The Beginner’s Guide to Building a Diversified Investment Portfolio

Building a diversified investment portfolio is crucial for wealth growth and risk management, as it helps mitigate the impact of any single underperforming investment. Beginners should focus on spreading investments across asset categories like stocks, bonds, and real estate, while regularly monitoring and rebalancing their portfolios to maintain alignment with financial goals. Seeking professional advice can also be beneficial, providing personalized guidance and helping navigate complex investment decisions.

Building a diversified investment portfolio might sound like something only financial wizards can do, but in reality, it’s a strategy anyone can master with a bit of patience and knowledge. Think of it as crafting a well-balanced meal; you want a bit of everything to ensure you get all the nutrients you need. Similarly, a diversified portfolio helps you manage risk while pursuing growth by spreading your investments across different asset classes. This strategy prevents any single poor performer from spoiling the whole batch.

If you’re new to investing, the journey can feel intimidating. But don’t worry; you’re not alone. Many people start their investment paths feeling overwhelmed by the jargon and options. The key is to start simple and build from there. By focusing on a few core principles, you can create a portfolio that aligns with your financial goals and risk tolerance. Whether you’re aiming for long-term wealth growth or just want to make sure your hard-earned money isn’t stagnating, diversification is your friend.

Understanding the Basics of Diversification

Diversification is all about not putting all your eggs in one basket. In the world of investments, this means allocating your money across various assets to reduce the risk of any single investment's poor performance impacting your overall portfolio. If one type of asset is having a bad day, others might be doing well, balancing out potential losses.

Historically, different asset classes like stocks, bonds, and real estate don’t always move in the same direction at the same time. For example, when the stock market takes a dive, bonds often remain stable or even increase in value, acting as a safety net. This is why it’s crucial to include a mix of asset types in your portfolio. According to Investopedia, a well-diversified portfolio typically includes a mix of stocks, bonds, and real estate, each with its own risk and return characteristics.

But diversification isn't just about choosing different types of assets; it's also about selecting various investments within each category. For instance, within stocks, consider different sectors such as technology, healthcare, and energy. This further minimizes the risk because even within asset classes, market conditions can vary.

Stocks: The Growth Engine

Stocks are often seen as the growth engine of a portfolio. They represent ownership in a company and thus carry the potential for higher returns compared to other asset classes. However, they also come with higher volatility. Being a stock investor means riding the waves of market highs and lows.

For beginners, it might be wise to start with index funds or exchange-traded funds (ETFs), which offer built-in diversification. These funds track major market indices and include a wide array of stocks, reducing the risk associated with investing in individual companies. As Warren Buffett famously advises, "By periodically investing in an index fund, the know-nothing investor can actually outperform most investment professionals."

Remember to diversify across sectors and geographies as well. U.S. stocks might dominate your portfolio, but don’t overlook international opportunities. Emerging markets, for example, can offer substantial growth potential, albeit with increased risks.

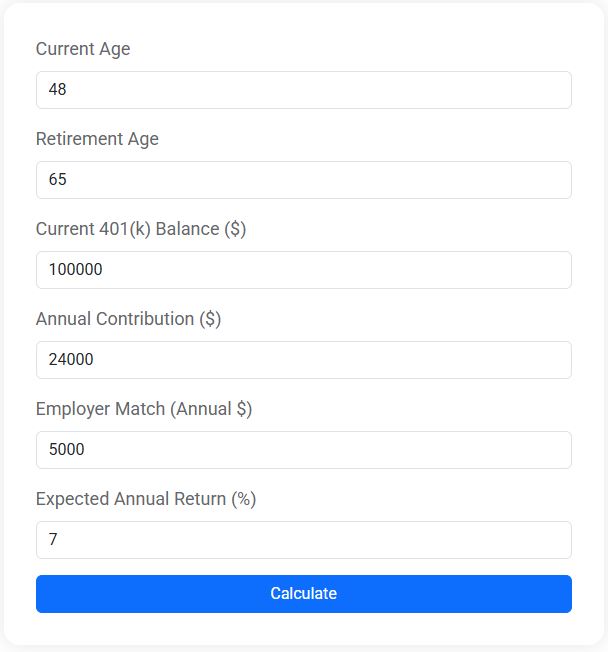

401(k) Retirement Calculator

Wondering how much your 401(k) will be worth when you retire? Our free 401(k) Retirement Calculator helps you estimate your future savings based on your current balance, annual contributions, employer match, and expected rate of return. Whether you're just getting started or already building your nest egg, this tool gives you a clear picture of how your retirement account can grow over time.

Bonds: The Stabilizer

Bonds are the stabilizers in your portfolio, providing regular income and reducing overall volatility. When you purchase a bond, you’re essentially lending money to an entity (like a government or corporation) that promises to pay you back with interest. They’re generally less risky than stocks, making them a perfect balance to the more volatile nature of equities.

Government bonds, like U.S. Treasury bonds, are considered very safe, but they usually offer lower returns. Corporate bonds can provide higher yields but come with greater risk. Diversifying within bonds is just as important as with stocks; consider a mix of government, municipal, and corporate bonds to spread risk.

According to Morningstar, maintaining a healthy bond allocation can protect your portfolio during economic downturns. For instance, during the 2008 financial crisis, bonds helped cushion the blow for many investors when stock markets plummeted.

Real Estate: Tangible Assets

Real estate investment offers a tangible asset that can generate income and appreciate over time. While buying physical property is one way to invest, it's not the only option. Real Estate Investment Trusts (REITs) allow you to invest in real estate without the hassle of managing physical properties. They often provide regular dividend income and diversification within the real estate sector.

Real estate can act as an inflation hedge because property values and rents typically rise with inflation. However, it’s important to be aware of the risks, such as market downturns affecting property values or rental income. Diversifying across different types of properties, like residential, commercial, and industrial, can mitigate some of these risks.

As real estate investor Barbara Corcoran says, "Real estate is best suited as a long-term investment." The potential for steady income and capital appreciation makes it an attractive component of a diversified portfolio.

Regular Monitoring and Rebalancing

Building a diversified portfolio is not a one-time task. It requires regular monitoring and rebalancing to ensure it remains aligned with your financial goals. Over time, certain investments may perform better than others, causing your portfolio to drift from its original allocation. For instance, if stocks have a stellar year, they might make up a larger portion of your portfolio than intended, increasing your risk exposure.

Rebalancing involves selling some of the outperforming assets and reinvesting in underperforming ones to maintain your desired asset allocation. While this might seem counterintuitive, it’s a disciplined approach to managing risk and ensuring your portfolio continues to reflect your strategy.

According to Vanguard, rebalancing annually or semi-annually is typically sufficient for most investors. It’s a practical way to take the emotion out of investing, encouraging you to buy low and sell high.

Seeking Professional Advice

For those feeling uncertain, seeking professional advice can be a smart move. Financial advisors can offer personalized guidance, helping you navigate complex investment decisions and tailor your portfolio to your specific needs. They can also provide insights into market trends and potential opportunities you might not have considered.

When choosing an advisor, look for someone who is a fiduciary, meaning they are legally obligated to act in your best interest. This ensures that their recommendations are aligned with your financial goals rather than driven by commissions or other incentives.

As financial advisor Jane Smith points out, "A good advisor can be a valuable partner in your financial journey, offering not just expertise but also peace of mind." Knowing you have a knowledgeable ally can make all the difference in your investment experience.

Investing is a journey, not a sprint. By building a diversified portfolio and staying committed to your strategy, you can navigate the ups and downs with confidence. Remember, it's not about avoiding risk altogether but managing it wisely. With these principles in mind, you’re well on your way to creating a robust investment portfolio.