Emergency Preparedness: Why Having a Savings Cushion Is Essential

Having an emergency savings cushion is essential for navigating life's unforeseen events like job loss or medical emergencies without derailing your long-term financial goals. It's recommended to save three to six months' worth of living expenses in a high-yield savings account for easy access and financial stability, while regularly reviewing and adjusting your savings strategy. Building this financial buffer not only helps manage immediate crises but also contributes to long-term financial independence and confidence in pursuing future opportunities.

Life is full of surprises—some delightful and others, well, less so. Whether it’s a sudden job loss, an unexpected medical bill, or even the car breaking down at the worst possible moment, these surprises can throw a serious wrench into our financial plans. That's where an emergency savings cushion comes in. It’s not just a nice-to-have; it's an essential part of your financial toolkit. Picture it as a financial safety net, catching you when you fall, allowing you to land softly instead of crashing into hard financial reality.

But why, exactly, is an emergency fund so crucial? Think of it as your first line of defense against life's inevitable curveballs. Without it, even a minor financial hiccup can spiral into a full-blown crisis, derailing your long-term goals and dreams. Let’s dive into why having this cushion is vital and how you can build one that suits your lifestyle.

Understanding the Role of an Emergency Fund

At its core, an emergency fund is a stash of money set aside specifically to cover unexpected expenses. Think of it as your personal financial shock absorber. Without it, you're more likely to turn to credit cards, loans, or other high-interest debt options when the unexpected strikes. According to a study by the Federal Reserve, nearly 40% of Americans would struggle to cover a $400 emergency expense, which highlights just how critical this cushion can be.

Having this fund in place means you can handle emergencies without having to sacrifice your financial health in the long run. It’s about more than just weathering the storm; it’s about doing so without derailing your financial future. As financial advisor Jane Smith explains, "An emergency fund is not just about surviving the unexpected; it’s about maintaining your financial trajectory towards your bigger goals."

How Much Should You Save?

The age-old question of how much to save doesn't have a one-size-fits-all answer, but financial experts generally recommend setting aside three to six months’ worth of living expenses. This range provides a buffer that covers a wide array of potential emergencies, from short-term job losses to unexpected medical issues. Of course, the right amount for you depends on your personal circumstances, including job stability, family size, and lifestyle.

For instance, if you're a freelancer with variable income, you might want to aim for the higher end of that spectrum. On the other hand, if you have a stable job and a dual-income household, a smaller cushion might suffice. The key is to assess your own risk factors and adjust your savings targets accordingly. Regularly revisiting and recalibrating your savings goal is a smart move, ensuring it continues to meet your needs over time.

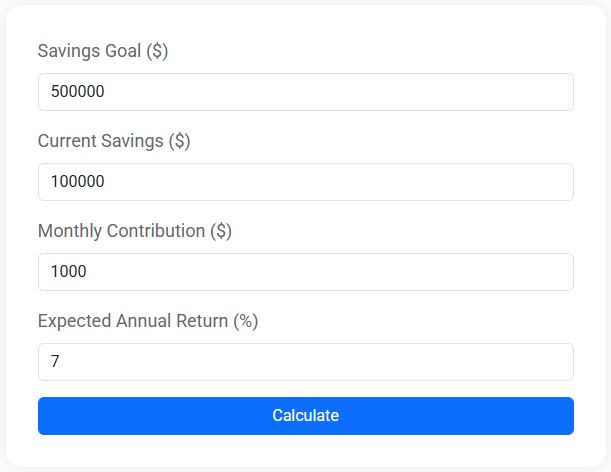

Savings Goal Calculator

Use our free Savings Goal Calculator to find out how long it will take to reach your savings target. See your timeline and how interest can help you grow faster.

Where to Keep Your Emergency Fund

When it comes to stashing your emergency savings, accessibility and safety are paramount. A high-yield savings account is often recommended as an ideal spot. These accounts not only keep your money easily accessible but also earn you some interest—helping your fund grow over time. "Think of it as keeping your money safe while it works a little for you," says financial analyst Tom Hargrove.

Some people also consider money market accounts or short-term Certificates of Deposit (CDs) for their emergency fund, but it’s crucial to weigh the pros and cons. While these options might offer slightly higher returns, they could limit your access to the funds without penalty, which defeats the purpose of having an emergency fund in the first place. Always opt for an account where you can quickly and easily access your money when you need it most.

Building Your Savings Cushion

The journey to building an emergency fund can seem daunting, especially if you're starting from scratch. However, like any financial goal, it becomes more manageable by breaking it down into smaller, actionable steps. Start by setting a realistic monthly savings target that fits into your budget. Even small, consistent contributions add up over time.

Consider automating your savings to make this process easier. By setting up automatic transfers from your checking account to your savings account, you ensure that you're consistently working towards your goal without having to think about it. As author and personal finance guru David Bach notes, "Pay yourself first by automating your savings, and watch your emergency fund grow almost effortlessly."

Reassessing and Adjusting Your Strategy

Your emergency fund isn't a "set it and forget it" kind of deal. Life changes, and so should your savings strategy. Regularly review your fund to ensure it still aligns with your current needs and circumstances. Have there been significant changes in your life, like a new job, a new family member, or a move to a different city? These can all impact how much you should have saved.

Additionally, as your income grows, consider increasing your savings rate to keep pace with your lifestyle. Regular reassessments not only keep your emergency fund relevant but also help you maintain financial discipline and focus.

The Broader Impact of an Emergency Fund

Beyond providing immediate financial relief during tough times, an emergency fund can have profound long-term benefits. It contributes to your overall financial independence and boosts your confidence to seize new opportunities without fear. Whether it's changing careers, starting a business, or investing in personal development, having that financial cushion allows you to make bold moves.

Moreover, the peace of mind an emergency fund provides cannot be overstated. Knowing you have a financial safety net reduces stress and enhances your ability to enjoy life without constant worry about "what if" scenarios. As the saying goes, "Prepare for the worst and hope for the best," and an emergency fund is your preparation tool.

Ultimately, building and maintaining an emergency savings cushion is one of the most empowering financial decisions you can make. It’s about being proactive, not reactive, and ensuring that when life throws you a curveball, you’re ready to catch it with grace and resilience.