The Ultimate Guide to Building an Emergency Fund

An emergency fund is essential for financial security, acting as a buffer against unexpected expenses such as medical emergencies or job loss, and helps avoid debt. Typically, it's advised to save three to six months' worth of living expenses, adjusting based on personal circumstances. Building this fund involves setting realistic goals, automating savings, and choosing the right account, while maintaining it requires regular reviews and replenishing after use to ensure it remains a reliable safety net.

Imagine this: Your car breaks down on the way to work, and the repair bill is steep. Or, perhaps, you unexpectedly find yourself between jobs. These scenarios, while daunting, are less stressful if you have an emergency fund in place. An emergency fund is your financial safety net, a buffer that shields you from debt and allows you to handle life's curveballs with confidence. Having one isn't just about peace of mind; it's a cornerstone of financial security.

Typically, experts recommend having three to six months' worth of living expenses stashed away. This cushion can cover essential costs like rent, groceries, utilities, and insurance during tough times. But everyone's situation is different, and the right size for your emergency fund may vary based on personal circumstances. Let’s dive into what an emergency fund is, how to build it, and why it's crucial for your financial health.

Understanding the Importance of an Emergency Fund

Think of an emergency fund as insurance against life's unpredictability. Without it, you might find yourself relying on high-interest credit cards or loans to cover unexpected expenses. According to a survey by Bankrate, nearly 60% of Americans do not have enough savings to cover a $1,000 emergency. This lack of preparedness can lead to a cycle of debt that's hard to break.

Having an emergency fund provides a sense of control and stability. It allows you to make better financial decisions without the pressure of immediate financial strain. For example, if you lose your job, you can take the time to find a position that suits you rather than jumping at the first offer out of necessity. Moreover, it can prevent you from derailing long-term financial goals, like saving for retirement or your child's education.

Determining Your Target Amount

The general rule of thumb is to save enough to cover three to six months of living expenses. However, the exact amount depends on your unique circumstances. Consider factors like job stability, income sources, and family size. If you're a freelancer or work in an industry with fluctuating income, you might aim for the higher end of that range.

For instance, if your monthly expenses are $3,000, then an emergency fund of $9,000 to $18,000 would be ideal. However, single individuals with fewer obligations may get by with less, while those with dependents or mortgages might require more. As financial advisor Jane Smith suggests, "It's better to err on the side of caution and aim for a larger fund, even if it takes longer to build."

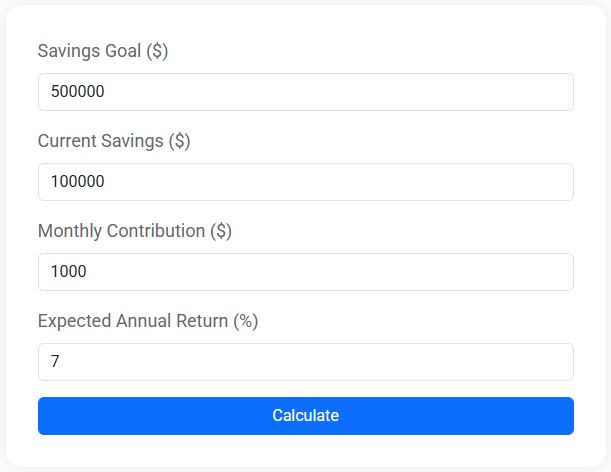

Savings Goal Calculator

Use our free Savings Goal Calculator to find out how long it will take to reach your savings target. See your timeline and how interest can help you grow faster.

Setting Realistic Savings Goals

Building an emergency fund can feel daunting, especially if you're starting from scratch. The key is to set realistic, achievable goals. Start by assessing your current financial situation and determining how much you can comfortably save each month. Even small contributions add up over time.

One effective strategy is to break your ultimate goal into smaller, more manageable milestones. For example, aim to save one month's worth of expenses first, then gradually increase your target. Celebrate these small victories to keep yourself motivated. As the saying goes, "How do you eat an elephant? One bite at a time."

Automating Your Savings

Automation is your ally when it comes to saving. By setting up automatic transfers from your checking account to a dedicated savings account, you can ensure consistent contributions to your emergency fund. This approach minimizes the temptation to skip a month or spend the money elsewhere.

Consider timing these transfers to coincide with your payday. This way, you're paying yourself first before you even have a chance to miss the cash. Many online banks offer features that facilitate this process, making it easier than ever to grow your savings with minimal effort.

Choosing the Right Account

Where you keep your emergency fund matters. Ideally, the money should be easily accessible but separate from your regular checking account to minimize the temptation to dip into it. A high-yield savings account is often a good choice because it offers better interest rates than traditional savings accounts, helping your money grow over time.

Money market accounts are another option, providing a blend of accessibility and higher interest rates. Just be sure to check for any restrictions or minimum balance requirements. As CNBC notes, the key is to balance liquidity with earning potential, ensuring that your funds are both safe and working for you.

Maintaining and Replenishing Your Fund

Once you've established your emergency fund, it's crucial to maintain it. Regularly review your finances to ensure that your fund still aligns with your current expenses and needs. Life changes, such as a new job or a new baby, may necessitate adjustments to your savings goal.

After you've used your emergency fund, it's essential to replenish it as soon as possible. Treat it as a priority to restore your safety net to its full strength. This may mean temporarily cutting back on non-essential spending or redirecting funds from other savings goals until your emergency fund is back to where it needs to be.

Building Resilience Through Financial Security

Ultimately, an emergency fund is about building financial resilience. It's not just a number in your bank account; it's a lifeline that provides security and peace of mind. By taking the time to establish a robust emergency fund, you're investing in your ability to navigate the ups and downs of life with confidence.

Remember, the journey to financial security is personal and unique to you. Whether you're just starting to save or looking to boost an existing fund, the important thing is to stay committed. With discipline, patience, and persistence, you'll create a safety net that stands the test of time, allowing you to face life's uncertainties with optimism and strength.