The Psychology of Saving: How to Trick Your Brain into Saving More

Saving money can be challenging due to psychological factors that favor immediate gratification, but understanding and leveraging mental accounting, anchoring, automation, social proof, and positive reinforcement can trick your brain into saving effectively. Mental accounting involves compartmentalizing funds for specific goals, while anchoring helps you stay focused on savings targets. Automating savings, surrounding yourself with savers, and rewarding milestones can reinforce positive saving habits and make the process more enjoyable.

Imagine this: you’re sitting at your favorite coffee shop, sipping on a latte that costs more than it really should, when you suddenly realize you haven't saved as much as you planned this month. You're not alone. Many of us struggle with saving, not because we lack the ability, but because our brains are wired to crave immediate gratification over long-term benefits. It’s human nature to want that shiny new gadget now rather than putting money away for a less tangible goal like retirement. However, with a bit of psychological jujitsu, you can trick your brain into saving more efficiently.

Understanding the psychology behind saving can arm you with strategies to outsmart those instant gratification gremlins living in your head. By leveraging concepts like mental accounting, anchoring, automation, social proof, and positive reinforcement, you can cultivate a healthier relationship with your finances. So, let’s dive into these brain hacks that can make saving feel less like a chore and more like a rewarding game.

Mental Accounting: Compartmentalizing for Success

Mental accounting is a term coined by economist Richard Thaler, and it refers to the way we categorize and compartmentalize money in our minds for different purposes. This concept can be your ally when it comes to saving. By creating separate “accounts” in your mind or on paper for specific goals—like a vacation, emergency fund, or a new car—you can create a psychological barrier that prevents you from dipping into these funds for other expenses. Think of it as having a series of labeled jars on your shelf, each with its own purpose.

This approach is more than just theoretical. For instance, setting up separate savings accounts for each goal can make a big difference. When you log into your banking app and see a specific account labeled “Hawaii 2025,” you're less likely to raid it for a spontaneous shopping spree. According to a study published in the Journal of Economic Behavior & Organization, people who earmark their savings for specific purposes are less likely to spend them impulsively, reinforcing the power of mental accounting.

Anchoring: Setting the Right Benchmarks

Anchoring is a psychological phenomenon where we rely heavily on the first piece of information we receive (the “anchor”) when making decisions. This can be a powerful tool for saving when you set clear, ambitious savings goals. For example, if you anchor your savings target at $10,000 for an emergency fund, you're more likely to make saving decisions that align with reaching that figure, rather than settling for less.

One practical way to apply anchoring is by visualizing your savings goal in a tangible form. Perhaps you’re saving for a dream vacation—print out a picture of your destination and place it where you’ll see it daily. This constant visual reminder serves as an anchor, keeping your goal top of mind. As financial advisor Jane Smith explains, "Anchoring your savings goals with specific numbers and visual cues can keep you focused and motivated, even when the going gets tough."

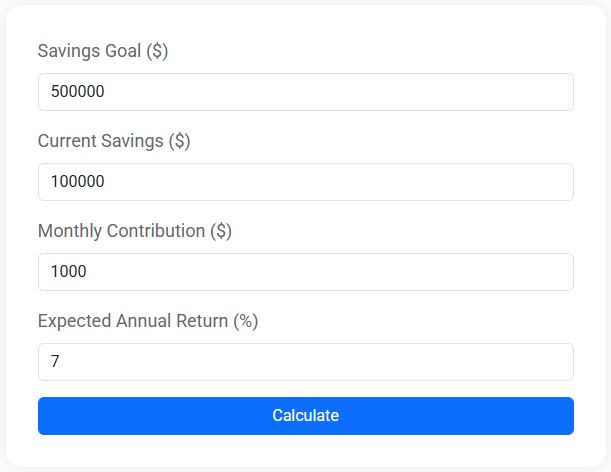

Savings Goal Calculator

Use our free Savings Goal Calculator to find out how long it will take to reach your savings target. See your timeline and how interest can help you grow faster.

Automation: Set It and Forget It

In a world where technology can automate almost anything, why not put it to work for your savings? Automation is one of the simplest yet most effective ways to trick your brain into saving more. By setting up automatic transfers from your checking account to your savings account, you remove the temptation to spend money that should be saved. It’s the ultimate “out of sight, out of mind” strategy.

Take, for example, the story of Anna, a busy mom who struggled to save consistently. By automating her savings, Anna found that she could effortlessly contribute to her emergency fund without feeling the pinch of manual transfers. As personal finance blogger Joshua Becker notes, “Automation is powerful because it takes the decision-making out of the equation, which is often where people stumble.” By setting your savings on autopilot, you can build your financial cushion without much conscious effort.

Social Proof: The Influence of Your Circle

Humans are social creatures, and we're influenced by the actions and behaviors of those around us—this is known as social proof. If your friends and family are spenders, you may find yourself following suit. However, surrounding yourself with savers can have the opposite effect. If your social circle is focused on financial wellness, you’re more likely to adopt similar habits.

Consider joining a savings group or community, either in person or online, where members share tips, goals, and successes. This not only provides accountability but also inspiration. A study from the Journal of Consumer Research found that individuals are more likely to save money when they perceive that their peers are doing the same. As financial psychologist Brad Klontz puts it, "Your financial behavior is contagious. By aligning yourself with savers, you create an environment that naturally encourages better money habits."

Positive Reinforcement: Celebrate the Milestones

Saving money isn’t always fun, but the journey can be made more enjoyable with positive reinforcement. Celebrating small milestones along the way can provide the motivation needed to keep going. This doesn’t mean splurging with every achievement, but rather finding meaningful, cost-effective ways to reward yourself.

For instance, if you reach a savings goal, treat yourself to an experience rather than a material item—perhaps a small day trip or a nice meal with friends. According to a study in the Journal of Consumer Psychology, experiences tend to bring more lasting happiness than material purchases. The key is to ensure that your reward doesn’t undermine your savings efforts. Personal finance guru Dave Ramsey often emphasizes the importance of celebrating wins, no matter how small, as it reinforces the positive behavior that got you there.

In conclusion, saving money doesn’t have to be an uphill battle against your own instincts. By understanding and leveraging the psychology of saving, you can create habits that make saving feel less like a sacrifice and more like a natural part of your financial life. Whether it’s through mental accounting, setting anchors, automating your savings, surrounding yourself with like-minded individuals, or celebrating milestones, each strategy offers a unique way to trick your brain into becoming a more effective saver. So, the next time you’re tempted to splurge on that overpriced latte, remember these tools and give your future self a little extra love.