Frugal Living 101: Simple Ways to Save Money Every Day

In today's uncertain economic climate, adopting frugal living strategies can significantly reduce expenses without diminishing your lifestyle quality. Key approaches include smart grocery shopping, enhancing home energy efficiency, making mindful transportation choices, embracing DIY projects, and enjoying budget-friendly entertainment. These simple yet effective habits not only help stretch your dollars further but also contribute to achieving long-term financial peace of mind.

In today's fast-paced world, where financial stability often feels like a moving target, embracing frugal living can be a game-changer. It's not about depriving yourself of life's pleasures; rather, it's about making conscious choices that align with your financial goals. By adopting simple, everyday strategies, you can significantly reduce expenses while maintaining, or even enhancing, your quality of life. Whether you're saving for a rainy day, paying off debt, or planning a dream vacation, living frugally can help you achieve long-term financial security and peace of mind.

Frugal living isn't just a buzzword; it's a lifestyle choice that reflects mindfulness about spending. Think of it as a toolkit for navigating today's unpredictable economic climate. The beauty of frugality is its versatility—it can be tailored to fit any lifestyle, income level, or family size. So, let's dive into some practical and effective ways to save money every day.

Smart Grocery Shopping

Grocery shopping can be a significant drain on your budget if not handled wisely. One of the simplest strategies is to plan your meals around the weekly sales. Before heading to the store, take a few minutes to browse the flyers or online deals, and make a list. This not only keeps impulse buys at bay but also ensures you’re capitalizing on discounts.

Moreover, buying in bulk can lead to substantial savings, especially for non-perishable items like rice, pasta, and canned goods. Retailers like Costco and Sam's Club offer bulk buying options, which can significantly lower the cost per unit. However, it’s crucial to ensure you have enough storage space and can consume these items before they expire.

Another great tip is to embrace the power of coupons and cashback apps. Apps like Ibotta and Rakuten offer rebates on everyday purchases, adding up to considerable savings over time. According to a report by CNBC, nearly 90% of shoppers use coupons to save money on groceries, proving that a little effort can go a long way.

Enhancing Home Energy Efficiency

Reducing energy consumption is not only good for the planet but also for your wallet. Simple adjustments, such as switching to LED bulbs, can cut lighting costs by up to 75%. These bulbs last longer and use significantly less energy compared to traditional incandescent bulbs, making them a smart investment.

Sealing drafts in your home can also lead to noticeable savings. Use weather stripping around doors and windows to prevent heat loss in the winter and cool air escape in the summer. According to the U.S. Department of Energy, sealing leaks can save you up to 20% on heating and cooling bills each year.

Programmable thermostats are another excellent way to boost efficiency. By setting your thermostat to lower the temperature while you're asleep or away, you can reduce energy usage without sacrificing comfort. As financial advisor Jane Smith highlights, "A small investment in a smart thermostat can pay for itself in less than a year through energy savings."

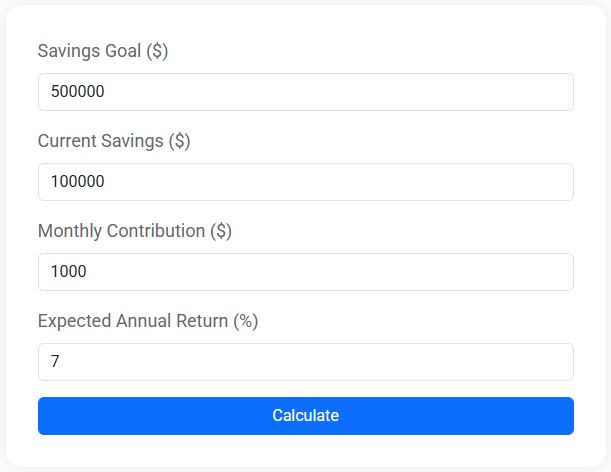

Savings Goal Calculator

Use our free Savings Goal Calculator to find out how long it will take to reach your savings target. See your timeline and how interest can help you grow faster.

Mindful Transportation Choices

Transportation costs can eat up a significant portion of your budget, but there are ways to cut down on these expenses. Carpooling with colleagues or friends is a simple yet effective strategy. Not only does it save on fuel and reduce wear and tear on your vehicle, but it also gives you a chance to socialize during your commute.

Consider public transportation or biking for short distances. Many cities offer monthly passes for buses or trains, which can be far more economical than daily parking fees and gas. Plus, biking not only saves money but also boosts your physical health and reduces your carbon footprint.

If owning a car is a necessity, maintaining it regularly can prevent costly repairs down the line. Simple acts like checking tire pressure, changing the oil on schedule, and replacing air filters can improve fuel efficiency and extend the life of your vehicle.

Embracing DIY Projects

The do-it-yourself approach can lead to significant savings in various aspects of life. Whether it's fixing a leaky faucet or repainting a room, tackling projects yourself can cut labor costs and provide a sense of accomplishment. YouTube and DIY blogs are treasure troves of tutorials that can guide you through almost any task.

Gardening is another rewarding DIY activity that can save money on produce. Growing your own vegetables and herbs not only reduces grocery bills but also ensures you have fresh, organic ingredients at your fingertips. Even with limited space, container gardening on a balcony or patio can yield a surprising bounty.

Crafting your own gifts and home decor can also reduce expenses. Handmade items often carry more sentimental value than store-bought ones, and they can be tailored to personal tastes and preferences. Plus, crafting can be a fun and relaxing hobby that enhances your creativity.

Enjoying Budget-Friendly Entertainment

Entertainment doesn't have to break the bank. There are plenty of affordable ways to have fun and relax. Take advantage of free community events, such as outdoor concerts, farmers' markets, and art walks. These events often provide a chance to enjoy local culture and meet new people without spending a dime.

Libraries are also a fantastic resource for entertainment. Beyond books, many libraries offer free access to e-books, audiobooks, movies, and even workshops or classes. It's a great way to explore new interests and stay entertained without spending money.

For those who enjoy dining out, consider trying "eat-in" nights with friends. Each person can bring a dish, creating a potluck experience without the restaurant prices. Not only does this save money, but it also allows for more intimate and meaningful connections.

By adopting these frugal living strategies, you can take control of your finances without sacrificing the things that matter most. It's about making thoughtful choices that enhance your life and bring you closer to your financial goals. With a bit of creativity and a willingness to change habits, you can stretch your dollars further and enjoy a richer, more fulfilling life.