From Dreams to Reality: Turning Your Financial Goals into a Plan

Turning your dreams into reality requires more than just wishful thinking; it necessitates a well-structured financial plan. Start by clearly defining your financial goals, create a realistic budget to support them, and establish a savings strategy to fund your aspirations. Regularly monitor your progress and seek professional guidance to optimize your efforts, ensuring your financial journey is both strategic and adaptable to changing circumstances.

Turning your dreams into reality isn't just about wishful thinking or hoping that lady luck will smile on you. It takes a well-thought-out plan, a bit of elbow grease, and a solid understanding of your financial landscape. Your dreams, whether they're buying a home, starting a business, or retiring early, need a sturdy financial foundation to stand on. In this article, we'll delve into the steps necessary to transform your financial dreams into actionable plans, ensuring they're not only achievable but also sustainable.

So, grab a cup of coffee, and let's chat about how to make those dreams of yours a reality. We'll break down the process into manageable parts, from setting clear financial goals to creating a realistic budget, establishing a savings strategy, and continually monitoring your progress. Along the way, we'll sprinkle in some wisdom from experts and maybe even a personal story or two to keep things grounded and relatable.

Defining Your Financial Goals

First things first: you need to know exactly what you're aiming for. Financial goals should be specific, measurable, achievable, relevant, and time-bound (yes, the good old SMART criteria). Instead of saying, "I want to save money," try, "I want to save $20,000 for a down payment on a house within the next three years."

Start by writing down your goals and categorizing them into short-term, medium-term, and long-term. Short-term goals might include building an emergency fund or paying off credit card debt, while long-term goals could involve retirement savings or funding your child's education. By clarifying your objectives, you'll be better equipped to create a roadmap to reach them.

Remember, these goals are not set in stone. Life changes, and so can your priorities. It's essential to revisit and adjust your goals periodically to ensure they remain aligned with your values and circumstances.

Creating a Realistic Budget

Once you have a clear picture of what you want to achieve, it's time to get down to the nitty-gritty of budgeting. A well-crafted budget is the backbone of any financial plan. It outlines your income, expenses, and how much you can realistically allocate toward your goals.

Start by tracking your spending for a month or two to get a sense of where your money is going. There are numerous apps and tools available that can simplify this process, like Mint or YNAB ("You Need A Budget"). According to CNBC, using these tools can help identify spending patterns and areas where you might be able to cut back.

Create categories for essentials like housing, utilities, and groceries, as well as discretionary spending like dining out or entertainment. Aim to adhere to the 50/30/20 rule: 50% of your income goes to needs, 30% to wants, and 20% to savings and debt repayment. This framework provides a balanced approach to managing your finances and can be adjusted as your situation evolves.

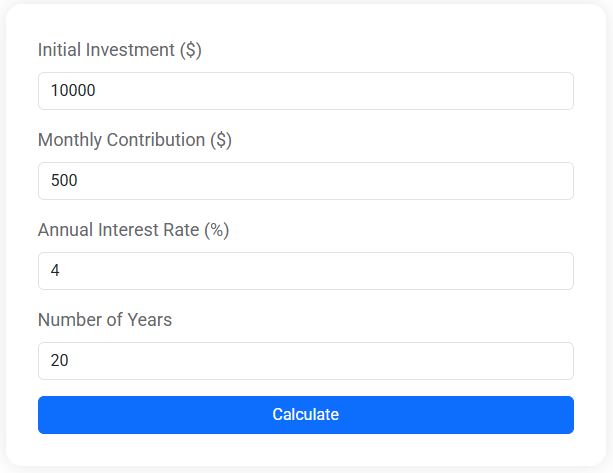

Compound Interest Calculator

Discover how your savings can grow with compound interest. Our free Compound Interest Calculator helps you estimate future investment value based on your initial deposit, monthly contributions, and expected interest rate. Whether you're saving for retirement, a house, or long-term goals, this tool gives you a clear view of your financial growth over time.

Establishing a Savings Strategy

With a budget in place, the next step is to establish a saving strategy that aligns with your goals. This means deciding how much to save and where to put those savings. Automating your savings can be a game-changer. By setting up automatic transfers from your checking account to a savings or investment account, you remove the temptation to spend that money.

Diversifying your savings is also crucial. For short-term goals, consider high-yield savings accounts or certificates of deposit (CDs) which offer relatively low risk and easy access to your funds. For long-term goals, you might want to explore investment options like stocks, bonds, or mutual funds, which typically offer higher returns over time.

As financial advisor Jane Smith often says, "The best time to start saving was yesterday; the second-best time is today." Don't fall into the trap of waiting for the "right time" to start saving—begin with whatever you can, and gradually increase your contributions as your financial situation improves.

Monitoring Your Progress

Creating a plan is just the beginning. Regularly monitoring your progress is vital to ensure you're on track to meet your goals. Set aside time each month to review your budget and savings, making adjustments as needed. Life is unpredictable, and your financial plan should be flexible enough to accommodate unexpected changes, like a job loss or medical emergency.

Use this time to celebrate small victories, too. Did you stick to your budget for three months straight? Did you pay off a lingering debt? Acknowledging these achievements can boost your motivation and reinforce positive financial habits.

Monitoring also involves keeping an eye on market trends if you have investments. As the economy shifts, you might need to rebalance your portfolio or revise your strategy. Stay informed by reading financial news or consulting with a financial advisor.

Seeking Professional Guidance

Even if you're a DIY kind of person, there are times when seeking professional guidance can be invaluable. A financial advisor can provide personalized recommendations based on your unique situation, offer insights that you might overlook, and help optimize your financial plan.

According to a study by Vanguard, working with a financial advisor can add about 3% to your portfolio’s value over time, primarily by providing discipline and preventing costly mistakes. Whether you're dealing with complex tax issues, planning for retirement, or simply want a second opinion, professional advice can be a worthwhile investment.

When choosing an advisor, make sure they're a fiduciary, meaning they're legally bound to act in your best interest. Ask for recommendations, check credentials, and interview potential advisors to find someone who aligns with your values and goals.

Adapting to Changing Circumstances

Lastly, remember that flexibility is key. Life is ever-changing, and your financial plan should be dynamic enough to adapt. Whether you're facing a career change, starting a family, or dealing with an unexpected expense, being able to pivot without derailing your goals is crucial.

Keep communication open with your partner or family members involved in your financial journey. Regularly discuss any changes in income, expenses, or priorities, and adjust your plan accordingly. This ensures everyone is on the same page and working together towards shared goals.

In the end, turning dreams into reality is more marathon than sprint. It requires patience, perseverance, and a willingness to adapt. By defining your goals, crafting a budget, employing a strategic savings plan, monitoring your progress, and seeking professional guidance when needed, you'll be well on your way to making those dreams come true. And remember, it's not just about the destination—enjoy the journey along the way.