Passive vs. Active Investing: Choosing the Right Strategy for Your Goals

The article discusses the key differences between passive and active investing strategies, highlighting that your choice should align with your financial goals, risk tolerance, and available time. Passive investing offers simplicity, lower costs, and market-average returns, making it ideal for long-term wealth accumulation with minimal involvement. In contrast, active investing involves frequent trading and higher costs but offers the potential for higher returns, appealing to those willing to dedicate time and effort to outperform the market.

When it comes to investing, the financial world often feels like a bustling marketplace filled with options, each promising to take you to your desired financial destination. Two of the most talked-about strategies are passive and active investing. Both have their champions and critics, and understanding the nuances of each can help you decide which path aligns best with your financial goals, risk tolerance, and available time for managing your investments.

Imagine you’re on a journey to financial independence. Passive investing is like boarding a reliable cruise ship, where you’re assured of a steady, if unspectacular, voyage to your destination. On the other hand, active investing resembles piloting a speedboat, requiring constant attention and skill to navigate the waves, with the potential for both thrilling gains and unexpected losses. Let’s dive into the specifics of these two strategies and see which might be the better fit for your financial journey.

Understanding Passive Investing

Passive investing is all about embracing the market's natural ebb and flow. It’s a strategy that involves buying and holding a diversified portfolio of assets over the long term, with minimal trading. The most common vehicle for passive investing is index funds, which aim to replicate the performance of major indices like the S&P 500 or the Dow Jones Industrial Average.

One of the biggest advantages of passive investing is its simplicity. Since you’re not trying to beat the market, you can enjoy lower costs. The expense ratios for index funds are typically much lower than those for actively managed funds. For instance, according to data from Morningstar, the average expense ratio for passive funds was 0.13% in 2022, compared to 0.66% for active funds.

Passive investing also requires less time and effort. You don’t need to constantly analyze market trends or individual stocks. This makes it an attractive option for those who prefer a "set it and forget it" approach. Moreover, history has shown that over the long haul, most active managers fail to outperform the market. As Warren Buffett famously quipped, "Inactivity strikes us as intelligent behavior."

Exploring Active Investing

Active investing, on the other hand, is all about hands-on management and the potential for higher returns. Active investors seek to outperform the market by frequently buying and selling securities based on research, forecasts, and personal judgment. This strategy can involve individual stock picking, market timing, and the use of derivatives.

The allure of active investing is the potential for greater returns. Skilled active investors can capitalize on market inefficiencies and earn significant profits. However, this approach requires a deep understanding of the markets, willingness to take risks, and dedication to continual research. As legendary investor Peter Lynch once said, "The person that turns over the most rocks wins the game."

However, active investing comes with its challenges. It’s time-intensive and can be stressful, especially during volatile market conditions. The costs are also higher due to more frequent trading and the management fees associated with actively managed funds. According to Investopedia, active funds typically incur trading costs that can add up to 1% or more annually, eating into potential returns.

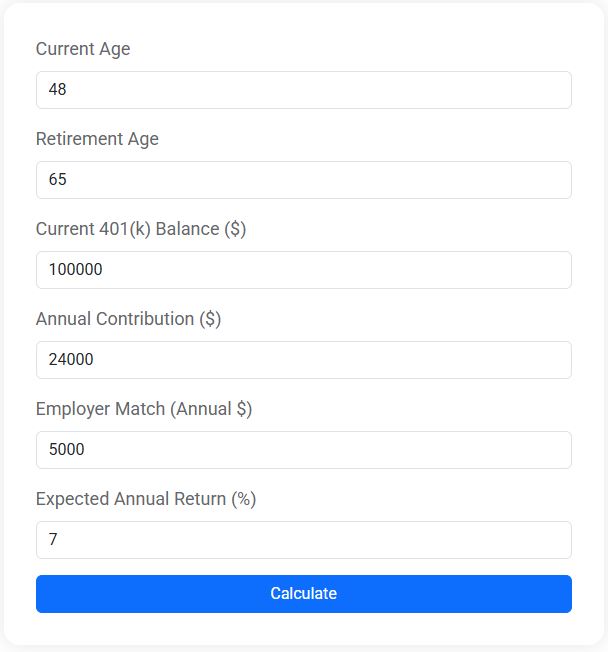

401(k) Retirement Calculator

Wondering how much your 401(k) will be worth when you retire? Our free 401(k) Retirement Calculator helps you estimate your future savings based on your current balance, annual contributions, employer match, and expected rate of return. Whether you're just getting started or already building your nest egg, this tool gives you a clear picture of how your retirement account can grow over time.

Aligning Your Strategy with Your Goals

Deciding between passive and active investing isn’t just about choosing one over the other; it’s about aligning your investment strategy with your personal financial goals. If your primary goal is long-term wealth accumulation with minimal involvement, passive investing might be the way to go. The reduced costs and market-average returns can be a solid foundation for building wealth over time.

Conversely, if you have the time, resources, and appetite for risk, active investing might offer the opportunity to achieve returns beyond what the market delivers. This could be particularly appealing if you enjoy researching stocks or have a knack for identifying undervalued companies.

It’s also worth considering a hybrid approach, combining elements of both strategies to suit different aspects of your portfolio. For instance, you might choose to invest passively in a retirement account while actively managing a smaller portion of your portfolio for potential higher returns.

Considering Risk Tolerance and Time Commitment

Your risk tolerance plays a crucial role in determining the appropriate investment strategy. Passive investing typically involves less risk, as it spreads investments across a broad market index. This diversification can help cushion against the volatility of individual stocks or sectors.

Active investing, by contrast, requires a higher risk tolerance. The potential for higher returns comes with the possibility of significant losses, especially if the market doesn’t behave as predicted. As financial advisor Jane Smith explains, "Active investors must be comfortable with the idea that their choices might not always pan out, and they need to be prepared for the emotional rollercoaster that comes with it."

Time commitment is another critical factor. Passive investing demands minimal time once you’ve set up your portfolio, making it ideal for those with busy schedules or less interest in daily market movements. Active investing, however, requires regular monitoring and decision-making, which can be both time-consuming and stressful.

The Role of Costs in Investment Strategy

Costs can significantly impact your investment returns, making it essential to consider them when choosing a strategy. As mentioned earlier, passive investing is generally more cost-effective due to lower expense ratios and reduced trading costs. These savings can compound over time, boosting your overall returns.

Active investing, with its higher management fees and trading expenses, demands careful consideration of whether the potential for higher returns justifies the additional costs. In many cases, the higher performance touted by active managers is negated by these expenses.

Consider the example of John, a savvy investor who transitioned from active to passive investing. After years of paying high fees for active management, he realized that the net returns were often less than what he could have achieved through a simple index fund. By switching to a passive strategy, he significantly reduced his costs and improved his overall financial outcomes.

Conclusion: Finding Your Path

Ultimately, the choice between passive and active investing should reflect your personal financial goals, risk tolerance, and lifestyle. Whether you prefer the steady, reliable cruise of passive investing or the exciting, hands-on approach of active investing, there’s no one-size-fits-all answer. The key is to understand each strategy’s strengths and weaknesses and how they align with what you want to achieve.

As you embark on your investment journey, remember that it’s not just about achieving the highest returns, but about finding a strategy that you can stick with through thick and thin. Whether you’re a passive investor enjoying a leisurely cruise or an active investor navigating the waves, the most important thing is to stay informed, stay engaged, and make choices that support your long-term financial success.