The Dos and Don’ts of Saving Money for a Rainy Day

Setting clear and specific savings goals is essential for building a consistent and effective rainy day fund, as it helps you stay focused and motivated. Automating your savings can prevent the temptation to overspend and ensures regular contributions, while keeping the fund for true emergencies requires discipline. Regularly reviewing your savings plan and avoiding high-risk investments will help maintain financial security and liquidity for unexpected expenses.

We've all heard the expression "save for a rainy day," but what exactly does that mean? Think of a rainy day fund as your financial umbrella, shielding you from life's unexpected downpours—be it a sudden car repair, an unplanned medical expense, or even a temporary job loss. Having a stash of cash set aside can provide peace of mind and financial stability when life throws a curveball. But building and maintaining this fund isn't as simple as tossing a few extra bucks into a jar. It requires a bit of strategy and discipline. So, let's dive into the dos and don'ts of saving money for a rainy day.

Do: Set Clear and Specific Savings Goals

Setting clear and specific savings goals is your first step toward creating an effective rainy day fund. Imagine telling yourself, "I'll save some money," versus, "I'll save $50 a week for six months to reach a $1,200 emergency fund." The latter is not only more specific but also gives you a target to aim for. This specificity helps keep you motivated and focused, much like having a destination in mind makes a road trip more manageable.

According to a study by the American Psychological Association, people who set specific goals are more likely to achieve them. Knowing exactly what you're aiming for transforms a vague intention into a concrete plan. Plus, having a clear goal allows you to track your progress, which can be incredibly rewarding and motivating.

Start by assessing your monthly expenses and income to determine a realistic savings target. Consider what kinds of emergencies you're preparing for; a good rule of thumb is to aim for three to six months' worth of living expenses. Tailoring your goals to your personal situation ensures that your rainy day fund is both practical and achievable.

Do: Automate Your Savings

If you're like most people, the temptation to spend money rather than save it can be overwhelming. That's where automation comes in. By setting up automatic transfers from your checking account to your savings account, you can make saving money as effortless as paying your monthly Netflix subscription.

Consider the advice of financial advisor Jane Smith, who suggests, "Treat your savings like a bill you must pay each month." Automating your savings ensures that you consistently set aside money without having to think about it. This strategy removes the temptation to skip a month or two, keeping your financial goals on track.

Most banks offer free online tools to set up recurring transfers, allowing you to choose how much money is moved and how often. Whether it's weekly, bi-weekly, or monthly, find a frequency that aligns with your pay schedule. This approach not only helps build your rainy day fund but also instills a habit of regular saving.

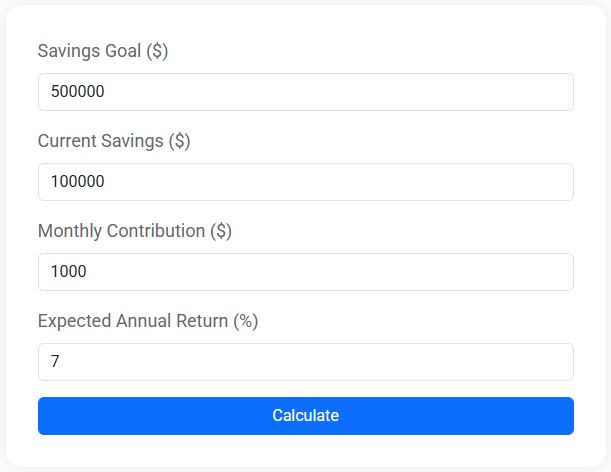

Savings Goal Calculator

Use our free Savings Goal Calculator to find out how long it will take to reach your savings target. See your timeline and how interest can help you grow faster.

Don't: Dip Into the Fund for Non-Emergencies

Once you've started building your rainy day fund, it might be tempting to use it for expenses that aren't true emergencies. A sale on the latest smartphone or a spontaneous weekend getaway might feel like they warrant dipping into those savings, but resist the urge. The purpose of this fund is to provide a safety net for genuine emergencies, not to finance lifestyle upgrades.

Keeping your rainy day fund separate from your regular savings account can help prevent unnecessary withdrawals. Consider opening a separate savings account solely for emergencies, preferably one that's not too easily accessible. As financial expert Suze Orman advises, "If it's easy to access, it's easy to spend."

Maintaining discipline can be challenging, but remember why you started saving in the first place. The peace of mind that comes from having a financial buffer far outweighs the temporary satisfaction of an impulse purchase.

Do: Regularly Review Your Savings Plan

Your financial situation and needs can change over time, so it's essential to review your savings plan regularly. Life events such as a new job, a growing family, or a change in expenses may require adjusting your savings goals. Set aside time every few months to assess whether your current plan still aligns with your financial priorities.

During your review, consider factors like inflation, which can erode the purchasing power of your savings over time. You might find it necessary to increase your contributions to maintain the fund's value. Additionally, check for any unnecessary fees associated with your savings account that could be eating into your funds.

Regularly updating your plan ensures that your rainy day fund remains robust and responsive to your life's dynamics. This proactive approach can help you stay prepared for whatever financial challenges come your way.

Don't: Invest in High-Risk Options for Your Rainy Day Fund

While it might be tempting to grow your rainy day fund through investments, high-risk options are not suitable for this purpose. The primary goal of these savings is liquidity and security, which means you should be able to access the money quickly when needed. High-risk investments can jeopardize your fund, especially if the market takes a downturn at an inopportune moment.

According to CNBC, financial advisors recommend keeping your rainy day funds in a high-yield savings account or a money market account. These options offer better interest rates than traditional savings accounts while still providing easy access to your money.

Remember, the purpose of a rainy day fund is not to generate high returns but to provide a financial cushion. Prioritizing safety and liquidity over potential gains will ensure that your savings are there when you need them most.

Building a rainy day fund is more than just a financial exercise—it's an investment in peace of mind. By setting clear goals, automating your savings, maintaining discipline, regularly reviewing your plan, and avoiding high-risk investments, you can create a robust safety net for life's unexpected challenges. With these dos and don'ts in mind, you're well on your way to weathering any financial storm that comes your way.