech-savvy generations. As regulatory frameworks adapt to these innovations, staying informed and flexible will be crucial for investors to seize new opportunities and navigate challenges in this dynamic environment.

The world of investing is experiencing a seismic shift, driven by a blend of cutting-edge technology, evolving financial products, and a new wave of investor priorities. As we stand on the precipice of this transformation, it's clear that the future of investing is not just about capital growth but also about aligning with personal values and leveraging technology for smarter decision-making. In particular, advancements in areas like artificial intelligence, blockchain, and sustainable investing are reshaping how we think about finance.

Young, tech-savvy investors are at the forefront of this change, demanding platforms and strategies that are both innovative and ethical. Meanwhile, industry veterans are adapting to keep pace, often incorporating these new tools to enhance their traditional investment models. In this dynamic environment, flexibility and informed decision-making are key to navigating both opportunities and challenges. Let's dive into the trends and technologies that are setting the stage for the future of investing.

Artificial Intelligence: The Brain Power Behind Modern Investing

Artificial intelligence (AI) is no longer just a futuristic concept—it's an integral part of today's financial landscape. From robo-advisors to AI-driven trading algorithms, this technology is making investing more accessible and efficient. Robo-advisors like Betterment and Wealthfront use AI to provide personalized investment portfolios, automatically adjusting asset allocations based on market conditions and individual goals. This democratizes access to sophisticated investment strategies that were once the domain of high-net-worth individuals.

Moreover, AI's ability to analyze vast datasets in real-time provides investors with insights that are both deep and actionable. For instance, AI can identify patterns and trends in market movements that human analysts might miss, offering a competitive edge in decision-making. As financial advisor Jane Smith notes, "AI doesn't just crunch numbers; it finds connections and predicts outcomes that are crucial for strategic investing."

However, AI isn't without its challenges. Concerns about data privacy and the potential for algorithmic bias remind us that while AI is a powerful tool, it must be used responsibly. Investors should stay informed about how AI models are constructed and remain vigilant about the ethical implications of their use.

Blockchain: The Backbone of Future Financial Transactions

Blockchain technology, best known as the foundation for cryptocurrencies like Bitcoin and Ethereum, is poised to transform more than just currency exchange. Its decentralized, transparent, and secure nature makes it ideal for a range of financial applications, from smart contracts to asset tokenization.

Smart contracts, for instance, are self-executing contracts with the terms directly written into code, ensuring that transactions are carried out without the need for a third party. This innovation reduces costs and increases trust between parties. A vivid example of blockchain's potential is the tokenization of assets, which allows for fractional ownership of high-value items like real estate or art, thus widening the pool of potential investors.

According to a report by Deloitte, blockchain could also streamline back-office operations, reducing errors and increasing efficiency across the financial sector. Yet, as with any burgeoning technology, there are hurdles to overcome—namely, regulatory acceptance and standardization across international borders. As these frameworks evolve, blockchain's role in the financial ecosystem is likely to expand significantly.

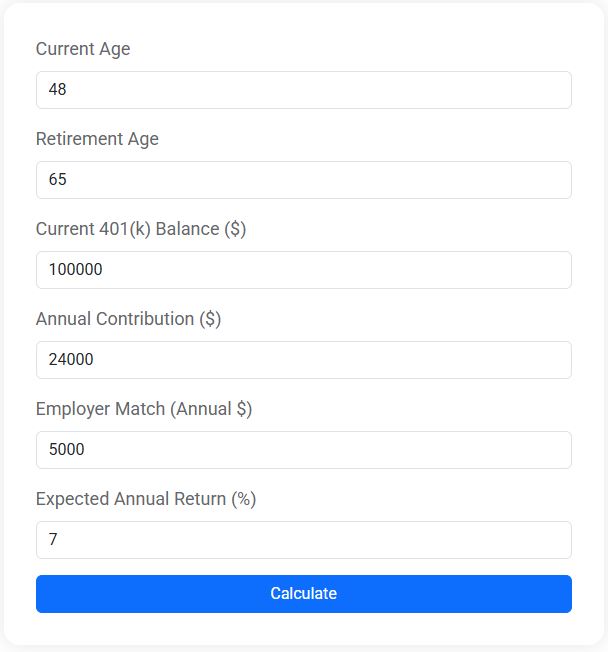

401(k) Retirement Calculator

Wondering how much your 401(k) will be worth when you retire? Our free 401(k) Retirement Calculator helps you estimate your future savings based on your current balance, annual contributions, employer match, and expected rate of return. Whether you're just getting started or already building your nest egg, this tool gives you a clear picture of how your retirement account can grow over time.

Sustainable Investing: Aligning Portfolios with Personal Values

The shift towards sustainable investing reflects a growing desire to align financial decisions with personal and societal values. Environmental, social, and governance (ESG) criteria are becoming essential factors in investment analysis, driven by both investor demand and regulatory pressure.

This trend is particularly pronounced among millennials and Gen Z, who prioritize sustainability and ethical considerations alongside financial returns. Investment platforms are responding by offering ESG-focused funds and tools that allow investors to measure the impact of their portfolios. According to CNBC, ESG assets are on track to reach $50 trillion by 2025, underscoring the momentum behind this movement.

Sustainable investing isn't just about doing good; it also makes financial sense. Companies with strong ESG practices are often more resilient and better positioned for long-term success. However, investors should be wary of "greenwashing," where companies exaggerate their sustainability efforts. Conducting thorough research and seeking out transparent ESG metrics are crucial steps in making informed decisions.

Fintech Innovations: Bridging Gaps and Creating Opportunities

Financial technology, or fintech, has revolutionized the way individuals interact with their finances. From mobile banking apps to peer-to-peer lending platforms, fintech innovations are breaking down barriers and making financial services more accessible than ever. Companies like Robinhood and Acorns have attracted a new generation of investors by providing user-friendly, low-cost solutions that demystify the investment process.

Fintech is also fostering greater financial inclusion by reaching underserved populations. Mobile payment systems and micro-investing platforms are enabling people in developing regions to participate in the global financial system, offering tools for saving, investing, and building wealth.

Yet, the rapid pace of fintech innovation raises questions about security and regulation. As fintech companies continue to push the envelope, regulators must keep pace to ensure that consumer protections and financial stability are maintained. For investors, staying informed about the latest fintech trends and understanding the regulatory landscape will be key to leveraging these tools effectively.

Adapting to Changing Regulatory Landscapes

As these technologies and trends reshape the investment landscape, regulatory frameworks are evolving to keep up. Governments and regulatory bodies worldwide are grappling with how to oversee new financial instruments and technologies without stifling innovation.

For instance, the rise of cryptocurrencies has prompted discussions around how to regulate digital assets while ensuring consumer protection and preventing fraud. In the U.S., the Securities and Exchange Commission (SEC) has been actively working to create guidelines that address these challenges, but the path forward remains complex and uncertain.

Investors should pay close attention to regulatory developments, as these will impact everything from investment strategies to tax implications. Being adaptable and staying ahead of regulatory changes will be crucial for navigating the future financial landscape.

In this rapidly changing environment, the key to success lies in staying informed and flexible. By understanding the technologies and trends shaping the future of investing, investors can position themselves to seize new opportunities and overcome challenges. The future may be uncertain, but it is also filled with potential for those willing to embrace change and think creatively about their financial strategies.