Maximizing Your Savings: How to Make Your Money Work Harder

To make your savings work harder, it's crucial to automate them, use high-interest savings accounts, and fully utilize employer-sponsored retirement plans. Diversifying your investment portfolio and regularly reviewing your financial plan are also essential strategies to maximize growth and minimize risk. By implementing these steps, you can achieve financial goals more efficiently and enjoy a secure future.

We’ve all heard the saying, “make your money work for you,” but how often do we stop to ask what that really means? In today’s fast-paced world, where financial stability can seem like a moving target, it's crucial to not just save money, but to ensure those savings are actively and effectively working toward your future goals. Whether you’re starting with a modest nest egg or have a more robust portfolio, there are strategies you can employ to maximize your savings and propel yourself toward financial security.

Let’s break down some practical steps you can take right now to ensure your savings aren’t just sitting idly by, but are actively contributing to your financial goals. From automation to diversification, each move you make can bring you a step closer to making the most out of every dollar. And remember, it’s not just about saving more—it’s about saving smart.

Automate Your Savings

One of the simplest yet most effective strategies to maximize your savings is to automate them. By setting up automatic transfers from your checking account to your savings account or retirement fund, you can ensure that a portion of your income is consistently set aside without having to think about it. This “set it and forget it” method helps eliminate the temptation to spend extra cash and underscores the importance of paying yourself first.

Consider this scenario: if you automate a transfer of $200 per month into a savings account, you’ll have $2,400 saved by the end of the year without even thinking about it. According to a 2022 study by the Consumer Financial Protection Bureau, individuals who automate their savings are more likely to meet their financial goals compared to those who don’t. It’s a small change that can make a big impact over time.

Moreover, automation creates a sense of psychological detachment from the money being saved. When you don’t see the money in your spending account, you’re less likely to miss it. This not only builds discipline but also helps you grow your savings with minimal effort and stress.

Use High-Interest Savings Accounts

Not all savings accounts are created equal. While traditional savings accounts may offer convenience, their interest rates often leave much to be desired. Enter high-interest savings accounts—an increasingly popular option for those looking to maximize their growth potential without risking capital.

High-interest savings accounts typically offer rates that are several times higher than those of standard accounts. For instance, if you have $10,000 in a high-interest account with a 4% annual return, you’ll earn $400 in interest over the year. Compare this to the paltry $10 or $20 you might earn in a traditional account, and the difference is clear.

However, it’s important to shop around and compare offers from various banks and credit unions. Online banks often provide more competitive rates due to lower overhead costs. As financial advisor Jane Smith notes, “A high-interest savings account is a no-brainer for anyone looking to squeeze more out of their cash savings without taking on additional risk.”

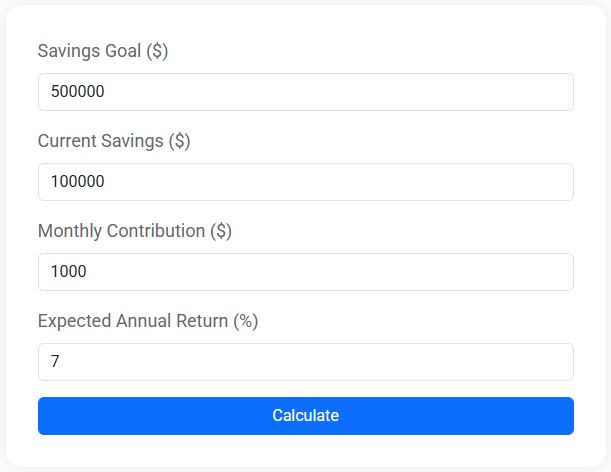

Savings Goal Calculator

Use our free Savings Goal Calculator to find out how long it will take to reach your savings target. See your timeline and how interest can help you grow faster.

Maximize Employer-Sponsored Retirement Plans

Employer-sponsored retirement plans, such as 401(k)s or 403(b)s, are a powerful tool for growing your savings thanks to their tax advantages and, in many cases, employer matching contributions. If your employer offers a match, not contributing enough to get the full match is essentially leaving free money on the table.

Let's break it down: if your employer offers a 50% match on contributions up to 6% of your salary, and you earn $50,000 a year, that’s an extra $1,500 annually added to your retirement savings if you contribute the full amount. Over decades, this can grow significantly, especially when compounded with market returns.

Furthermore, contributions to these plans are typically pre-tax, reducing your taxable income and potentially placing you in a lower tax bracket. As CNBC reports, maximizing these contributions can be a game-changer for your long-term financial health, allowing you to retire more comfortably.

Diversify Your Investment Portfolio

Diversification is a cornerstone of investing that helps balance risk and reward by spreading investments across different asset classes. The idea is simple: don’t put all your eggs in one basket. By diversifying, you protect your portfolio from the volatility of any single investment.

Consider including a mix of stocks, bonds, and other assets like real estate or commodities. Each asset class has different risk and return characteristics, and their performances often don’t move in sync. For example, while stocks offer higher growth potential, bonds can provide stability during market downturns.

According to a report by the Financial Industry Regulatory Authority, properly diversified portfolios tend to outperform more concentrated portfolios over time. This strategy minimizes the impact of a poor-performing asset and maximizes the potential for steady, long-term growth.

Additionally, regularly reviewing and rebalancing your portfolio ensures that your asset allocation remains aligned with your risk tolerance and financial goals. It’s not just about picking the right investments, but also about maintaining the right mix over time.

Regularly Review Your Financial Plan

Your financial plan is not a static document; it should evolve as your life circumstances change. Regularly reviewing and adjusting your financial plan ensures that you remain on track to meet your goals, whether they include buying a home, saving for education, or planning for retirement.

Life events such as a new job, marriage, or the birth of a child can significantly impact your financial situation. Revisiting your plan annually—or whenever a major life event occurs—allows you to adjust your savings rate, investment strategy, and risk tolerance accordingly.

Additionally, staying informed about changes in the financial landscape, such as new tax laws or shifts in the economy, can help you adapt your strategy to take advantage of new opportunities or mitigate potential risks. Financial advisor Mark Thompson suggests, “Think of your financial plan as a living document. Continuously updating it ensures you’re always prepared for whatever life throws your way.”

By implementing these strategies, you’re not just saving money—you’re actively working towards a secure and prosperous future. Remember, the key is to be proactive and intentional with your savings. With a strategic approach, you can make your money work harder and achieve your financial dreams more efficiently.