Investing in Your Future: How to Save for Long-Term Financial Goals

Achieving long-term financial goals, such as retirement, buying a home, or funding a child's education, requires setting clear and attainable goals, creating a realistic budget, automating savings, and investing wisely. Regularly reviewing and adjusting your financial plan ensures that you stay on track, adapt to life changes, and maintain focus on building a secure financial future. With discipline and patience, these steps can help anyone build a solid financial foundation.

When it comes to financial planning, the long game often gets overshadowed by immediate concerns. But the truth is, setting your sights on the horizon and preparing for long-term goals could be one of the most rewarding endeavors you undertake. Whether you're dreaming of a comfortable retirement, eyeing that charming house on the corner, or hoping to send your child off to college without student loan debt, the road to these milestones is paved with strategic saving and smart investing.

Let's be honest, the journey can seem daunting, especially when life throws its curveballs. But with the right approach, achieving your long-term financial goals is not just a pipe dream—it's entirely within reach. By breaking down the process into manageable steps, you can steer your financial ship steadily towards the future you envision.

Setting Clear and Attainable Goals

First and foremost, you need to know where you're heading. Setting clear and attainable financial goals is akin to mapping out your route before a long road trip. Without a destination, even the best car won't get you anywhere. Start by defining what your long-term goals are. Be specific: instead of saying "I want to save for retirement," quantify it—"I want to have $1 million saved by age 65."

Once you've set your goals, break them down into smaller, actionable steps. This makes the process less overwhelming and more achievable. For instance, if buying a home is on your list, determine the down payment you'll need and the timeline for saving it. As financial planner Amanda Rodriguez advises, "Think of your goals as milestones on your financial journey. Each step you take is progress."

Keep in mind that goals should be flexible. Life changes, and so should your plans. Periodically revisit and revise your goals as needed. This adaptability ensures you're always moving in the right direction, even if the path changes.

Creating a Realistic Budget

With your goals in hand, the next step is crafting a budget that aligns with them. A budget is essentially your roadmap, showing you where your money is going and how much is left for saving and investing. Start by listing your income sources and mandatory expenses like rent, utilities, and groceries. What's left is your discretionary spending and potential savings.

Be honest with yourself about your spending habits. It's easy to underestimate monthly expenses, so track them for a couple of months to get an accurate picture. Financial guru Dave Ramsey often emphasizes the importance of a zero-based budget, where every dollar is accounted for: "Give every dollar a job," he says. This ensures that your money is working for you, not the other way around.

Don't forget to build some flexibility into your budget for unexpected expenses. An emergency fund, ideally covering three to six months of living expenses, can prevent financial derailment. Remember, a budget is a living document—review it regularly and adjust as your circumstances change.

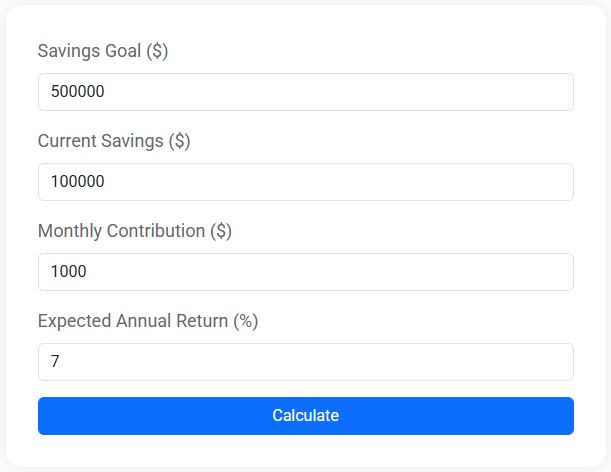

Savings Goal Calculator

Use our free Savings Goal Calculator to find out how long it will take to reach your savings target. See your timeline and how interest can help you grow faster.

Automating Your Savings

Once your budget is set, it's time to put your savings on autopilot. Automating your savings can be a game-changer when it comes to consistency and discipline. Set up automatic transfers from your checking account to your savings and investment accounts. This way, you're prioritizing savings without relying on memory or willpower.

Consider adopting the "pay yourself first" principle. This means treating your savings like a non-negotiable expense, paid before discretionary spending. According to a study by the National Bureau of Economic Research, individuals who automate their savings are more likely to achieve their financial goals than those who don't.

Automation doesn't mean you should set it and forget it entirely. Regularly check in on your savings progress and adjust contributions as your income or goals change. This proactive approach keeps you engaged and committed to your financial plan.

Investing Wisely

Saving is crucial, but investing is where your money truly grows. The power of compound interest can significantly boost your savings over time, turning modest contributions into substantial wealth. Start by educating yourself on different investment vehicles, such as stocks, bonds, and mutual funds.

It's important to align your investment strategy with your risk tolerance and time horizon. For example, if you're saving for retirement that's 30 years away, you might opt for a portfolio that leans heavily on stocks due to their higher growth potential. However, if you're saving for a home down payment in five years, you might prefer more stable, lower-risk investments.

Consider consulting a financial advisor to tailor an investment plan to your specific needs. As investment expert Warren Buffett famously advises, "Never invest in a business you cannot understand." This means doing your homework and making informed decisions to maximize your returns while minimizing risk.

Regularly Reviewing and Adjusting Your Plan

Life is anything but predictable, which means your financial plan should be dynamic. Regularly reviewing and adjusting your plan ensures you stay on track, even as your circumstances evolve. Set aside time at least annually to review your goals, budget, and investments.

During these check-ins, assess whether you're on target to meet your goals. If not, determine what adjustments are needed. Maybe your budget needs tweaking, or perhaps your investments require rebalancing. The key is staying flexible and willing to adapt as needed.

Don't hesitate to seek professional advice if you're unsure about your plan's trajectory. A financial advisor can provide valuable insights and help you navigate complex decisions. As Charles Schwab's Carrie Schwab-Pomerantz notes, "Having a plan doesn't mean having a rigid path. It means having a framework to guide you through whatever life throws your way."

In the end, investing in your future is about more than just money—it's about building a foundation for the life you envision. With clear goals, a realistic budget, automated savings, and a wise investment strategy, you're well on your way to achieving your long-term financial aspirations. Remember, the journey may be long, but with patience and perseverance, the rewards are well worth the effort.