Financial Spring Cleaning: Tips for Decluttering Your Finances

Spring is the ideal time to not only declutter your home but also to organize your finances by reassessing your financial goals, reviewing your budget, and organizing financial documents. Simplifying accounts and planning for the future are crucial steps to streamline your financial management and ensure long-term success. Embrace these habits regularly to maintain financial health and reduce stress.

Spring is in the air, and while many of us are grabbing dusters and organizing closets, it might be the perfect moment to give your finances a little freshening up too. Think of it as a financial spring cleaning—a chance to reassess your financial goals, streamline your accounts, and ensure you're on track for the future. As we shake off the winter blues, it’s a great time to tidy up those financial cobwebs that have been lurking in the shadows.

Just like a cluttered home can create stress and anxiety, a disorganized financial life can lead to unnecessary chaos. Tackling these tasks may feel daunting, but the benefits are well worth the effort. Imagine the peace of mind that comes from knowing where every dollar is, having a clear path towards your financial goals, and being prepared for whatever life throws your way. So grab a cup of coffee, settle in, and let’s dive into some practical steps to declutter your finances this spring.

Reassess Your Financial Goals

First things first, let's talk about your financial goals. Just like that sweater you haven’t worn in three years, some goals may no longer fit your life. Are there goals you set at the start of the year that now seem less important? Or maybe your circumstances have changed—new job, new family member, or even a new outlook on life. This is a great time to sit down and reevaluate what truly matters to you financially.

Consider creating a vision board or a simple list of your top financial priorities. Whether it’s saving for a house, planning a big vacation, or building an emergency fund, having clear goals can guide your financial decisions. According to a 2023 survey by Fidelity, individuals who set specific financial goals are more likely to achieve them. The key is to make these goals SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. By doing so, you're not just dreaming; you're creating a roadmap to success.

Review and Refresh Your Budget

Once your goals are crystal clear, it's time to give your budget a good scrub. Think of your budget as your financial GPS—it helps guide you towards your goals. But like any good map, it needs regular updates to reflect your current reality. Start by examining your income and expenses. Are there areas where you're consistently overspending, or perhaps underspending, in ways that could better serve your goals?

Look for subscriptions or services you no longer use—those can be sneaky budget busters. As financial advisor Jane Smith suggests, "Even small monthly subscriptions can add up over time, eating away at your discretionary spending." Canceling a few unused services could free up funds for more meaningful expenses. Also, consider adjusting your spending categories to better align with your values. If dining out is a joy for you, allocate more funds there, but be sure to balance it by cutting back elsewhere.

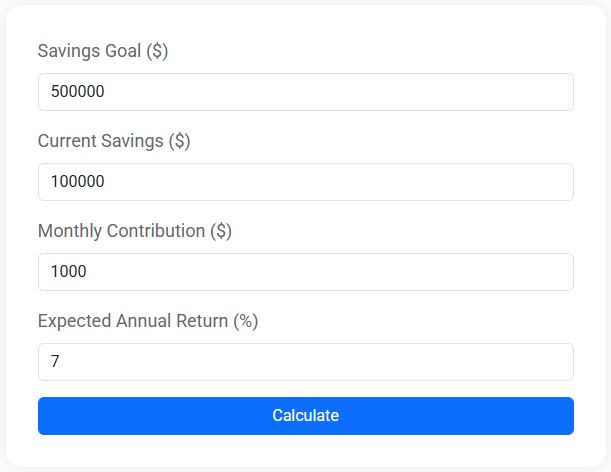

Savings Goal Calculator

Use our free Savings Goal Calculator to find out how long it will take to reach your savings target. See your timeline and how interest can help you grow faster.

Organize Financial Documents

Next, let's tackle the paper (or digital) trail that accompanies financial life. Organizing your financial documents not only reduces stress but also saves time when you need to retrieve information quickly. Start by gathering all your essential paperwork—tax returns, bank statements, insurance policies, and investment documents. Decide which documents need to be kept as hard copies and which can be safely stored digitally.

For digital storage, consider using secure cloud services that offer encryption. Ensure that your files are well-organized, with clear folder names and a consistent naming convention. For instance, you might have folders for each year, further divided by document type. As a precaution, back up your files regularly to prevent data loss. Remember, a well-organized system is like a well-maintained filing cabinet; it’s only useful if you can find what you need when you need it.

Simplify Your Accounts

If you find yourself juggling multiple bank accounts and credit cards, it might be time to simplify. Having too many accounts can lead to confusion, missed payments, and even forgotten assets. Start by reviewing all your accounts—do you really need them all? Closing unnecessary accounts can streamline your finances and reduce the mental load.

Consider consolidating accounts where possible. For example, if you have multiple retirement accounts from past jobs, you might roll them into a single IRA for easier management. Be sure to check for any fees or tax implications before making changes. As CNBC highlights, consolidating accounts can not only reduce fees but also make it easier to monitor your overall financial picture. Simplification can be incredibly freeing, allowing you to focus more on your financial goals and less on managing minutiae.

Plan for the Future

Finally, with a tidy financial house, it’s time to look ahead. Planning for the future is about more than just saving money—it's about ensuring that you and your loved ones are protected and prepared. Start by reviewing your insurance policies. Are you adequately covered in areas like health, life, and property insurance? Unexpected events can throw a wrench in even the best-laid plans, so it's essential to have the right safety nets in place.

Also, consider your retirement savings. Are you on track to meet your retirement goals? Tools like retirement calculators can provide a snapshot of your current trajectory and help you adjust contributions as needed. Don’t forget to review your estate plan as well. Ensure your will, power of attorney, and any trusts are up to date and reflect your current wishes.

Embrace Regular Financial Maintenance

Once your financial spring cleaning is complete, the key to maintaining this newfound clarity is regular upkeep. Just like you wouldn’t wait a decade to clean out your garage, don’t let your finances gather dust. Set aside time monthly or quarterly to review your budget, check in on your goals, and tidy up your documents. This routine maintenance can help catch small issues before they become significant problems.

Regular financial check-ins also provide an opportunity to celebrate successes. Did you manage to pay off a credit card, or reach a savings milestone? Take a moment to pat yourself on the back. According to behavioral finance studies, recognizing achievements reinforces positive habits, making it more likely you’ll continue on the path to financial health.

By embracing these habits and making financial spring cleaning an annual tradition, you’ll not only reduce stress but also set yourself up for long-term success. Remember, a little effort each year can lead to a lifetime of financial health and well-being. So here's to a fresh start this spring—your finances will thank you.