Achieving Your Financial Goals: The Importance of Planning Ahead

Financial planning is vital for achieving financial success and involves setting clear goals, creating a realistic budget, building an emergency fund, and investing for the future. By defining specific and measurable objectives, maintaining a flexible budget, and preparing for unexpected expenses, you create a robust financial strategy. Regularly reviewing and adjusting your financial plan ensures it remains aligned with your evolving goals and life changes, helping you confidently navigate your financial journey.

Achieving your financial goals is akin to embarking on a long, rewarding journey. Picture this: a cross-country road trip where you plot your route, pack your essentials, and keep an eye on the gas gauge to ensure you reach your destination smoothly. Financial planning is much like that. It involves setting clear objectives, preparing for the unexpected, and making sure you're on track to reach your end goal, whether that's buying a home, retiring comfortably, or simply building a robust safety net.

Too often, people set off on their financial journey without a map, or worse yet, without a destination in mind. This can lead to unnecessary stress and missed opportunities. By taking the time to plan ahead, you can transform your financial chaos into a well-oiled machine, steering you steadily toward financial success. Let’s dive into the key components of effective financial planning.

Setting Clear Goals

The first step in any successful financial plan is setting clear, specific goals. Imagine saying, "I want to be rich someday." It's a sentiment many of us share, but it's not exactly actionable. Instead, consider defining what "rich" means to you. For example, "I want to save $100,000 for a down payment on a house within the next five years" is a goal that is both specific and measurable. It gives you a target to aim for and a timeline to work within.

According to a study by Dr. Gail Matthews, a psychology professor at Dominican University, people who write down their goals are 42% more likely to achieve them. It's not just about having goals but being able to articulate and track them. This approach transforms a vague desire into a tangible plan, making it easier to monitor progress and stay motivated.

Creating a Realistic Budget

Once you've set your financial goals, the next step is to create a realistic budget. A budget is like the GPS for your financial journey, providing direction and helping you make adjustments as needed. Start by evaluating your income and expenses to understand where your money is going each month. This can be eye-opening, revealing spending habits you might not have been aware of.

One effective method is the 50/30/20 rule, popularized by Senator Elizabeth Warren. This budgeting approach suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. It's a flexible framework that can be adjusted to fit your unique circumstances. The key is to ensure your budget reflects your financial priorities and goals.

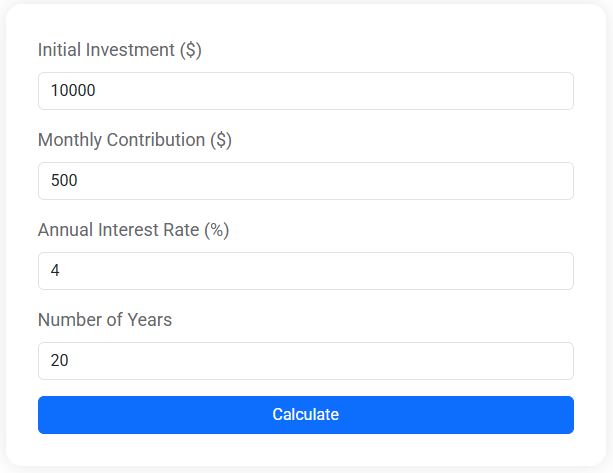

Compound Interest Calculator

Discover how your savings can grow with compound interest. Our free Compound Interest Calculator helps you estimate future investment value based on your initial deposit, monthly contributions, and expected interest rate. Whether you're saving for retirement, a house, or long-term goals, this tool gives you a clear view of your financial growth over time.

Building an Emergency Fund

Life is unpredictable, and even the best-laid financial plans can be derailed by unexpected expenses. That's where an emergency fund comes in. Think of it as your financial safety net, ready to catch you when life throws a curveball. Aiming for three to six months' worth of living expenses is a common recommendation, but the exact amount should be tailored to your personal situation.

For instance, if you're a freelancer with a variable income, you might want to aim for the higher end of that range. On the other hand, if you have a stable job, you might feel comfortable with a smaller cushion. The key is to have something set aside so that an unexpected car repair or medical bill doesn't force you to dip into your savings or go into debt.

Investing for the Future

Once you have your budget and emergency fund in place, it's time to think about the future. Investing is an essential component of any long-term financial plan. It allows your money to grow over time, helping you beat inflation and build wealth. Whether you're saving for retirement, a child's education, or another long-term goal, investing can help you get there faster.

There are various investment options to consider, from stocks and bonds to real estate and retirement accounts like a 401(k) or IRA. The best approach depends on your risk tolerance, time horizon, and financial goals. As Warren Buffett famously said, "Someone's sitting in the shade today because someone planted a tree a long time ago." Investing is about planting those seeds now for a prosperous tomorrow.

Regularly Reviewing and Adjusting Your Plan

Financial planning is not a one-time task but an ongoing process. Life changes, and so should your financial plan. Whether it's a new job, a growing family, or shifting priorities, it's essential to regularly review and adjust your financial strategy to ensure it remains aligned with your goals.

Set aside time at least once a year to evaluate your progress and make necessary adjustments. Are you on track to meet your goals? Have your priorities shifted? Are there new financial opportunities or challenges on the horizon? As financial advisor Jane Smith notes, "A financial plan is like a living document; it should evolve as your life does."

Preparing for Life's Unexpected Twists

As much as we plan, life has a way of surprising us. Whether it's a sudden job loss, a health crisis, or an economic downturn, being prepared for life's unexpected twists is crucial. In addition to an emergency fund, consider other protective measures like insurance and estate planning. These can provide peace of mind and financial security in the face of uncertainty.

Insurance can cover everything from health and life to disability and property, depending on your needs. Meanwhile, estate planning ensures that your assets are distributed according to your wishes should anything happen to you. This kind of planning might not be the most exciting part of financial management, but it’s an essential one.

Conclusion: Confidently Navigating Your Financial Journey

Achieving your financial goals requires more than just wishful thinking. It's about taking deliberate, informed steps that guide you toward your desired destination. By setting clear goals, creating a realistic budget, building an emergency fund, and investing wisely, you lay a strong foundation for financial success. Remember, a financial plan is not set in stone. It's a flexible, evolving strategy that adapts to your changing life circumstances and goals.

Regularly reviewing and adjusting your plan ensures that you remain on the right path, no matter what life throws your way. With careful planning and a proactive approach, you can confidently navigate your financial journey, turning your dreams into reality. So, grab that metaphorical map, chart your course, and embark on the road to financial success. The journey may be long, but with the right plan, it's one you'll be well-equipped to tackle.