10 Essential Tips for Effective Financial Planning

Financial planning is crucial for managing personal finances and achieving both immediate and long-term goals. Key strategies include setting clear financial objectives, creating a realistic budget, building an emergency fund, managing debt effectively, and investing wisely. By consistently reviewing and adjusting your financial plan, you can navigate life changes and work towards a secure financial future.

Financial planning might sound like one of those tasks that's easy to put off until tomorrow, but trust me, it's one of the most important things you can do for yourself and your future. Whether you're trying to get a handle on your everyday spending or aiming to hit big milestones like buying a house or retiring comfortably, having a solid financial plan can make all the difference. It's like having a roadmap — sure, you might get there eventually without one, but you'll probably take a lot more wrong turns along the way.

The good news is that financial planning doesn't have to be overwhelming. It's about breaking things down into manageable steps and being consistent with your efforts. To help guide you on this journey, I've put together ten essential tips that cover the basics. This isn't just about pinching pennies or cutting out your daily latte (because let's be real, it's about balance). It's about making thoughtful decisions that align with your goals and values.

1. Set Clear Financial Objectives

Before diving into numbers and spreadsheets, take some time to think about what you really want to achieve financially. Are you saving for a down payment on a house, planning for a child's education, or dreaming of an early retirement? Clearly defining your goals can give your financial plan direction and purpose. According to a study by the Journal of Financial Planning, individuals who set specific goals are more likely to achieve financial success compared to those who don't. So, jot down your goals, both short-term and long-term, and revisit them regularly to stay on track.

2. Create a Realistic Budget

Once you've set your goals, it's time to get a grip on your income and expenses. A budget is simply a plan for how you want to allocate your money each month. Start by listing your sources of income and all your monthly expenses, including fixed costs like rent or mortgage, utilities, groceries, and discretionary spending. The key is to be realistic. If you love dining out, don't set an unrealistically low budget for restaurants. Instead, find a balance that allows you to enjoy life while still meeting your financial goals.

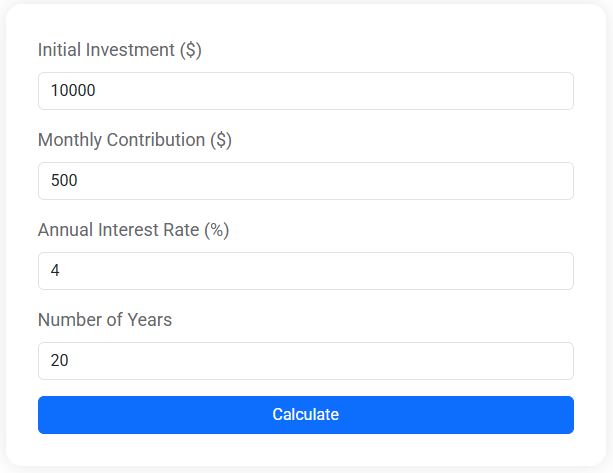

Compound Interest Calculator

Discover how your savings can grow with compound interest. Our free Compound Interest Calculator helps you estimate future investment value based on your initial deposit, monthly contributions, and expected interest rate. Whether you're saving for retirement, a house, or long-term goals, this tool gives you a clear view of your financial growth over time.

3. Build an Emergency Fund

Life is full of surprises, and not all of them are pleasant. An emergency fund is your financial cushion for unexpected expenses like medical bills, car repairs, or job loss. Financial advisors often recommend setting aside three to six months' worth of living expenses. This might sound daunting, but start small. Even saving a few dollars a week can add up over time. The peace of mind knowing you have a safety net is well worth the effort.

4. Manage Debt Effectively

Debt can be a major hurdle in your financial journey, but it doesn't have to be a roadblock. Start by listing all your debts, including credit cards, student loans, and any other liabilities. Prioritize paying off high-interest debt first, as it can grow quickly and become overwhelming. Consider using strategies like the debt snowball method, where you pay off the smallest debts first to build momentum. As financial expert Dave Ramsey often says, "Personal finance is 80% behavior and only 20% head knowledge."

5. Invest Wisely

Once you have a handle on your debt and a solid emergency fund, it's time to think about investing. Investing is a way to grow your wealth over time and beat inflation. However, it's important to invest wisely. Start by educating yourself on different investment options like stocks, bonds, and mutual funds. Consider speaking with a financial advisor to tailor an investment strategy that aligns with your risk tolerance and goals. Remember, investing is a marathon, not a sprint, so patience is key.

6. Continuously Educate Yourself

The world of finance is constantly evolving, and staying informed is crucial to making smart decisions. Take advantage of free resources like podcasts, blogs, and books to expand your financial knowledge. Websites like Investopedia offer a wealth of information on financial concepts and current market trends. By continuously educating yourself, you can make informed decisions that benefit your financial health in the long run.

7. Review and Adjust Your Financial Plan Regularly

A financial plan isn't a set-it-and-forget-it kind of deal. Life changes, and so should your plan. Make it a habit to review your financial situation at least once a year. Look at your income, expenses, debts, and investments to ensure you're still on track to meet your goals. If you've had any major life changes, like a new job, marriage, or the birth of a child, it's essential to adjust your plan accordingly. Think of your financial plan as a living document that evolves with you.

8. Protect Your Finances with Insurance

Insurance might not be the most exciting topic, but it's a critical component of financial planning. Health, auto, home, and life insurance can protect you from significant financial losses. Evaluate your insurance needs based on your lifestyle and risk factors. Remember, it's better to have coverage and not need it than to need it and not have it. As the old saying goes, "Hope for the best, plan for the worst."

9. Plan for Retirement Early

Retirement might feel like a distant dream, but the earlier you start planning, the better off you'll be. Take advantage of employer-sponsored retirement plans like a 401(k) or individual retirement accounts (IRAs). Even small contributions can grow significantly over time thanks to compound interest. According to the Employee Benefit Research Institute, people who save consistently for 40 years can accumulate more than twice as much as those who save for only 20 years.

10. Seek Professional Guidance When Needed

Financial planning can be complex, and there's no shame in asking for help. A certified financial planner can provide personalized advice and help you navigate complicated financial decisions. Whether you're dealing with tax planning, estate planning, or investment strategies, a professional can offer valuable insights. Just like you'd see a doctor for health concerns, think of a financial planner as your go-to for financial well-being.

Financial planning is a journey, not a destination. It's about taking control of your money so it doesn't control you. By setting clear goals, budgeting wisely, and continually educating yourself, you can create a financial plan that supports the life you want to live. Remember, every financial decision you make today is an investment in your future self. So, start where you are, use the resources you have, and watch your efforts compound into a secure financial future.