The Top 3 High-Yield Savings Accounts for Your Money

In today's uncertain economic climate, high-yield savings accounts are a great option for maximizing returns on your savings with higher interest rates than traditional accounts. Top contenders like Ally Bank, Marcus by Goldman Sachs, and Discover Bank offer competitive APYs, no fees, and user-friendly platforms, making them excellent choices for diverse financial needs. When selecting an account, consider factors such as accessibility, fees, and additional features, and integrate it into a broader savings strategy with regular contributions and periodic reviews to optimize your financial growth.

In today's economic climate, where uncertainty seems to be the only constant, safeguarding your hard-earned cash is more crucial than ever. High-yield savings accounts are emerging as a savvy choice for anyone looking to maximize the returns on their savings without taking on the risks associated with other investment vehicles. Unlike traditional savings accounts, these financial products offer significantly higher interest rates, allowing your money to grow while remaining easily accessible.

But with so many options out there, where should you stash your cash? To make your decision easier, let’s take a closer look at three standout players in the high-yield savings account arena: Ally Bank, Marcus by Goldman Sachs, and Discover Bank. Each offers competitive annual percentage yields (APYs), minimal fees, and user-friendly platforms that cater to a variety of financial needs.

Ally Bank: A Digital Pioneer with Flexibility

Ally Bank has long been a favorite among online banking enthusiasts, and for good reason. It boasts a competitive APY that consistently ranks among the top in the industry, and it’s known for its no-nonsense approach to fees. With no monthly maintenance charges and no minimum balance requirements, Ally makes it easy for savers at any level to start earning more from their money.

One of Ally's standout features is its user-friendly digital platform. Whether you're accessing your account via a web browser or the mobile app, the interface is intuitive and packed with useful tools. For example, the bank offers a "Buckets" feature, allowing you to segment your savings into different goals, such as a vacation fund or an emergency reserve. This can be a game-changer for those who benefit from visualizing their financial targets.

According to a recent review by NerdWallet, Ally’s customer service is another highlight. Available 24/7, their representatives are well-trained and ready to assist with any questions or concerns. This level of support can be incredibly reassuring, especially when you’re managing your finances digitally.

Marcus by Goldman Sachs: Simplicity and Security

Marcus by Goldman Sachs is another strong contender in the high-yield savings account market. Known for its straightforward and transparent approach, Marcus offers a high APY with no fees attached. This simplicity is appealing to those who prefer a more streamlined banking experience.

What sets Marcus apart is its association with Goldman Sachs, a financial institution with over 150 years of history. This connection lends an extra layer of credibility and security, making it an attractive option for those who prioritize trust in their banking choices. As financial advisor Jane Smith points out, "The backing of a well-established bank can provide much-needed peace of mind in today’s volatile economy."

Marcus also offers a seamless online banking experience. The account setup process is quick and painless, and the platform is designed to make managing your money as effortless as possible. Marcus doesn’t offer some of the additional features that other banks might, like checking accounts or credit cards, but what it does, it does exceptionally well. For those who value simplicity and security over bells and whistles, Marcus is an excellent choice.

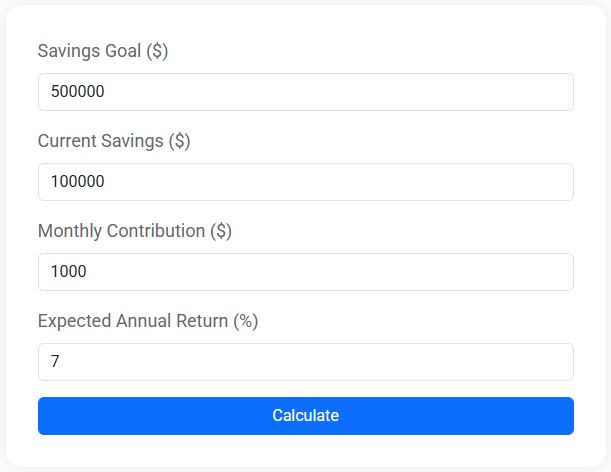

Savings Goal Calculator

Use our free Savings Goal Calculator to find out how long it will take to reach your savings target. See your timeline and how interest can help you grow faster.

Discover Bank: Rewards and Reliability

Discover Bank is often recognized for its credit card offerings, but its high-yield savings account deserves equal attention. Offering a competitive APY, Discover combines high interest rates with a reliable service model. As with the other banks on this list, there are no monthly fees or minimum balance requirements, allowing you to grow your savings without worrying about unexpected charges.

One of Discover's unique selling points is its customer rewards program. While it may not directly impact the savings account, having access to Discover’s other products can lead to additional perks and cash back opportunities. This integration makes it easier for customers who prefer to keep all their financial activities under one umbrella.

Discover’s customer service is frequently praised in reviews, with representatives available 24/7 for assistance. The bank's mobile app is robust, offering a range of features that make tracking your savings goals and transactions straightforward. According to a recent report by CNBC, Discover’s app is among the most highly rated in the financial sector, thanks to its comprehensive functionality and ease of use.

Choosing the Right Account for Your Needs

When selecting a high-yield savings account, it's important to consider more than just the APY. Accessibility, platform usability, customer service, and any additional features should all factor into your decision. For instance, if you’re someone who likes to visualize your savings goals, Ally’s "Buckets" feature might tip the scales. Alternatively, if you value the stability of a well-established institution, Marcus by Goldman Sachs could be your best bet.

Moreover, integrating a high-yield savings account into a broader financial strategy is key to optimizing your financial growth. Regular contributions, whether automated or manual, can help you take full advantage of compound interest over time. Additionally, periodic reviews of your account's performance and the interest rate environment are crucial. Economic conditions change, and ensuring your savings account remains competitive is part of a proactive financial strategy.

Building a Sustainable Savings Plan

Finally, a high-yield savings account should be just one component of a diversified financial plan. Consider it a secure place to store your emergency fund or short-term savings, while exploring other investment opportunities for long-term growth. As financial advisor Jane Smith explains, "Diversification is the cornerstone of any robust financial plan. Relying solely on one type of account or investment can leave you vulnerable to market shifts."

Incorporating these accounts into your broader financial picture can help you meet various life goals, from purchasing a home to retiring comfortably. The key is to remain informed and adaptable, ensuring your savings strategy evolves alongside your life circumstances and financial environment.

In summary, high-yield savings accounts from Ally Bank, Marcus by Goldman Sachs, and Discover Bank offer compelling options for savers looking to earn more from their deposits. By choosing the right account for your needs and integrating it into a comprehensive savings plan, you can navigate the uncertainties of the economic landscape with confidence.