Savings Challenges to Boost Your Financial Discipline

Building financial discipline is essential for reaching personal financial goals, and savings challenges offer a structured yet fun way to enhance this discipline. Challenges like the 52-Week Money Challenge, No-Spend Challenge, Spare Change Challenge, 30-Day Savings Rule, and Envelope System Challenge help you save consistently, curb impulsive spending, and hone budgeting skills. By integrating these challenges, you can boost your savings, develop mindful spending habits, and move closer to achieving long-term financial success.

Building financial discipline is akin to developing a new habit—it requires consistency, commitment, and sometimes a bit of creativity to keep things interesting. Enter savings challenges: a dynamic way to instill financial discipline while making the process engaging. These challenges not only encourage you to save more but also help in identifying and curbing impulsive spending habits, and sharpening your budgeting prowess. Whether you're just starting out on your savings journey or are a seasoned saver looking for a fresh approach, these challenges might just be the spark you need to ignite your financial goals.

Let’s dive into some of the most popular savings challenges that have helped countless individuals take control of their finances. From the classic 52-Week Money Challenge to the practical Envelope System Challenge, there’s something here for everyone. Each one offers a unique approach to saving, allowing you to find a method that resonates with your lifestyle and financial objectives.

The 52-Week Money Challenge

The 52-Week Money Challenge is a favorite for a reason—it's simple yet effective. The premise is straightforward: you start by saving $1 in the first week, $2 in the second week, and continue to increase your savings by an additional dollar each week, culminating in a $52 deposit in the final week. By the end of the year, you'll have saved $1,378.

What makes this challenge appealing is its gradual increase, which allows you to ease into the habit of saving more over time. It's a great way to boost your savings without feeling the pinch, especially in the early weeks when the amounts are small. Plus, it aligns with the calendar year, making it easy to track. Stephanie, a single mom from Ohio, shared her experience on a personal finance blog, saying, "The first few months felt like a breeze, and by the time the bigger amounts rolled around, I'd already adjusted my budget to accommodate the weekly savings."

The No-Spend Challenge

If you're looking to curb impulse spending and get a real handle on your cash flow, the No-Spend Challenge might be what you need. The rules are simple: for a set period (a week, month, or even just weekends), you commit to spending money only on necessities like groceries, bills, and transportation. Everything else is off the table.

This challenge forces you to confront and reassess your spending habits, often highlighting just how much money leaks out on non-essential purchases. As financial advisor Jane Smith explains, "Many clients are shocked at how much they save during a no-spend period—it's a real eye-opener." The challenge can also free up funds to redirect towards savings or debt repayment, offering a dual benefit.

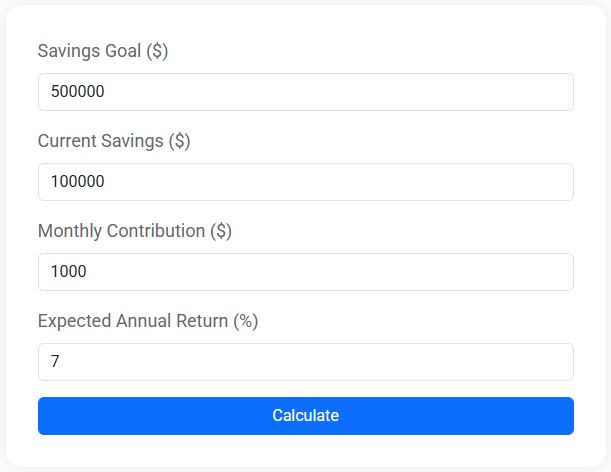

Savings Goal Calculator

Use our free Savings Goal Calculator to find out how long it will take to reach your savings target. See your timeline and how interest can help you grow faster.

The Spare Change Challenge

The Spare Change Challenge is as easy as it sounds: every time you make a cash purchase, toss your change into a jar. Over time, these small amounts accumulate into a surprisingly hefty sum. With the decline of cash transactions, you can adapt this challenge digitally by rounding up your debit card purchases and transferring the difference to a savings account.

This method of saving is almost effortless and taps into the power of incremental changes. For instance, if you round up just $0.50 every day, you'll have nearly $200 by the end of the year. It’s a great way to build an emergency fund without feeling the impact on your day-to-day budget. Amy, a college student, shared on Reddit how she turned her spare change into a $500 fund that covered an unexpected car repair.

The 30-Day Savings Rule

The 30-Day Savings Rule is less about accumulating cash and more about preventing unnecessary expenditures. Here's how it works: when you find yourself wanting to make an impulse purchase, jot it down and wait 30 days. If after a month you still feel the item is worth buying, go ahead—otherwise, pocket the cash.

This waiting period acts as a cooling-off phase, allowing you to separate wants from needs. According to a study by the Journal of Consumer Research, delaying gratification can significantly enhance your ability to make rational spending decisions. By practicing this rule, you not only save money but also cultivate a more mindful approach to consumption.

The Envelope System Challenge

The Envelope System Challenge is a throwback to the days of cash budgeting but remains a potent tool for many. Here's how it works: determine your monthly spending categories (like groceries, entertainment, dining out) and allocate a set amount of cash to each envelope. Once the cash is gone, that's it for the month.

This tactile approach helps reinforce spending limits and provides a clear visual cue when you're nearing your budget's edge. It’s particularly useful for those who struggle with overspending on credit cards. According to CNBC, individuals who use cash tend to spend 12-18% less compared to those using cards, thanks to the psychological impact of handing over physical money.

Choosing the Right Challenge for You

With so many options, it might be tempting to dive into multiple challenges at once—however, it's often more effective to start with one that aligns best with your financial goals and lifestyle. Consider what you're hoping to achieve: is it building a robust savings cushion, cutting down on frivolous spending, or becoming more disciplined with your budget? Each challenge offers a unique pathway to enhancing your financial discipline.

Remember, the key to success with any savings challenge is consistency. It's about forming habits that last beyond the challenge itself. As you progress, celebrate your wins—big or small—and don't be discouraged by setbacks. Financial discipline, like any other skill, takes time to develop.

So, grab a cup of coffee, pick a challenge, and start your journey to financial discipline today. Your future self will thank you.