The Hidden Costs of Impulse Buying: How to Resist Temptation and Save

Impulse buying, often fueled by emotional triggers and retailer strategies, can significantly impact your financial well-being, with the average American spending over $5,000 annually on such unplanned purchases. To combat this, strategies like the 24-hour rule, sticking to shopping lists, and using budgeting techniques can help resist temptation and encourage more deliberate spending. Developing mindful spending habits and appreciating what you already have can ultimately lead to greater financial security and peace of mind.

Impulse buying is a little like that siren's song you can't resist when you're exhausted after a long day. You're wandering through your favorite store or scrolling online, and then BAM! You're suddenly convinced you need that quirky kitchen gadget or that trending jacket. It happens to the best of us. And while it might seem harmless to indulge once in a while, these seemingly small purchases can add up—and fast. According to a rather eye-opening study by Slickdeals, the average American spends over $5,000 annually on impulse buys. That's a chunk of change that could be padding your savings or paying down debt.

The sneaky part is how these purchases often happen without us even realizing it. Retailers have honed their craft, using everything from strategic product placement to irresistible sales pitches to nudge us toward opening our wallets. But here's the thing: understanding the psychology behind these impulses and arming ourselves with the right strategies can help us reclaim control over our spending habits. Let's dive into how impulse buying can affect your finances and explore practical ways to resist the urge.

The Emotional Triggers Behind Impulse Buying

Impulse buying is rarely about the item itself. More often, it's about fulfilling an emotional need. Whether it's stress, boredom, or even the thrill of snagging a bargain, our emotions play a big role in those spur-of-the-moment decisions. As psychologist Kit Yarrow notes, "Shopping can be a quick fix for a mood, but the happiness it provides is fleeting." That instant gratification can quickly turn into buyer's remorse once the rush wears off.

Retailers know this all too well and craft environments to keep us on an emotional high. The smell of freshly baked cookies wafting through a department store, the cheerful music playing in the background, and the colorful displays all work to create a pleasurable experience that encourages spending. Understanding these triggers is the first step to breaking the cycle.

Retail Strategies That Encourage Impulse Buys

Retailers are masters of subtle persuasion. From strategic product placements at checkout counters to flash sales that create a sense of urgency, they know how to turn browsing into buying. Ever noticed how those tempting snacks and gadgets are conveniently positioned where you're waiting in line? It's no accident. These items are placed there to catch your eye when you're most vulnerable—bored and ready to make a quick decision.

Online shopping takes these strategies to a new level, using targeted ads and personalized recommendations to keep you clicking. Social media platforms, with their ever-present 'buy now' buttons and influencers touting must-have products, make it even harder to resist. Awareness of these tactics is crucial if you're going to resist the urge to splurge.

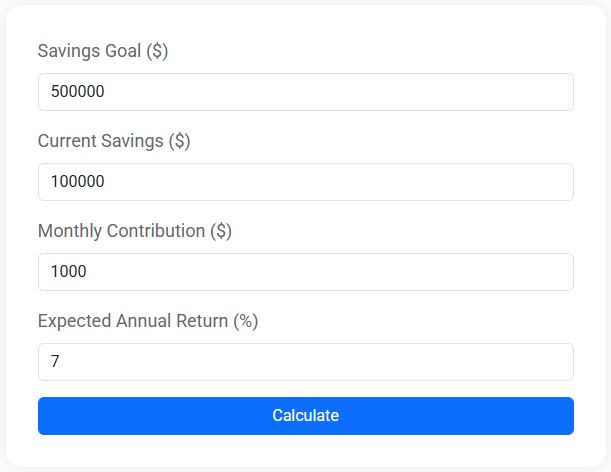

Savings Goal Calculator

Use our free Savings Goal Calculator to find out how long it will take to reach your savings target. See your timeline and how interest can help you grow faster.

The Financial Impact of Impulse Buying

Let's talk numbers. Spending $5,000 a year on impulse purchases might sound abstract, but break it down and it becomes startlingly real. That's over $400 a month—money that could fund a vacation, contribute to a retirement fund, or pay down debt. The opportunity cost is significant. Each impulse buy represents a choice not to save or invest that money elsewhere.

Moreover, frequent impulse buying can lead to more than just a dented bank account. It can contribute to accumulating credit card debt if you're not careful. As financial advisor Jane Smith highlights, "Impulse buying can create a cycle of overspending that leads to financial stress." Managing this kind of stress often requires additional time and resources, further impacting your financial well-being.

Strategies to Resist Impulse Buying

So, how do we combat the urge to splurge? One effective method is the 24-hour rule, where you wait a day before making a purchase. This cooling-off period can help you determine if you really need the item or if it's just a fleeting desire. Another strategy is to stick to a shopping list. Having a list helps you stay focused on what you need, minimizing the chance of wandering off into impulse territory.

Budgeting apps can also be a game-changer. They provide a real-time snapshot of your spending, making it easier to see where your money is going and whether you're sticking to your financial goals. As author Ramit Sethi advises, "Conscious spending is about spending extravagantly on the things you love and cutting costs mercilessly on the things you don't."

Developing Mindful Spending Habits

Mindfulness isn't just for meditation. Applying it to your spending habits can make a world of difference. This means being present and aware of why you're making a purchase, rather than acting on autopilot. Ask yourself if the item truly adds value to your life or if you're buying it to fill an emotional void.

Gratitude can also play a powerful role in curbing impulse buys. Taking time to appreciate what you already have can reduce the desire to accumulate more stuff. When you start valuing experiences and relationships over material possessions, the urge to buy diminishes.

The Long-term Benefits of Curbing Impulse Buying

Resisting impulse purchases isn't just about saving money in the short term; it's about setting yourself up for long-term financial security. By cultivating deliberate spending habits, you free up funds for important goals—whether that's building an emergency fund, investing in your future, or simply enjoying peace of mind knowing you have a financial cushion.

Ultimately, it's about finding balance. You don't have to deprive yourself of all spontaneous purchases, but being mindful about when and why you indulge can lead to greater satisfaction. In the end, it's about making choices that align with your values and financial priorities. With practice, resisting the siren call of impulse buying becomes less about sacrifice and more about empowerment.