From Spendthrift to Saver: Transforming Your Money Mindset

Transforming your financial habits from a spendthrift to a saver involves understanding spending triggers, setting clear financial goals, and creating a personalized budget that aligns with your values. Embrace mindful spending and build a supportive environment to reinforce positive financial behaviors and pave the way for a more secure future. Begin with small, deliberate steps to shift your money mindset and achieve lasting financial well-being.

Transforming your financial habits can feel like trying to turn a cruise ship—daunting at first, but with the right tools and mindset, it’s entirely doable. Imagine ditching the stress of living paycheck to paycheck and embracing the calm confidence that comes with financial security. That’s the dream, right? But how do you get there, especially if you’ve spent years as a self-proclaimed spendthrift? Shifting from a spender to a saver is less about deprivation and more about aligning your finances with your values. By understanding your spending triggers, setting clear goals, and crafting a personalized budget, you can make lasting changes that stick.

Humans are creatures of habit, and our money habits are no exception. Often, they’re deeply ingrained, shaped by upbringing, societal norms, and even our emotional states. But the good news is, habits can be changed. It starts with awareness and the willingness to take small, deliberate steps toward a healthier financial future. Let’s dive into how you can transform your money mindset from spendthrift to saver.

Understanding Your Spending Triggers

Before you can change your relationship with money, you need to understand it. What triggers your spending? Is it stress, boredom, or perhaps a way to celebrate? Many of us have emotional ties to our spending habits that we aren’t fully aware of. According to a study by the Journal of Consumer Research, people often spend more when they’re sad, as a way to self-soothe. Identifying these triggers is the first step in taking control of your finances.

Consider keeping a spending journal for a month. Note not only what you buy but also how you’re feeling at the time. Patterns will likely emerge. You might discover that you tend to splurge on Fridays as a reward for a tough week or that your late-night online shopping is a way to cope with insomnia. Recognizing these patterns allows you to address the root cause of your spending and seek healthier alternatives.

Setting Clear Financial Goals

Once you’ve identified your spending triggers, the next step is to set clear financial goals. Goals give you direction and motivation. Think about what you truly want to achieve financially—is it paying off debt, building an emergency fund, or saving for a dream vacation? Be specific. Instead of saying, “I want to save money,” try, “I want to save $5,000 in the next 12 months for a trip to Italy.”

Break down your goals into manageable steps. If that Italy trip is your aim, calculate how much you need to save each month and factor it into your budget. As financial coach Dave Ramsey often emphasizes, when you have a clear goal in sight, it’s easier to say no to unnecessary expenses because you’re saying yes to something bigger and more meaningful.

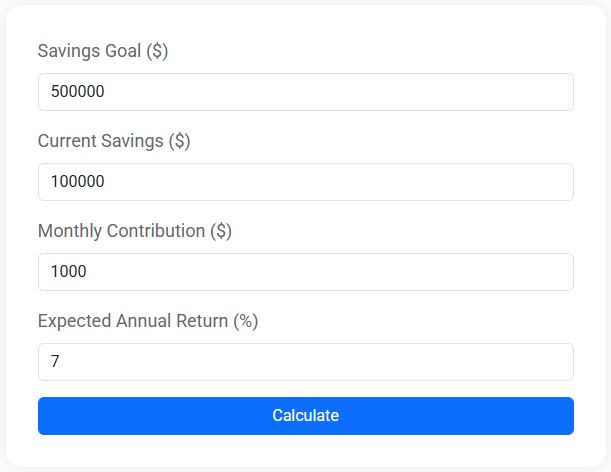

Savings Goal Calculator

Use our free Savings Goal Calculator to find out how long it will take to reach your savings target. See your timeline and how interest can help you grow faster.

Creating a Personalized Budget

A budget is your roadmap to financial success, but it doesn’t have to be restrictive. In fact, a good budget reflects your values and priorities. Start by listing your income and all your expenses. Then, categorize your spending into needs and wants. Needs are your essentials—think rent, groceries, utilities. Wants are everything else, from dining out to a subscription service you rarely use.

The key is to allocate your money in a way that aligns with your values. If travel is a priority, allocate more to that category and less to others that aren’t as important. Personal finance expert Suze Orman suggests using the "50/30/20" rule as a starting point: 50% for needs, 30% for wants, and 20% for savings and debt repayment. Tailor these percentages to fit your lifestyle and goals.

Embracing Mindful Spending

Mindful spending is about being intentional with your money. It’s not about never enjoying a latte again but rather savoring it because it fits within your budget and values. Before making a purchase, ask yourself: Is this bringing me closer to my financial goals? Is it something I need or truly value?

A practical exercise is to implement a 24-hour rule for non-essential purchases. If you see something you want, wait a day before buying it. This pause can help you avoid impulse purchases and ensure that what you’re buying truly aligns with your values. As behavioral economist Dan Ariely notes, our decisions improve when we give ourselves a moment to reflect.

Building a Supportive Environment

Transforming your money mindset isn’t something you have to do alone. Surrounding yourself with a supportive environment can make a significant difference. Discuss your financial goals with a trusted friend or family member who can hold you accountable. Consider joining online communities or budgeting groups where you can share tips and experiences with like-minded individuals.

Financial advisor Jane Smith suggests finding a "money buddy"—someone who is also working toward financial goals. You can check in with each other regularly, celebrate wins, and offer encouragement when challenges arise. Having a network of support can reinforce positive financial behaviors and make the journey more enjoyable.

Starting Small for Lasting Change

Finally, remember that change doesn’t happen overnight. Start with small, deliberate steps. If saving seems impossible, begin with just $5 a week. Incremental changes can lead to significant results over time. As you see progress, your confidence will grow, and so will your commitment to your new financial path.

Celebrate your wins, no matter how small. Did you stick to your budget for a month? Treat yourself to a guilt-free reward that fits within your financial plan. Progress is progress, and each step forward is a testament to your dedication to transforming your financial habits.

Shifting from spendthrift to saver is a journey of self-discovery and empowerment. By understanding your spending habits, setting clear goals, and building a supportive environment, you can achieve financial well-being. Embrace the process, stay patient, and remember: the destination is worth the effort.