Why You Should Start Saving for Retirement Now

Starting to save for retirement early is crucial due to the benefits of compound interest, which allows your money to grow exponentially over time, and helps you navigate market volatility with a long-term perspective. Early saving also instills a disciplined financial habit, maximizes employer benefits such as 401(k) matching, and secures your financial future by ensuring you maintain your lifestyle in retirement without stress. Prioritizing retirement savings now provides peace of mind and reduces the need for larger savings later in life.

Picture this: you're sitting at a cozy café, sipping your favorite latte, when the conversation shifts to retirement savings. Your friend, who's always been ahead of the curve, leans in and says, "You know, the best time to start saving for retirement was yesterday. The second-best time? Today." It's a familiar refrain, but there's a world of wisdom packed into those words. Starting to save for retirement early isn't just a smart move; it's a crucial one. Let's dive into why you should make it a priority now, and how it can set you up for a worry-free future.

At first glance, retirement might seem like a distant dream, particularly if you're in your twenties or thirties, bustling through the early stages of your career. However, the sooner you begin saving, the more time you give your money to grow. This isn't just a financial cliché; it's a practical principle rooted in the magic of compound interest, the steady hand that can transform modest savings into a significant nest egg over the years.

The Magic of Compound Interest

Albert Einstein famously described compound interest as the "eighth wonder of the world." While that may sound hyperbolic, there's no denying its power when it comes to growing your retirement savings. The concept is simple: you earn interest on your initial investment, and then you earn interest on that interest. Over time, this snowball effect can lead to exponential growth.

Consider this example: if you start saving $200 a month at age 25, with an average annual return of 7%, you'd have around $500,000 by the time you hit 65. Wait ten years to start, and that number drops to about $250,000. That's half as much, just because you started later. Compound interest rewards time, so the earlier you start saving, the more you can capitalize on this powerful financial force.

To see compound interest in action, think of it as planting a tree. The earlier you plant, the longer it has to grow, and the more it yields. Each year adds another ring of growth, expanding its reach and depth. Similarly, each dollar you invest today could be worth much more tomorrow.

Navigating Market Volatility

Stock market fluctuations can be nerve-wracking, especially if you're new to investing. However, starting your retirement savings early gives you a significant advantage: time. Time allows you to ride out the inevitable ups and downs of the market, smoothing out short-term volatility with a long-term perspective.

When you're investing for retirement, you're not in it for the quick wins. You're playing the long game. As financial advisor Jane Smith explains, "Market volatility is less scary when you know you have decades ahead to recover from downturns." Starting early means you can afford to take calculated risks, which can lead to higher returns over the long haul.

Moreover, a long investment horizon enables you to benefit from dollar-cost averaging. By contributing regularly to your retirement accounts, you're buying more shares when prices are low and fewer when they're high, which can reduce the average cost per share over time. This strategy mitigates risk and takes advantage of market fluctuations.

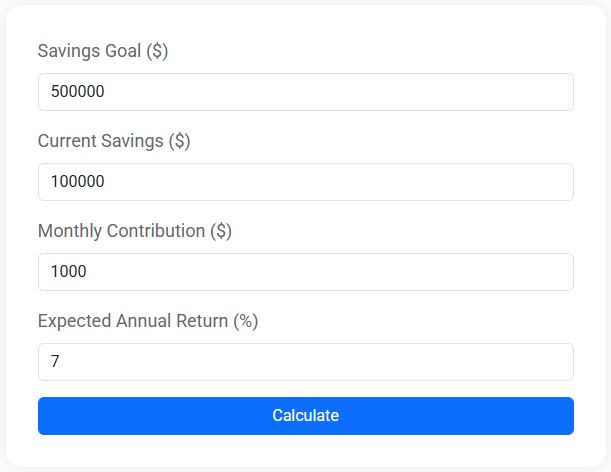

Savings Goal Calculator

Use our free Savings Goal Calculator to find out how long it will take to reach your savings target. See your timeline and how interest can help you grow faster.

Building Disciplined Financial Habits

Saving for retirement isn't just about the end goal; it's about cultivating habits that will serve you well throughout your life. By prioritizing retirement savings now, you're committing to a disciplined approach to managing your finances. This discipline can spill over into other areas, like budgeting, debt management, and even spending habits.

Imagine setting up an automatic contribution to your retirement account. It's a small action that takes minutes to arrange but pays dividends in the form of consistent growth. Over time, these regular contributions become second nature—just another line item in your monthly budget. It's a habit that reinforces the importance of paying yourself first.

Furthermore, establishing good financial habits early can reduce the financial stress that often accompanies major life events, such as buying a home or starting a family. With a solid retirement savings plan in place, you're better prepared to navigate these milestones without derailing your long-term financial goals.

Maximizing Employer Benefits

If your employer offers a retirement savings plan like a 401(k), there's a good chance they also offer matching contributions. This is essentially free money added to your retirement account, but only if you take advantage of it. By starting to save early, you can maximize these benefits and significantly boost your retirement savings.

Let's say your employer matches 50% of your contributions up to 6% of your salary. If you earn $60,000 annually and contribute 6% ($3,600), your employer will add an additional $1,800 to your account. That's a 50% return on your investment right off the bat, and it's money you wouldn't get if you weren't contributing at least enough to get the full match.

Missing out on employer matching is like leaving money on the table. By starting to save early and contributing enough to get the full match, you're essentially giving yourself a raise. It's a straightforward way to enhance your retirement savings without any additional cost to you.

Securing Your Financial Future

Ultimately, the goal of saving for retirement is to ensure you can maintain your lifestyle without stress when you stop working. Starting early makes this goal much more attainable. With a robust retirement fund, you're in control of when and how you retire, rather than being forced into decisions by financial necessity.

Retirement should be a time to enjoy the fruits of your labor, whether that means traveling, pursuing hobbies, or spending time with family. By starting to save now, you're laying the groundwork for a secure and comfortable future. You're not just saving money; you're buying peace of mind.

And let's not forget about the unexpected. Life has a way of throwing us curveballs—health issues, economic downturns, or family emergencies. A healthy retirement fund can serve as a financial buffer, allowing you to navigate these challenges without derailing your plans.

Less Stress Later in Life

There's a common misconception that you can wait until later in life to start saving for retirement. After all, you might think, "I’ll earn more and save more then." But the truth is, the longer you wait, the more you have to save each month to catch up. This can create significant financial pressure when you’re in your 40s or 50s and have competing financial priorities like paying for your children’s education or caring for aging parents.

By starting early, you spread the savings burden over a longer period, reducing the amount you need to save each month. This not only alleviates financial stress but also allows you more freedom to enjoy life now, knowing you’re already taking care of your future. You’re giving yourself the gift of flexibility and security.

In the grand scheme of things, starting to save for retirement now is one of the most important financial decisions you can make. It's a decision that involves foresight and commitment, but the benefits are well worth the effort. So, as you sip your latte and ponder your financial future, remember that the steps you take today will echo through the years, ensuring a future where you can relax and enjoy the fruits of your labor.