Financial Wellness: How Investing in Yourself Can Lead to Financial Success

Investing in yourself is a powerful financial strategy that involves enhancing your skills and knowledge, building a professional network, prioritizing health, embracing a growth mindset, and setting clear goals. By continuously updating your education and skills, you can boost your earning potential and remain competitive in the job market. Additionally, focusing on personal wellness and developing a strong network can open up new opportunities and provide a solid foundation for achieving both personal fulfillment and financial success.

Investing in yourself might seem like a no-brainer, but in the hustle and bustle of daily life, it's easy to overlook. We often associate "investment" with stocks, real estate, or other financial instruments, but the most profound investment you can make is in yourself. Why? Because enhancing your skills and knowledge, fostering a robust network, and prioritizing your well-being can lead to greater financial success. Not to mention, it can also bring about personal fulfillment and a sense of purpose.

Think about it: when you focus on personal growth, you not only increase your earning potential but also ensure you remain agile and adaptable in an ever-changing job market. Let's explore how investing in various aspects of yourself can pave the way for financial prosperity.

Enhancing Skills and Knowledge

In today's rapidly evolving world, continuous learning is not just beneficial—it's essential. The job market is not static; it shifts with technological advancements and new industry standards. By consistently updating your education and skills, you can stay ahead of the curve. This doesn't necessarily mean enrolling in expensive degree programs. Online courses, workshops, and industry certifications can be just as impactful.

For instance, if you're in the tech industry, platforms like Coursera, Udemy, or LinkedIn Learning offer courses on the latest programming languages or project management techniques. These platforms provide flexibility to learn at your own pace while still holding down a full-time job. As career strategist Alison Doyle notes, "The most successful people are lifelong learners. They understand that the world is constantly changing, and they are willing to adapt and grow."

Moreover, expanding your knowledge isn't limited to professional skills. Learning new languages, understanding cultural nuances, or even diving into history can open new doors and perspectives. This holistic approach to learning enriches your life both personally and professionally.

Building a Professional Network

Your network is your net worth, as the saying goes, and there's a lot of truth to that. Building a robust professional network can lead to new opportunities, partnerships, and even friendships that can last a lifetime. But networking isn't about collecting business cards or LinkedIn connections; it's about building meaningful relationships.

Attend industry conferences, join professional groups, and participate in workshops to meet like-minded individuals. Engage in conversations, show genuine interest in others' work, and offer help when possible. These interactions can lead to collaborations or job opportunities that you might not have found otherwise.

Consider the story of John, a graphic designer who attended a local design meetup. There, he met a freelance writer who later introduced him to a startup looking for a part-time designer. This connection not only provided John with additional income but also helped him transition to a full-time role at the startup. Networking, as John found, isn't just about who you know but also about who they know.

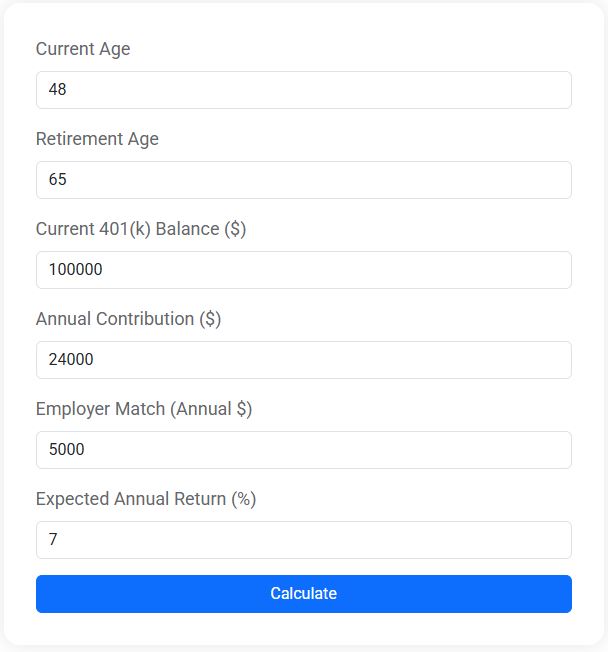

401(k) Retirement Calculator

Wondering how much your 401(k) will be worth when you retire? Our free 401(k) Retirement Calculator helps you estimate your future savings based on your current balance, annual contributions, employer match, and expected rate of return. Whether you're just getting started or already building your nest egg, this tool gives you a clear picture of how your retirement account can grow over time.

Prioritizing Health and Wellness

Investing in your health might not seem directly linked to financial success, but your well-being is foundational to everything else. When you're healthy, you're more productive, focused, and energetic. This directly impacts your ability to perform at your best in professional settings.

Prioritizing health doesn't have to mean expensive gym memberships or costly wellness retreats. Simple habits like taking regular walks, eating balanced meals, and ensuring adequate sleep can make a significant difference. As personal trainer and wellness coach Lisa Hill says, "Your body is your greatest asset. Taking care of it is crucial for both personal and financial success."

Mental health is equally important. Stress and burnout can severely affect your work performance and decision-making abilities. Taking time for mental relaxation, whether through meditation, hobbies, or simply unplugging from technology, can enhance your overall quality of life and work.

Embracing a Growth Mindset

A growth mindset, a concept popularized by psychologist Carol Dweck, involves believing that your abilities and intelligence can be developed through dedication and hard work. This mindset fosters a love for learning and resilience in the face of challenges.

When you embrace a growth mindset, setbacks are viewed as opportunities for growth rather than insurmountable obstacles. This perspective encourages you to take on challenges, seek feedback, and learn from criticism, all of which are essential for personal and professional development.

Consider Sarah, an entry-level employee who consistently sought feedback and viewed challenges as learning opportunities. Her dedication and willingness to grow led her to a managerial position within just a few years. Her story exemplifies how a growth mindset can propel your career and financial success.

Setting Clear Goals

Clear, actionable goals are the cornerstone of personal and financial success. Without them, it's easy to drift aimlessly, unsure of where you're headed. Setting goals gives you direction and motivation.

Start by defining both short-term and long-term goals. Short-term goals might include saving a specific amount each month or completing a professional course. Long-term goals could involve buying a home, starting a business, or planning for retirement. Write these goals down and review them regularly to track your progress.

Financial planner Laura Adams emphasizes, "Goals are like a GPS for your life. They help you stay on track and reach your desired destination." By knowing what you want to achieve, you can make informed decisions that align with your financial aspirations.

In summary, investing in yourself is a multifaceted approach that encompasses skill enhancement, networking, wellness, mindset, and goal-setting. Each of these elements feeds into the others, creating a cycle of growth and opportunity. As you continue to develop yourself, you'll find that financial success is not just a possibility—it's a natural outcome. So, take that course, attend that networking event, prioritize your health, embrace challenges, and set those goals. Your future self will thank you.