Secure Your Future: Why Financial Planning is Crucial

Financial planning is crucial for achieving financial stability, whether you're just starting out or preparing for retirement. It involves setting realistic goals, budgeting, investing wisely, and preparing for unexpected events, ensuring you allocate resources effectively and remain resilient against life's uncertainties. By understanding these fundamentals, you can navigate financial challenges confidently and secure your future.

Financial planning might sound like something only the wealthy or those with an MBA need to worry about, but the truth is, it’s for everyone. Whether you're a recent college grad juggling student loans or a seasoned professional inching closer to retirement, having a financial plan is like having a roadmap for your money. It’s not just about making more; it’s about making the most of what you have, preparing for the unexpected, and ultimately securing your future.

Imagine your financial life as a long road trip. Without a plan, you might run out of gas, take wrong turns, or even end up stranded. Financial planning is your GPS—it helps you chart a course to your destination, adjust for detours, and keep moving forward. In this article, we'll explore why financial planning is crucial, how it works, and some steps you can take to create your own plan.

Setting Realistic Goals

The first step in any financial plan is setting goals. Think of these as the destinations on your road trip. Goals give your money a purpose and help you measure progress. They can be short-term, like saving for a vacation or paying off a credit card, or long-term, like buying a house or retiring comfortably.

Setting realistic goals means being honest about your current financial situation. According to financial advisor Jane Smith, "Your goals should challenge you but also be achievable given your income and expenses." For instance, if you're earning $50,000 a year, aiming to save $20,000 annually might not be realistic without significant lifestyle changes. Instead, start with a more attainable goal that still pushes you to improve your habits.

Budgeting: The Backbone of Your Plan

Once you've set your goals, budgeting becomes the backbone of your financial plan. A budget is essentially a spending plan that ensures your income is allocated efficiently towards your goals. It's not about restricting yourself; it's about prioritizing what's important.

Creating a budget starts with tracking your expenses. Many people are surprised when they see where their money actually goes each month. Are you dining out more often than you realized? Is that gym membership you haven’t used in months still charging you? By identifying these patterns, you can make informed decisions about where to cut back and where to invest more. Tools like Mint or YNAB (You Need A Budget) can simplify this process by automating expense tracking and analysis.

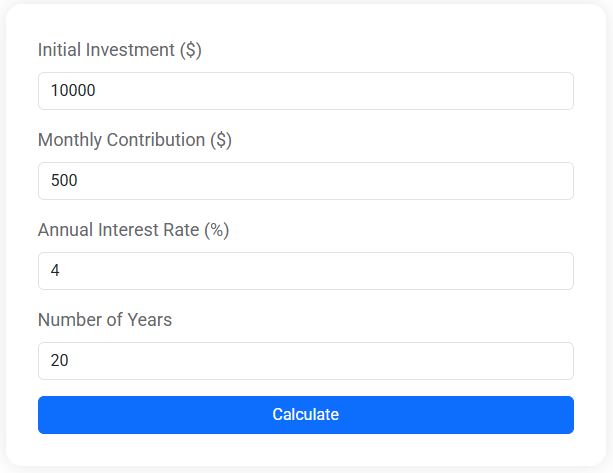

Compound Interest Calculator

Discover how your savings can grow with compound interest. Our free Compound Interest Calculator helps you estimate future investment value based on your initial deposit, monthly contributions, and expected interest rate. Whether you're saving for retirement, a house, or long-term goals, this tool gives you a clear view of your financial growth over time.

Investing Wisely

Investing can seem daunting, but it's a critical component of financial planning. It's how you make your money work for you, potentially growing it beyond what you'd achieve through saving alone. But here’s the kicker: investing isn't just for the wealthy. As Warren Buffet famously said, "Do not save what is left after spending, but spend what is left after saving."

Start by educating yourself about different types of investments—stocks, bonds, mutual funds, ETFs, and real estate—and consider your risk tolerance. Younger investors might lean towards stocks for higher returns, while those nearing retirement might prefer the stability of bonds. Remember, investing is a long-term game. Markets will rise and fall, but with a diversified portfolio, you can weather those ups and downs.

Preparing for the Unexpected

Life is full of surprises, and not all are pleasant. Whether it’s a car breakdown, a medical emergency, or an unexpected job loss, having a financial cushion is crucial. This is where an emergency fund comes into play.

An emergency fund is typically three to six months' worth of living expenses set aside for unforeseen events. According to a 2022 survey by Bankrate, 56% of Americans couldn't cover a $1,000 emergency with savings. This statistic highlights the importance of having a safety net. Building this fund might take time, but it should be a priority within your financial plan. Start small if you need to, contributing a little each month, and gradually build up your reserve.

Navigating Life's Financial Challenges

Financial planning is not a one-time event but an ongoing process. Life changes—marriage, kids, career shifts, and health challenges—require regular updates to your plan. Think of it as tuning your GPS along the way to ensure you're still on the best path to reach your goals.

Regularly reviewing and adjusting your plan keeps it aligned with your current circumstances and future aspirations. It helps you stay proactive rather than reactive, giving you confidence in managing whatever life throws your way. As financial expert Suze Orman aptly puts it, "You are the boss of your money, and if you don't treat it like a boss, it will boss you around."

Conclusion: The Peace of Mind Financial Planning Brings

At its core, financial planning is about more than just numbers. It's about creating a life with fewer financial worries and more freedom to enjoy the things that truly matter. It provides peace of mind knowing that you’re prepared for the future, whatever it may hold.

By setting realistic goals, budgeting effectively, investing wisely, and preparing for the unexpected, you can build a solid financial foundation. So grab that metaphorical map, set your course, and take charge of your financial journey. Your future self will thank you.