7 Steps to Achieving Your Savings Goals

Saving money doesn't have to be daunting if approached strategically. By defining clear goals, assessing your financial situation, creating a realistic savings plan, reducing unnecessary expenses, and continuously monitoring your progress, you can effectively work towards achieving your financial dreams, whether it's a house down payment, an emergency fund, or a vacation. Consistency and adaptability are key to turning your savings goals into achievable realities.

Saving money can sometimes feel like trying to climb a mountain with no end in sight. We’ve all been there, staring at our bank accounts and wondering how to turn those numbers into a ticket to our dreams. Whether you’re aiming for a down payment on a house, an emergency fund, or that dream vacation, the challenge is real, but it’s not insurmountable. The key is having a strategy that works for you and sticking with it, even when life throws its curveballs.

Let’s break it down into seven actionable steps. Think of these as your roadmap to transforming those nebulous financial aspirations into tangible realities. We’re not talking about overnight success here—this is about creating a sustainable plan that you can live with, one that aligns with your lifestyle and values. After all, saving money is as much about intention and awareness as it is about numbers.

Step 1: Define Clear Goals

The first step in your savings journey is knowing exactly where you’re headed. It might sound obvious, but you’d be surprised how many people skip this crucial step. Think about what you truly want to achieve. Is it a cozy home, a safety net for unexpected expenses, or perhaps a trip to explore the world? Be specific about your goals. Instead of saying “I want to save for a house,” try “I want to save $40,000 for a down payment in five years.”

Specific goals give you something tangible to work toward and make it easier to track your progress. They also help you stay motivated. It’s not just about putting money away; it’s about putting money away for something that genuinely excites you. As financial planner Carl Richards puts it, “Goals are like personal guideposts that keep us on track and help us measure progress.”

Step 2: Assess Your Current Financial Situation

Before you can start saving, you need to know where you stand financially. This means taking a good, hard look at your income, expenses, debts, and assets. It’s all about understanding your cash flow. How much money is coming in each month, and how much is going out? A clear picture helps you see how much you can realistically save without stretching yourself too thin.

Create a simple budget to categorize your expenses. Tools like Mint or YNAB (You Need A Budget) can help automate this process and make tracking a breeze. Remember, this isn’t a one-time task—it’s a habit. By regularly reviewing your finances, you’ll stay aware of where your money goes and how you can redirect it toward your goals.

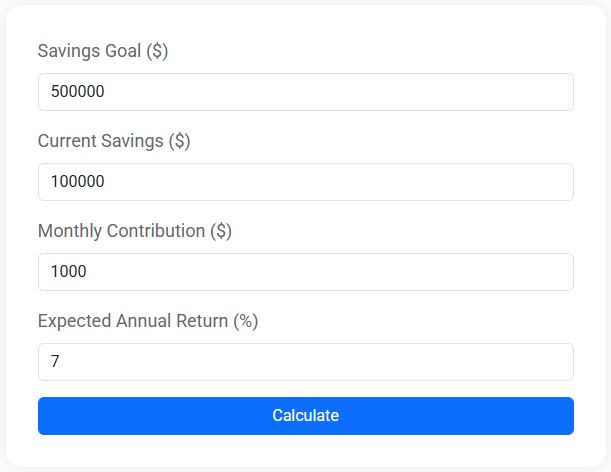

Savings Goal Calculator

Use our free Savings Goal Calculator to find out how long it will take to reach your savings target. See your timeline and how interest can help you grow faster.

Step 3: Create a Realistic Savings Plan

Once you’ve defined your goals and assessed your finances, it’s time to create a savings plan. This plan should be realistic and tailored to your situation. Start by determining how much you need to save each month to reach your goal within your desired timeframe. If your goal is to save $40,000 in five years, you’ll need to put away about $667 each month.

Don’t be discouraged if your initial calculations seem daunting. Adjust your timeframe or the amount you save each month to find a balance that suits you. The important thing is to start saving consistently. Even if you start small, the habit of saving will set the foundation for greater financial success. As financial advisor Suze Orman often says, “The key to wealth is living below your means.”

Step 4: Reduce Unnecessary Expenses

Finding extra money to save often means cutting back on unnecessary expenses. This doesn’t mean you need to live a life of austerity, but rather, you should identify areas where you can trim the fat. Consider your discretionary spending—things like dining out, subscription services, or impulse buys. Are there any areas where you can cut back?

Think about adopting strategies like meal planning to reduce grocery bills or unsubscribing from services you rarely use. Every little bit adds up. For instance, skipping that $5 daily coffee could save you over $1,800 a year! The idea is to make mindful choices that align with your values and financial goals. According to a report by CNBC, the average American spends $18,000 a year on non-essential items. Imagine redirecting even a fraction of that towards your savings.

Step 5: Automate Your Savings

Automation is a powerful tool in the savings arsenal. By setting up automatic transfers from your checking account to your savings account, you can make saving money effortless. Decide on a fixed amount to transfer each month, ideally right after you receive your paycheck. This way, you’re paying yourself first and will be less tempted to spend the money elsewhere.

Many banks offer savings accounts that allow you to set up automatic transfers. Some even provide options to round up your purchases to the nearest dollar and save the difference. Automation takes willpower out of the equation and helps you build your savings without having to think about it. As a wise saying goes, “Out of sight, out of mind.”

Step 6: Continuously Monitor Your Progress

Monitoring your progress is crucial to staying on track with your savings goals. Regularly reviewing your savings plan helps you stay accountable and motivated. Are you hitting your monthly targets? If not, why? Life is unpredictable, and your financial situation may change, requiring adjustments to your plan.

Use tools like spreadsheets or financial apps to track your progress. Celebrate small victories to keep morale high. If you’ve saved $1,000 towards your emergency fund, give yourself a pat on the back! As personal finance blogger Paula Pant suggests, “The key is not to bash yourself for falling short, but to recognize and rectify.”

Step 7: Stay Flexible and Adaptable

Life rarely goes as planned, and your savings journey will likely encounter bumps along the way. The key is to stay flexible and adapt your plan as needed. Perhaps an unexpected expense arises, or your income changes—be ready to adjust your savings goals and strategies accordingly.

Being adaptable doesn’t mean giving up on your goals. Rather, it’s about finding a new path to reach them. Consider alternate strategies like side hustles to boost your income or revisiting your budget to find more savings opportunities. Remember, consistency is important, but so is the ability to pivot when circumstances demand it.

Saving money is a journey, not a destination. By following these steps—defining clear goals, assessing your financial situation, creating a realistic plan, reducing unnecessary expenses, automating savings, monitoring progress, and staying adaptable—you can turn your savings dreams into reality. Like any good journey, it requires patience, persistence, and a little bit of planning. But the rewards, both financial and personal, are well worth the effort.