Building Wealth Through Strategic Financial Planning

Building wealth can be simplified through strategic financial planning by understanding your current financial situation, setting clear and achievable goals, and creating a flexible budget that aligns with your priorities. Investing wisely and diversifying your portfolio are crucial for long-term growth, while regularly monitoring and adjusting your financial plan ensures it remains effective amidst changing circumstances. By committing to these disciplined practices, you can achieve financial independence and security.

Building wealth might sound like a dream reserved for lottery winners or tech moguls, but the truth is, it’s achievable for anyone with a solid plan. The secret sauce? Strategic financial planning. This isn't about penny-pinching or skipping your favorite latte. Instead, it’s about understanding your financial landscape, setting realistic goals, and making informed decisions that align with those goals. Think of it as building a strong foundation for a house you plan to live in for decades — it requires time, effort, and a bit of foresight.

Imagine you're on a road trip. You wouldn't just hop in your car and drive, hoping you end up at the Grand Canyon. You’d map your route, decide on the best stops along the way, and keep an eye on your fuel gauge. Building wealth is a similar journey. It requires a detailed map — your financial plan — which guides you through different life stages, helps you avoid pitfalls, and ensures you’re moving steadily toward financial independence.

Understanding Your Current Financial Situation

Before setting off on your wealth-building journey, you need to know where you stand financially. This means taking a comprehensive look at your income, expenses, debts, and assets. Think of it as a financial health check-up. Are you spending more than you earn? Is debt weighing you down? Understanding these factors is crucial because they form the baseline from which all your financial decisions will flow.

For instance, if you're a recent graduate with student loans, your financial situation and strategy will differ vastly from someone nearing retirement. According to a study by the Federal Reserve, the average American household carries about $137,000 in debt. Knowing your numbers allows you to tackle your unique financial challenges head-on, rather than being blindsided by them.

Tracking your spending through apps like Mint or YNAB can provide insights into your financial habits. Seeing where your money goes each month can be enlightening and sometimes a bit shocking. But knowledge is power, and this newfound awareness is the first step toward making informed financial choices.

Setting Clear and Achievable Goals

Once you have a clear picture of your financial situation, the next step is to set goals. These should be specific, measurable, achievable, relevant, and time-bound (SMART). Instead of saying, "I want to save more," a SMART goal would be, "I want to save $5,000 by the end of the year for a vacation."

Financial goals give you direction and motivation. They can be short-term, like saving for a new laptop, or long-term, like planning for retirement. The key is to align these goals with your personal values and life aspirations. If travel is a passion, then a travel fund might be a priority. If education is important, investing in a college fund could take precedence.

As financial advisor Jane Smith says, "Goals are like the GPS for your financial journey. Without them, you’re just wandering aimlessly." By setting clear objectives, you’re not just dreaming — you’re actively creating a roadmap to your desired financial future.

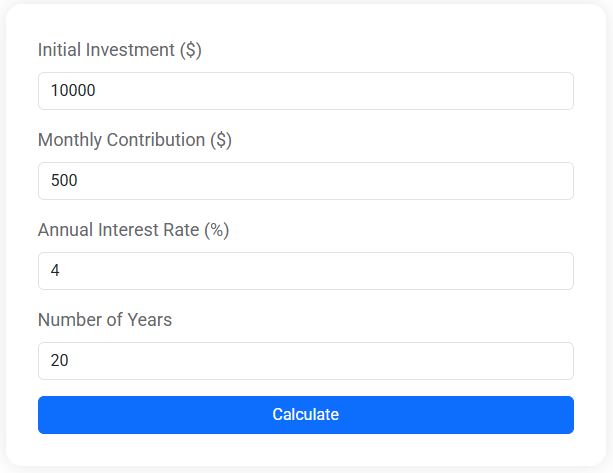

Compound Interest Calculator

Discover how your savings can grow with compound interest. Our free Compound Interest Calculator helps you estimate future investment value based on your initial deposit, monthly contributions, and expected interest rate. Whether you're saving for retirement, a house, or long-term goals, this tool gives you a clear view of your financial growth over time.

Creating a Flexible Budget

With your goals in place, it’s time to craft a budget that supports them. A budget is not a financial straitjacket but a tool for empowerment. It should reflect your priorities and be flexible enough to accommodate life's unexpected turns.

Start by categorizing your expenses into needs and wants. Needs are essentials like rent, utilities, and groceries, while wants might include dining out or that streaming service you love. Allocate funds accordingly, ensuring you're putting money toward your goals each month.

Remember, a budget is a living document. Life happens, and things change. Maybe your car needs an unexpected repair, or you get a bonus at work. Review and adjust your budget regularly to keep it aligned with your current circumstances and goals.

Investing Wisely and Diversifying Your Portfolio

Once you have a handle on your budget, consider how investing can help grow your wealth over time. Investing is a powerful tool for building wealth because it allows your money to work for you. But it’s crucial to invest wisely and diversify your portfolio to mitigate risks.

Diversification is akin to not putting all your eggs in one basket. By spreading your investments across various asset classes like stocks, bonds, and real estate, you reduce the risk of a single investment negatively impacting your entire portfolio. According to CNBC, a well-diversified portfolio can improve your chances of weathering market volatility.

If you’re new to investing, consider starting with low-cost index funds or ETFs, which offer diversification and usually have lower fees. Remember, investing is a long-term game. It’s about growth over time, not overnight riches.

Regularly Monitoring and Adjusting Your Financial Plan

Even the best financial plans need periodic reviews. Life is dynamic, and your financial plan should be too. Regularly monitoring your progress and making necessary adjustments ensures that your plan remains relevant and effective.

Set a routine to review your finances, maybe once a quarter. Look at your goals, see how close you are to achieving them, and adjust your budget or investments if needed. Has your income changed? Did you reach a goal and want to set a new one? These check-ins keep you on track and motivated.

Consider working with a financial advisor if you feel overwhelmed or need expert guidance. They can provide insights tailored to your unique situation and help you navigate complex financial decisions.

Committing to Disciplined Practices

Building wealth isn’t a sprint; it’s a marathon. It requires discipline, patience, and a commitment to the practices outlined above. It’s easy to get caught up in short-term desires or be swayed by market hype, but staying the course is essential for long-term success.

Celebrate your financial milestones, no matter how small. Each step forward is progress. Remember, wealth is not just about accumulating money; it's about creating financial security and independence, allowing you to live life on your terms.

In the end, strategic financial planning is about making your money work for you, so you can focus on what truly matters. By understanding your financial situation, setting achievable goals, creating a flexible budget, investing wisely, and regularly reviewing your plan, you’re well on your way to building lasting wealth. Enjoy the journey!