Breaking Bad Habits: How to Stop Overspending and Start Saving

Overspending can derail financial plans, but shifting the focus to saving is crucial for long-term stability. This article offers strategies to help curb overspending, such as understanding spending triggers, creating a realistic budget, practicing mindful spending, setting clear savings goals, and leveraging technology. By adopting these practices, you can cultivate financial habits that support a secure and prosperous future.

We’ve all been there: you walk into a store intending to buy just a loaf of bread, and you walk out with three bags full of items you didn’t even know you needed. Or maybe it’s the late-night online shopping spree, fueled by nothing more than a sense of boredom and a handy credit card. Overspending can feel like an insidious habit, quietly undermining our financial goals and leaving us wondering where all our hard-earned money went. But there’s good news. Just as easily as these bad habits form, they can be broken. And breaking them doesn’t have to mean sacrificing all the things you love. Instead, it can open the door to a more stable and secured financial future.

The key is to shift your mindset from one of constant consumption to one of mindful saving. This doesn’t happen overnight, and it’s not about deprivation. It’s about making smarter choices and being aware of the triggers that lead you to spend more than you’d like. Let’s dive into strategies that can help you curb overspending and start saving with real intent and purpose.

Understanding Your Spending Triggers

Every spending habit has a trigger. For some, it’s emotional—perhaps you shop when you’re stressed or bored. For others, it might be social—like the urge to keep up with friends who frequently dine out or travel. Recognizing these triggers is the first step to managing them. According to a study by the Journal of Consumer Research, emotional spending is often linked to a temporary boost in mood, but it rarely solves the underlying issue.

Start by keeping a spending journal. Note down what you buy, how you felt at the time, and any external factors that might have influenced your decision. Over time, patterns will emerge. You might discover that you tend to overspend after a tough day at work or when you’ve been scrolling through social media. Once you’re aware of these triggers, you can develop healthier coping mechanisms, like going for a walk or calling a friend.

Creating a Realistic Budget

Budgeting may not be the most exciting activity, but it’s a powerful tool for reigning in overspending. However, a budget that’s too restrictive can lead to frustration and eventual abandonment. Instead, aim for a realistic budget that reflects your actual income and expenses. Start by tracking your spending for a month to see where your money is going. Break down your expenses into categories like housing, groceries, entertainment, and savings.

Next, set limits for each category based on your priorities and financial goals. Don’t forget to include a small allowance for discretionary spending—completely cutting out fun expenses is a surefire way to fall off the budgeting wagon. As financial advisor Jane Smith aptly puts it, “A budget should be a reflection of your values, not a prison sentence.” Regularly review and adjust your budget as your circumstances change.

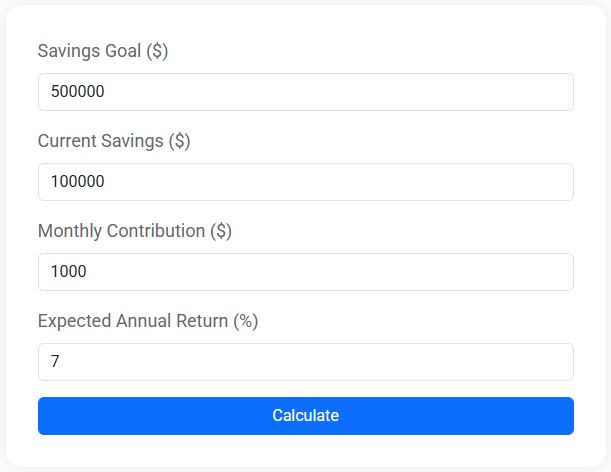

Savings Goal Calculator

Use our free Savings Goal Calculator to find out how long it will take to reach your savings target. See your timeline and how interest can help you grow faster.

Practicing Mindful Spending

Mindful spending is about being intentional with your purchases. It’s easy to get caught up in the thrill of a sale or the allure of instant gratification, but these impulses can quickly lead to financial strain. Before making a purchase, ask yourself: Do I really need this? Will it add value to my life? Is there a more budget-friendly alternative?

One technique to foster mindful spending is the 24-hour rule. If you’re tempted to buy something unplanned, wait a day before making the purchase. This cooling-off period often reveals whether the desire is genuine or fleeting. Additionally, unsubscribe from emails or notifications that tempt you with constant sales and deals. As CNBC suggests, controlling the influx of marketing messages can significantly reduce impulsive buying.

Setting Clear Savings Goals

Saving money is easier when you have clear goals in mind. Whether it’s building an emergency fund, saving for a vacation, or planning for retirement, having a target gives your savings a purpose. Start by defining short-term and long-term goals that are specific, measurable, and achievable. For example, instead of saying “I want to save more,” set a goal like “I want to save $500 in the next three months.”

Visual reminders can also be powerful motivators. Consider creating a vision board or using an app that tracks your progress towards your goals. Watching your savings grow can provide a sense of accomplishment and motivate you to continue. According to behavioral finance experts, setting tangible goals and tracking progress is linked to higher savings rates.

Leveraging Technology

In today’s digital age, technology can be a powerful ally in managing your finances. There are countless apps designed to help you track spending, create budgets, and save money. Apps like Mint or YNAB (You Need A Budget) can sync with your bank accounts to provide a real-time overview of your finances, making it easier to stick to your budget.

Moreover, consider setting up automatic transfers to your savings account on payday. Treating savings as a non-negotiable expense ensures that you pay yourself first, reducing the temptation to spend that money elsewhere. Additionally, many banks offer “round-up” features that automatically round up your purchases to the nearest dollar and deposit the difference into your savings—an easy way to save without even noticing.

Breaking the cycle of overspending requires a combination of self-awareness, strategy, and discipline. By understanding what drives your spending, creating a realistic budget, practicing mindful spending, setting clear goals, and leveraging technology, you can transform your financial habits. And the best part? You’ll not only stop the cycle of overspending, but you’ll also start building the foundation for a more secure and prosperous future.