Save More, Stress Less: Tips for Financial Peace of Mind

Financial stress is prevalent, but adopting a proactive approach with strategies like budgeting, building an emergency fund, managing debt, enhancing financial literacy, and setting clear financial goals can help alleviate it. Creating a realistic budget and establishing an emergency fund provide a solid foundation, while managing debt through methods like the snowball or avalanche approach can reduce anxiety. By consistently working towards financial goals and improving financial knowledge, individuals can achieve greater financial security and peace of mind over time.

In today's fast-paced world, financial stress is as common as your morning coffee. Whether it's worrying about mounting bills, unexpected expenses, or the looming cloud of debt, money woes can feel overwhelming. But here's the good news: with a proactive approach and a few strategic moves, you can save more and stress less. Imagine a life where you’re not constantly fretting over finances but instead enjoying peace of mind, knowing you’ve got a handle on your money. It’s not just a dream—it’s achievable with some dedication and know-how.

Let’s dive into some practical tips that can help you build a solid financial foundation, reduce anxiety, and move towards a future of financial security. Whether you're just starting out or looking to refine your money management skills, these insights will steer you in the right direction.

Create a Realistic Budget

Creating a budget might sound like financial boot camp, but think of it more as a roadmap to financial freedom. A well-crafted budget allows you to see where your money is going and helps you make informed decisions. Start by listing all your monthly income sources and expenses. Don’t forget to include those little things, like your daily latte or streaming subscriptions, as they can add up quickly.

Once you have a clear picture, categorize your expenses into needs and wants. This distinction can be eye-opening. By focusing on needs first, you’ll ensure that essentials like housing, utilities, and groceries are covered. Then, see where you can trim the fat. Maybe it’s cutting back on dining out or canceling a rarely-used subscription. According to a study by U.S. Bank, only 41% of Americans use a budget. Imagine the financial improvements we could see if more people took up this simple yet powerful tool.

Build an Emergency Fund

Life is unpredictable, and having a financial cushion can make all the difference. An emergency fund acts as your safety net, ready to catch you if unexpected expenses, like car repairs or medical bills, come your way. Aim to save three to six months’ worth of living expenses in a separate, easily accessible account. This might seem daunting at first, but remember, every little bit counts.

Start small if you must. Setting aside just $25 a week can grow into a substantial buffer over time. As financial advisor Jane Smith suggests, "The key is consistency. Regular contributions, no matter how small, build up over time and provide peace of mind." Not only does an emergency fund protect you from going into debt during a crisis, but it also offers a sense of security that reduces financial stress.

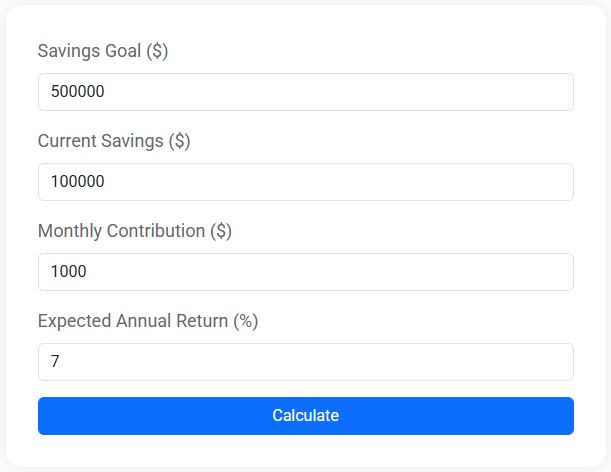

Savings Goal Calculator

Use our free Savings Goal Calculator to find out how long it will take to reach your savings target. See your timeline and how interest can help you grow faster.

Manage Debt Wisely

Debt can be a heavy burden, but managing it is crucial to achieving financial peace. Begin by listing all your debts, including credit cards, student loans, and other liabilities. Knowing exactly what you owe is the first step toward tackling it. Two popular debt management strategies are the snowball and avalanche methods.

With the snowball method, you pay off your smallest debt first, which can provide a psychological boost and motivation to keep going. Alternatively, the avalanche method focuses on paying off debts with the highest interest rates first, potentially saving you more money in the long run. Choose the method that aligns with your personality and financial goals. As CNBC highlights, "the best strategy is the one you’re motivated to stick with."

Enhance Your Financial Literacy

Knowledge is power, especially when it comes to managing your finances. The more you know, the better equipped you’ll be to make smart money decisions. Consider taking online courses, reading personal finance books, or following reputable finance blogs to enhance your understanding. Topics like investing, retirement planning, and tax strategies are all essential components of financial literacy.

Podcasts can also be a great resource, offering insights and tips from financial experts. As you increase your financial understanding, you’ll find yourself making more informed choices, which leads to greater confidence and reduced financial stress. Remember, the goal isn’t just to learn—apply what you learn to your personal finance journey.

Set Clear Financial Goals

Having clear financial goals provides direction and purpose to your money management efforts. Whether it’s saving for a home, planning for retirement, or building a travel fund, goals give you something to work towards. Start by identifying what’s most important to you, and then break down each goal into manageable steps.

For example, if your goal is to save $20,000 for a down payment on a home, calculate how much you need to set aside each month to reach your target in your desired timeframe. As you track your progress, you’ll find motivation in the milestones you achieve along the way. According to a study by the Dominican University of California, people who write down their goals are 42% more likely to achieve them. So grab a pen and start jotting down your financial dreams.

Consistently Review and Adjust

Your financial situation and goals are likely to evolve over time, which means your approach to money management should, too. Regularly reviewing your budget, financial goals, and strategies ensures that you stay on track and make necessary adjustments. Set a monthly or quarterly date with yourself to assess your progress and make changes when needed.

For instance, if you receive a salary increase, consider upping your savings contributions or tackling more of your debt. Conversely, if you encounter a financial setback, don’t be afraid to reassess and adjust your plan. Flexibility is key to maintaining financial health and reducing stress.

By embracing these strategies, you can transform your financial journey from a source of stress into a path of peace and security. The road to financial peace of mind is a marathon, not a sprint. Remember, every small step you take today will lead to a more stable and prosperous tomorrow. Keep learning, stay proactive, and most importantly, give yourself grace as you navigate your unique financial landscape.