The Art of Value Investing: Finding Undervalued Stocks for Long-Term Growth

Value investing is a time-tested strategy focused on purchasing undervalued stocks with strong fundamentals and long-term growth potential. This approach, championed by legendary investors like Warren Buffett, involves analyzing financial ratios, company earnings, and market position while maintaining patience and discipline to allow investments to mature. By avoiding common pitfalls, leveraging technology, and staying informed, investors can use value investing to potentially achieve significant returns and build wealth over time.

Value investing has long been the cornerstone of many successful investment portfolios, offering a roadmap to discerning the diamonds in the rough from the fool's gold. At its core, value investing is about purchasing stocks that the market has overlooked—shares that are undervalued relative to their intrinsic worth. This strategy, popularized by legendary figures like Warren Buffett and Benjamin Graham, demands a disciplined approach that marries patience with rigorous analysis. It's not for those seeking a quick buck; instead, it's for the investor willing to wait for the market to recognize the true potential of an undervalued asset.

In an era where the stock market can feel like a rollercoaster, the steady hand of value investing offers a reassuring alternative. Unlike speculative trading, which relies on predicting short-term market movements, value investing is rooted in understanding the fundamental drivers of a company’s success. By focusing on financial health, market position, and future growth potential, investors can make informed decisions that go beyond the daily noise of the stock ticker.

Understanding the Fundamentals of Value Investing

At the heart of value investing is the concept of intrinsic value—the true worth of a company based on its fundamentals, such as earnings, dividends, and growth prospects. This requires a deep dive into financial statements, scrutinizing metrics like the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and free cash flow. These numbers are not just figures on a page; they are indicators of a company’s financial health and operational efficiency.

For instance, a low P/E ratio might suggest that a stock is undervalued compared to its earnings, but it's crucial to look at industry standards. A tech company with a P/E of 10 might be a steal, while the same ratio for a manufacturing firm could indicate trouble. As financial advisor Jane Smith puts it, "The context is everything in value investing. A number means nothing without a story."

The Importance of Patience and Discipline

One of the most challenging aspects of value investing is the requirement for patience. In a world that often rewards quick wins, waiting for a stock to mature can feel like watching paint dry. However, as Buffett famously says, "The stock market is designed to transfer money from the Active to the Patient." Value investing is about recognizing that the market doesn’t always get it right in the short term, but over time, prices tend to reflect true value.

Discipline is equally important. It’s easy to be swayed by market trends or the latest hot tip. But sticking to an investment thesis based on sound research is what separates successful investors from the rest. This means resisting the urge to sell during market dips or to buy into hype-driven rallies. It’s about playing the long game.

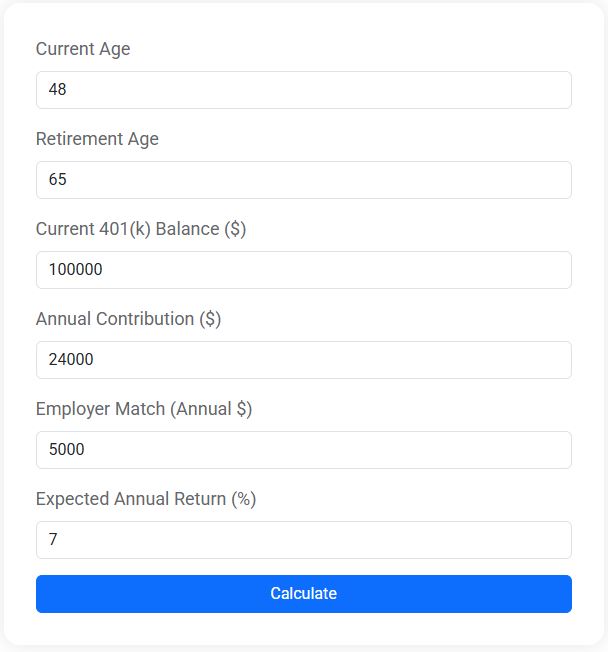

401(k) Retirement Calculator

Wondering how much your 401(k) will be worth when you retire? Our free 401(k) Retirement Calculator helps you estimate your future savings based on your current balance, annual contributions, employer match, and expected rate of return. Whether you're just getting started or already building your nest egg, this tool gives you a clear picture of how your retirement account can grow over time.

Leveraging Technology and Staying Informed

Today's value investors have access to tools that Buffett and Graham could only dream of. Advanced analytics, stock screeners, and financial news platforms provide a wealth of information at the click of a button. These technologies can aid in identifying potential investments and monitoring existing ones. However, technology is a double-edged sword—it can overwhelm as much as it can inform.

To avoid information overload, focus on reputable sources and utilize technology to complement, not replace, traditional analysis. As CNBC reports, "Investors who use technology wisely can gain an edge, but those who rely solely on it may miss the nuances that only a human touch can discern."

Avoiding Common Pitfalls

Despite its potential, value investing is not without its risks. One common mistake is falling into the value trap—buying a stock that appears cheap but is fundamentally flawed. This can happen when investors focus too much on low prices or ratios without considering underlying business issues, such as declining sales or poor management.

Another pitfall is the tendency to ignore market trends entirely. While value investing prioritizes long-term fundamentals, completely disregarding market sentiment can lead to missed opportunities or extended losses. It’s about finding a balance between sticking to your principles and being adaptable to market changes.

The Role of Diversification

Diversification is a critical component of any investment strategy, and value investing is no exception. While the temptation to put all your eggs in the most promising basket is strong, spreading investments across sectors and industries can mitigate risk. Historically, sectors like utilities or consumer staples have been fertile ground for value investors, but opportunities exist across the board.

Diversification also means considering both domestic and international stocks. As global markets become increasingly interconnected, expanding your investment horizon can uncover undervalued opportunities beyond your home turf. This not only protects against regional downturns but also captures growth in emerging markets.

Learning from the Masters

Warren Buffett, often dubbed the Oracle of Omaha, is perhaps the most famous advocate of value investing. His approach, characterized by buying quality companies at a fair price, has yielded extraordinary returns. Buffett’s investment in Coca-Cola is a classic example: he recognized its brand strength and growth potential long before the market caught on.

Benjamin Graham, the father of value investing, emphasized the importance of the "margin of safety," a buffer between a stock’s market price and its intrinsic value. His teachings underscore the need for caution and prudence, reminding investors that it's not just about finding bargains but ensuring those bargains have room to grow.

The Long-Term Payoff

Value investing requires a mindset shift—from short-term profits to long-term wealth building. It’s about understanding that real growth takes time and that the market is a vehicle for wealth transfer from the impatient to the patient. Historical data supports this: over the long haul, value stocks have often outperformed growth stocks, delivering robust returns to those willing to wait.

In the end, value investing is as much an art as it is a science. It demands a keen eye for detail, a commitment to research, and the courage to stand by your convictions. By mastering these elements, investors can unlock the potential for significant returns and lay the foundation for enduring wealth. Whether you're a seasoned investor or just starting out, embracing the principles of value investing can lead you on a rewarding journey in the world of finance.