The Power of Compound Interest: How It Can Help You Save

Compound interest, often misunderstood, is a powerful financial tool that builds wealth by earning interest on both the principal and accumulated interest, leading to exponential growth over time. Starting investments early and making regular contributions are key strategies to maximize its benefits, even with modest amounts. By understanding and leveraging compound interest, individuals can significantly enhance their financial future with minimal ongoing management.

Ah, compound interest—the financial world's best-kept secret. Or at least, it seems that way sometimes. Despite its power to transform your savings into a small fortune over time, many people still overlook or misunderstand it. But as you’ll discover, compound interest is not only about numbers; it’s about starting a journey towards financial security with the right tools and mindset. Let’s dive in and explore how this magical, yet perfectly logical, concept can be your ticket to a more prosperous future.

What makes compound interest so extraordinary is its ability to turn time into your strongest ally. Unlike simple interest, which calculates interest only on the initial amount (the principal), compound interest accumulates on both the initial principal and the previously accumulated interest. This means your money essentially earns money on its money, leading to exponential growth. As Albert Einstein reputedly said, "Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn't, pays it."

Understanding the Basics

Let's break it down to the fundamentals. Imagine you have $1,000 to invest at an annual interest rate of 5%. With simple interest, you’d earn $50 each year, resulting in $1,500 after a decade. However, with compound interest, your earnings become more impressive. By reinvesting the interest, your interest for the next year is calculated on $1,050, not just the original $1,000. Over ten years, your investment would grow to approximately $1,629—without you lifting a finger.

The key takeaway? The more frequently your interest compounds, the faster your money grows. Interest can compound annually, semi-annually, quarterly, or even daily. While more frequent compounding increases the complexity of calculations, it also turbocharges your savings. This is why understanding your investment’s compounding frequency is crucial.

Moreover, the rate at which your investment compounds plays a significant role. A seemingly small difference in interest rates can lead to substantial differences over time. For instance, a 2% difference in interest rates might not seem like much in the short term, but over the span of decades, it can be the difference between a comfortable retirement and a luxurious one.

The Time Factor: Start Early

Time is the secret sauce in the recipe of compound interest. The earlier you start, the more time your money has to grow. To illustrate, consider two friends, Alex and Jamie. Alex starts investing $200 a month at age 25, while Jamie waits until 35 to do the same. Both invest at an average annual return of 7%. By the time they retire at 65, Alex will have accumulated about $524,000, while Jamie will have around $244,000. The decade head start gives Alex more than double the wealth, even though both invested the same amount monthly.

Starting early also allows you to take advantage of market fluctuations. Investing in a diversified portfolio means you can weather the storm of market downturns and benefit from upswings. As financial advisor Jane Smith explains, "Starting early provides the flexibility to adjust your investment strategy and ride out market volatility, which is crucial for maximizing long-term gains."

In essence, the sooner you start, the less you need to contribute each month to reach your financial goals. This can be particularly advantageous for those on a tight budget or just starting their careers.

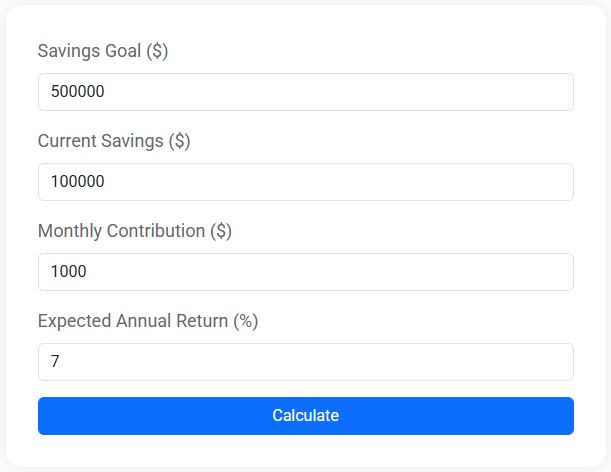

Savings Goal Calculator

Use our free Savings Goal Calculator to find out how long it will take to reach your savings target. See your timeline and how interest can help you grow faster.

Consistency is Key

While starting early is important, consistency in contributions is equally critical. Regularly contributing to your investments—even modest amounts—can lead to substantial growth over time. Think of it as planting seeds; the more you plant and nurture, the larger the forest grows.

Consider the case of a $100 monthly investment into a retirement account with an average annual return of 6%. After 30 years, you would have contributed $36,000, but thanks to compound interest, your account could grow to over $100,000. The key is to make investing a habit, much like brushing your teeth or exercising regularly.

This consistency doesn’t necessarily mean you need a large sum to start. As personal finance expert Dave Ramsey advises, "Focus on getting into the habit of saving regularly. Even small amounts, when invested consistently over time, can compound into significant wealth." The habit of saving and investing regularly is what sustains growth, even when life throws financial curveballs your way.

Leverage the Right Accounts

To ensure you’re making the most of compound interest, it’s crucial to choose the right investment accounts. Tax-advantaged accounts like 401(k)s and IRAs offer significant benefits. Contributions to these accounts grow tax-deferred, meaning you won’t pay taxes on earnings until you withdraw them, ideally in retirement when you're possibly in a lower tax bracket.

Consider a 401(k) with employer matching. If your employer matches up to 5% of your salary, that's essentially free money added to your retirement savings. As CNBC highlights, "Employer matching is one of the best benefits you can get. It’s an instant 100% return on your investment." Make sure to take full advantage of such opportunities, as they can significantly boost your compound interest gains.

Additionally, diversifying your investments across various asset classes can optimize growth. Stocks, bonds, and mutual funds each have their roles to play, and a balanced portfolio can help mitigate risks while maximizing potential returns.

Understand and Manage Risks

It’s important to remember that while compound interest is a powerful tool, it doesn't eliminate risks. Market volatility can affect the value of your investments, especially in the short term. However, understanding these risks and managing them effectively can enhance your financial stability.

Having a diversified portfolio is one way to manage risk. By spreading your investments across multiple asset classes, you reduce the impact of any single investment’s poor performance. As the saying goes, don’t put all your eggs in one basket.

Furthermore, it’s vital to periodically review and adjust your investment strategy to align with your financial goals and risk tolerance. As your life circumstances change, so too should your investment approach. A financial advisor can provide valuable guidance in tailoring a strategy that suits your needs, ensuring that you remain on track to achieve your financial objectives.

The Bottom Line

Compound interest is more than just a financial concept; it’s a powerful ally in your journey to financial independence. By understanding its mechanics and leveraging its potential through early and consistent investing, you can significantly enhance your wealth over time. Remember, the magic of compound interest lies in its ability to turn small, regular contributions into substantial wealth. Whether you're just starting out or looking to optimize your investment strategy, embracing the power of compound interest is a step towards a more secure financial future.

So, grab a cup of coffee, sit down with your financial goals, and start making compound interest work for you. Your future self will thank you.