The Savings Snowball Effect: How Small Changes Lead to Big Savings

The Savings Snowball Effect is a strategy that involves making small, manageable changes to your spending habits to gradually build significant savings over time. By consistently reducing everyday expenses, automating savings, and tracking progress, you create a momentum that enhances financial security and empowers you to pursue larger financial goals. This approach highlights that even the smallest efforts can lead to considerable financial growth, transforming your financial outlook one step at a time.

Imagine a snowball rolling down a hill, gathering more snow as it moves along, growing larger and more unstoppable with each rotation. This is the idea behind the Savings Snowball Effect — a strategy that transforms small, manageable changes into significant savings over time. By consistently chipping away at everyday expenses, automating your savings, and diligently tracking your progress, you create a momentum that not only enhances your financial security but also empowers you to pursue larger financial goals.

Consider this: even the smallest efforts can lead to considerable financial growth. It's about understanding that every dollar saved is a step closer to financial stability and freedom. And just like that snowball, the more you keep at it, the bigger your savings will grow. Let's dive into how you can harness this principle to transform your financial outlook, one step at a time.

Start Small: The Power of Incremental Change

Making drastic changes to your spending habits can be daunting and often unsustainable. Instead, aim for small, incremental adjustments. Perhaps it's brewing your coffee at home instead of hitting the café every morning, saving you $3 a day. That’s over $1,000 a year, just from one small change. This approach is not only easier to manage but also more likely to stick in the long run.

As financial coach Dave Ramsey often emphasizes, "The key to financial success is to make changes that are small enough to maintain." By focusing on one change at a time, you avoid feeling overwhelmed and make it easier to incorporate these adjustments into your daily routine. Each small victory gives you the confidence and motivation to tackle the next one, creating a positive feedback loop that fuels your financial journey.

Automate Your Savings: Set It and Forget It

One of the simplest yet most effective ways to build savings is through automation. By setting up automatic transfers from your checking account to a savings account, you remove the temptation to spend that money elsewhere. It’s a classic case of "out of sight, out of mind." Many banks offer the option to automatically transfer a portion of your paycheck into savings, turning saving into a seamless part of your financial routine.

This strategy is supported by behavioral economists who argue that automation helps overcome the common human tendency to procrastinate on saving. As Richard Thaler, a Nobel laureate in economics, points out, "People have a tendency to consume today and save tomorrow. Automation makes saving happen today." By treating savings like any other non-negotiable expense, you ensure that it happens consistently, without the need for constant vigilance or willpower.

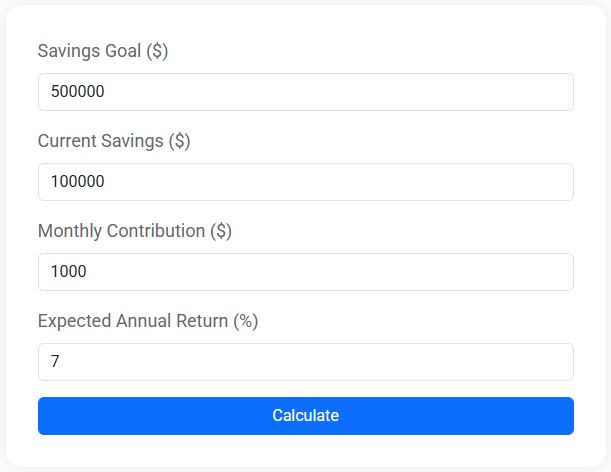

Savings Goal Calculator

Use our free Savings Goal Calculator to find out how long it will take to reach your savings target. See your timeline and how interest can help you grow faster.

Track Your Progress: Celebrate Small Wins

Tracking your progress is critical to maintaining motivation and staying on course. By keeping a detailed record of your savings and watching them grow over time, you reinforce positive behaviors and remain focused on your objectives. It’s much like maintaining a fitness journal; seeing how far you’ve come pushes you to keep going. Plus, tracking allows you to identify patterns or areas where you can further optimize your spending.

There are numerous apps and tools available that make tracking your savings easy and even enjoyable. Apps like Mint or YNAB (You Need A Budget) can provide insights into your spending habits and show you exactly where your money is going. These tools can be essential in helping you adjust your strategy and make informed decisions about future financial goals.

Embrace Frugality: The Art of Mindful Spending

Frugality is about being intentional with your money, ensuring that each dollar spent aligns with your values and priorities. This doesn’t mean you have to deprive yourself of all pleasures; rather, it's about making conscious choices that reflect what truly matters to you. Maybe it's choosing a night in with friends over an expensive dinner out, or borrowing books from the library instead of buying them. Each decision helps build your savings snowball.

As financial expert Liz Weston advises, "Frugality is not about being cheap, it's about being resourceful." By adopting a frugal mindset, you become more attuned to the value of your money and less susceptible to impulsive purchases. This mindfulness can significantly contribute to your savings over time, allowing you to allocate funds towards goals that genuinely enhance your life.

Set Clear Goals: Know What You're Saving For

Having clear, tangible goals is crucial for maintaining motivation and direction in your savings journey. Whether it’s an emergency fund, a dream vacation, or a down payment on a house, knowing what you’re working towards provides purpose and clarity. It transforms saving from a mundane task into a meaningful pursuit.

Break down larger goals into smaller, achievable milestones. For instance, if you aim to save $10,000 for a down payment, set interim goals of $1,000 increments. Celebrating these smaller victories keeps you motivated and reinforces the progress you’re making. As the saying goes, "A journey of a thousand miles begins with a single step." Each milestone reached is a step closer to your ultimate goal.

Be Prepared for Setbacks: Flexibility is Key

No savings journey is without its challenges. Unexpected expenses can arise, and financial setbacks are a part of life. The key is to approach these obstacles with resilience and flexibility. Having an emergency fund can provide a buffer, ensuring that an unexpected car repair or medical bill doesn’t derail your progress.

Remember, setbacks are not failures; they are opportunities to reassess and adjust your strategy. As financial planner Carl Richards notes, "Financial plans are worthless, but the act of planning is invaluable." The process of planning helps you adapt to changes and stay on track, even when things don’t go as expected. By remaining flexible and committed, you can overcome setbacks and continue building your savings snowball.

In conclusion, the Savings Snowball Effect is a powerful strategy for achieving financial growth through small, deliberate actions. By making incremental changes, automating your savings, and staying mindful of your spending, you can create a momentum that leads to substantial savings over time. With clear goals and a flexible mindset, you’re equipped to tackle any financial challenge and move confidently towards a secure financial future. Remember, even the smallest efforts can lead to significant rewards. So, start rolling your savings snowball today and watch it grow into something truly impactful.