10 Money-Saving Tips for Millennials

In today's fast-paced world, millennials face financial challenges such as student loans, high living costs, and an unpredictable job market, making saving money seem daunting. However, by creating a budget, prioritizing debt repayment, embracing a frugal lifestyle, automating savings, and investing in their future, millennials can build a solid financial foundation. These strategies empower them to navigate their unique financial landscape and work towards long-term financial security.

In today's fast-paced world, millennials face a unique set of financial challenges. Between juggling student loans, navigating high living costs, and dealing with an unpredictable job market, it’s no wonder many millennials find saving money daunting. But here's the good news: while the financial landscape may seem overwhelming, there are effective strategies that can help you build a solid financial foundation. By creating a budget, prioritizing debt repayment, embracing a frugal lifestyle, automating savings, and investing in your future, you can work towards long-term financial security. Let's dive into these ten money-saving tips that can empower you to navigate your financial journey.

Create a Realistic Budget

Budgeting might sound like a chore, but it's one of the most crucial steps in achieving financial stability. Start by tracking your income and expenses for a month to understand your spending patterns. Tools like Mint or YNAB (You Need A Budget) can make this process easier and more insightful. Once you have a clear picture, categorize your spending into needs, wants, and savings. This will help you identify areas where you can cut back and redirect funds towards savings or debt repayment. Remember, a budget isn't about restriction; it's about understanding where your money goes and making informed choices.

Focus on Debt Repayment

Student loans, credit card debt, and other liabilities can weigh heavily on your financial well-being. Prioritizing debt repayment is key to freeing up your finances. Consider using the avalanche method, where you pay off high-interest debts first, or the snowball method, where you start with the smallest debts to gain momentum. According to a study by CNBC, millennials are increasingly opting for debt consolidation to simplify their payments and reduce interest rates. Whatever strategy you choose, the goal is to consistently chip away at your debt to reduce stress and improve your credit score.

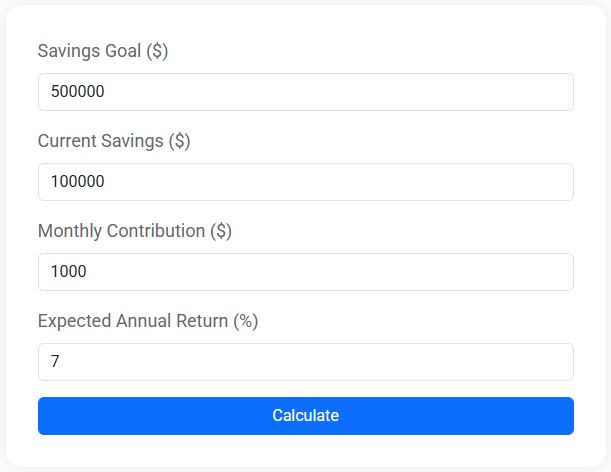

Savings Goal Calculator

Use our free Savings Goal Calculator to find out how long it will take to reach your savings target. See your timeline and how interest can help you grow faster.

Embrace Frugality

Living frugally doesn't mean living without; it means making intentional choices about how you spend your money. Look for areas in your life where you can cut costs without sacrificing quality. For instance, cooking at home rather than dining out can save you a significant amount over time. As financial advisor Jane Smith suggests, "Find joy in simple pleasures and focus on experiences rather than material possessions." Also, consider shopping for second-hand items, using public transportation, or swapping services with a friend. Each small change can add up to substantial savings.

Automate Your Savings

Automation is a powerful tool for building wealth effortlessly. Set up automatic transfers from your checking account to a savings or investment account every month. This "pay yourself first" strategy ensures that you prioritize savings before discretionary spending. Many banks allow you to create multiple savings accounts for different goals, such as an emergency fund, vacation fund, or down payment on a house. By automating your savings, you remove the temptation to spend and make consistent progress towards your financial goals.

Invest in Your Future

Investing can seem intimidating, but it's essential for building wealth over time. Start by contributing to your employer's 401(k) plan, especially if they offer a match — that's free money! If you're self-employed or your employer doesn't offer a retirement plan, consider opening an IRA. According to Forbes, the earlier you start investing, the more time your money has to grow through the power of compounding. Don't be afraid to seek advice from a financial advisor to help you develop an investment strategy that aligns with your risk tolerance and goals.

Build an Emergency Fund

An emergency fund is your financial safety net, providing peace of mind when unexpected expenses arise. Aim to save at least three to six months' worth of living expenses in a high-yield savings account. This fund will cover unforeseen costs like medical bills, car repairs, or job loss without derailing your financial plans. Start by setting aside a small amount each month and gradually increase it as your budget allows. Having an emergency fund can prevent you from relying on credit cards or loans in a crisis.

Cut Unnecessary Subscriptions

It's easy to lose track of subscription services, from streaming platforms to monthly box deliveries. Conduct a subscription audit to identify services you rarely use or can live without. Canceling these unnecessary expenses can free up cash for more important financial goals. According to a report by the New York Times, many people are surprised by how much they spend on subscriptions they don't fully utilize. By trimming these costs, you can allocate more money towards savings or debt repayment.

Negotiate Bills and Expenses

Negotiating isn't just for buying cars or houses; it's a skill that can save you money on everyday expenses. Contact your service providers, such as cable, internet, or insurance companies, to see if you can secure a better deal. Often, simply asking for a discount or mentioning a competitor's lower rate can result in savings. As consumer advocate Clark Howard advises, "The worst they can say is no, but the best is they can save you money." Regularly reviewing and negotiating your bills can lead to significant long-term savings.

Embrace DIY Solutions

Do-it-yourself solutions can be a fun and cost-effective way to tackle everyday tasks. From home repairs to personal care, there are countless tutorials and resources available online to help you learn new skills. For example, learning basic car maintenance or sewing can save you money on repairs and alterations. As you become more self-sufficient, you'll gain confidence and reduce your reliance on paid services. Plus, the money saved can be redirected towards your financial goals.

Stay Financially Informed

Knowledge is power, especially when it comes to managing your finances. Stay informed by reading personal finance blogs, listening to podcasts, or following financial experts on social media. Understanding economic trends, tax changes, and investment opportunities can help you make better financial decisions. Additionally, consider taking a financial literacy course to deepen your understanding of money management. By staying informed, you'll be better equipped to navigate the ever-evolving financial landscape and make choices that align with your goals.

Incorporating these money-saving tips into your life can help you build a solid financial foundation and work towards long-term security. By taking control of your finances, you can reduce stress, increase your financial freedom, and create the life you've always envisioned. Remember, the journey to financial well-being is a marathon, not a sprint. Start small, stay consistent, and celebrate your progress along the way.