5 Clever Ways to Save Money on Your Monthly Bills

In today's world, managing monthly expenses can be challenging, but implementing innovative strategies can make a significant difference in your financial health. By evaluating your subscription services, optimizing utility usage, negotiating with service providers, embracing DIY and preventive maintenance, and adopting a budget-friendly grocery shopping strategy, you can effectively reduce your monthly bills. With proactive and consistent efforts, these savvy tips help you save money without sacrificing your quality of life.

In a world where prices seem to climb faster than a cat up a tree, keeping your monthly expenses in check can feel like a Herculean task. Whether it's the sneaky rise in utility costs, the ever-expanding list of subscription services, or the unpredictable grocery bills, it's no wonder many of us are looking for smarter ways to save. The good news? There are plenty of clever strategies that can help you trim those pesky monthly bills without sacrificing the quality of your everyday life.

You might be wondering how to start. The secret lies in a combination of strategic planning, a bit of elbow grease, and a willingness to change old habits. By evaluating your subscription services, optimizing utility usage, negotiating with service providers, embracing DIY and preventive maintenance, and adopting a budget-friendly grocery shopping strategy, you can effectively slash your monthly expenses. Let's dive into these savvy tips, each one a potential game-changer for your wallet.

Reevaluate Your Subscriptions

Subscription services are the modern-day equivalent of small leaks that can sink a great ship. From streaming platforms to monthly magazines, these costs add up quickly. Take a hard look at your bank statements and identify every recurring charge. You might be surprised to find services you forgot you even subscribed to.

Consider prioritizing the subscriptions you actually use. For instance, if you can't remember the last time you watched a show on a particular streaming service, it might be time to cancel or pause it. According to a survey by West Monroe Partners, the average person underestimates their subscription spending by nearly $133 per month. That’s money that could be better spent or saved elsewhere.

Sharing is caring and can also be a lifesaver for your budget. If you have family or friends who subscribe to services you’re interested in, consider splitting the costs. Many streaming services offer plans that allow multiple users, which can significantly reduce individual expenses. By being mindful about what you truly need and use, you can keep your subscription costs in check.

Optimize Your Utility Usage

Utility bills can be a silent drain on your finances, often fluctuating with the seasons. However, making small changes in your daily habits can lead to significant savings. Start by conducting an energy audit of your home to identify areas where you can reduce waste. This might include sealing drafts, upgrading to energy-efficient appliances, or simply changing your light bulbs to LEDs.

Smart thermostats are another excellent tool to help you cut costs. These devices learn your schedule and adjust the temperature accordingly, ensuring you’re not wasting energy when you’re not at home. According to the U.S. Department of Energy, a smart thermostat can save you up to 10% on your heating and cooling bills annually.

Don't overlook the power of unplugging. Many electronics draw power even when turned off, a phenomenon known as "phantom load." By using power strips and turning them off when your devices aren't in use, you can cut down on this excess energy consumption. Every little bit helps, and these changes can add up to noticeable savings on your monthly utility bills.

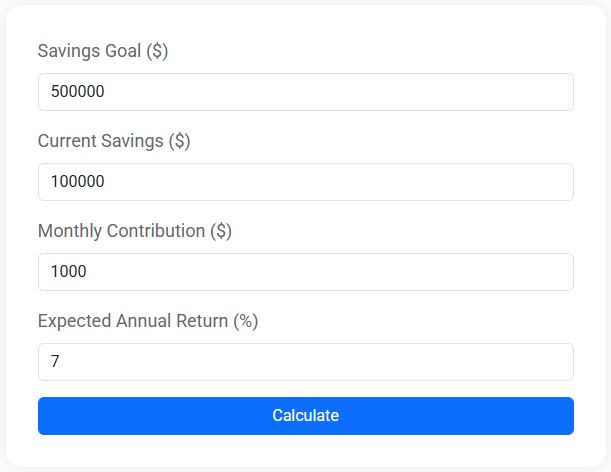

Savings Goal Calculator

Use our free Savings Goal Calculator to find out how long it will take to reach your savings target. See your timeline and how interest can help you grow faster.

Negotiate with Service Providers

If you’ve been a loyal customer, you might have more leverage with your service providers than you think. Whether it’s your internet, cable, or phone bill, a simple call can sometimes lead to a reduced rate or a better plan. Companies are often willing to offer discounts or promotions to retain customers, especially if you mention you’re considering switching to a competitor.

Before you call, do a bit of homework. Research competitor rates and have that information ready to discuss. It’s also helpful to know exactly what services you’re paying for and to assess if there are any you can do without. As financial advisor Jane Smith explains, "Negotiating isn’t just about asking for a lower price; it’s about understanding the value of what you’re buying and finding a solution that benefits both you and the provider."

Persistence pays off. If the first representative isn’t able to help, ask to speak to a manager or someone in the retention department. They often have more flexibility to offer discounts or modify your plan. Remember, the worst they can say is no, and you won’t lose anything by trying.

Embrace DIY and Preventive Maintenance

Taking a proactive approach to home and auto maintenance can save you a bundle in the long run. Regularly servicing your car and keeping up with home repairs might seem like a hassle, but it prevents more costly damages down the road. Think of it as a small investment in your future savings.

You don’t need to be a handyman to tackle basic maintenance tasks. There are countless resources available online, from YouTube tutorials to DIY blogs, offering step-by-step guides on everything from fixing a leaky faucet to changing your car’s oil. Not only will you save money on labor costs, but you’ll also gain valuable skills.

Preventive measures, like cleaning your HVAC filters and checking your home’s insulation, can make a big difference. According to the U.S. Environmental Protection Agency, regularly replacing your HVAC filters can lower your energy consumption by 5-15%. Small actions, when done consistently, contribute to lower bills and a more efficient household.

Adopt a Budget-Friendly Grocery Shopping Strategy

Grocery shopping on a budget doesn’t mean you have to sacrifice quality or flavor. It’s all about planning and making smart choices. Start by creating a list before you head to the store, and stick to it. Impulse buys are a budget’s worst enemy, and having a clear plan helps you avoid them.

Consider buying in bulk for non-perishable items or those with a long shelf life. Not only does this save you money, but it also reduces the frequency of shopping trips, cutting down on those tempting impulse purchases. As consumer advocate Clark Howard suggests, "Bulk buying is a great way to save, but only if you’re buying things you’ll actually use."

Don’t underestimate the power of generic brands. Often, these products are made by the same manufacturers as their branded counterparts but come at a fraction of the price. Additionally, consider shopping at local farmers' markets or joining a CSA (Community Supported Agriculture) to get fresh produce at lower costs than standard grocery stores.

Ultimately, saving money on your monthly bills is about making informed choices and being proactive. By implementing these clever strategies, you’ll find that trimming costs doesn’t have to mean sacrificing comfort or quality. With a bit of effort and a dash of creativity, you can improve your financial health and enjoy greater peace of mind.