Unlocking Your Wealth Potential: Strategies for Financial Planning

The article emphasizes the importance of financial planning in building and maintaining wealth, highlighting key strategies such as setting clear financial goals, maintaining a budget, and building an emergency fund. It also underscores the benefits of diversifying your investment portfolio and seeking professional financial advice. These steps collectively form a comprehensive plan that can help secure a financially stable future and support long-term financial aspirations.

Imagine a world where money isn't a source of stress or confusion, but rather a tool that helps you live the life you truly want. That's the power of financial planning. It's not about being rich overnight or obsessively counting every penny. Instead, it's about making informed and deliberate choices that align with your values and long-term goals. Whether you're saving for a dream vacation, planning for retirement, or simply trying to make ends meet, having a clear financial plan can be transformative.

In this article, we'll explore the key strategies that can help unlock your wealth potential. We'll dive into the importance of setting clear financial goals, the art of budgeting, the necessity of an emergency fund, and the benefits of diversifying your investments. Plus, we'll discuss why seeking professional financial advice is often a wise move. Think of these strategies as building blocks for a secure financial future, allowing you to support your aspirations and weather life's uncertainties.

Setting Clear Financial Goals

Setting clear financial goals is like having a roadmap for your money journey. Without it, you might find yourself wandering aimlessly, unsure of where your finances are headed. Start by identifying what you truly want to achieve with your money. Is it buying a home, retiring early, or perhaps funding your child's education? Whatever your goals, make them specific, measurable, achievable, relevant, and time-bound—also known as SMART goals. For instance, instead of a vague goal like "save more money," aim for "save $20,000 for a house down payment in five years."

Once your goals are set, break them down into smaller, manageable steps. This approach not only makes the process less daunting but also allows you to celebrate small victories along the way. Financial expert Dave Ramsey often emphasizes the power of "baby steps" in achieving financial success. By focusing on incremental progress, you're more likely to stay motivated and on track.

Maintaining a Budget

If financial goals are the destination, then a budget is the vehicle that gets you there. Maintaining a budget isn't about restricting your spending to the bare minimum; it's about understanding where your money goes and ensuring it aligns with your priorities. Start by tracking your income and expenses over a few months to get a clear picture of your financial habits. You might be surprised to discover areas where you can cut back without feeling deprived.

Consider using budgeting tools or apps like Mint or YNAB (You Need A Budget) to simplify the process. These platforms can help automate tracking and provide insights into your spending patterns. Remember, a budget should be flexible. Life changes, and so should your budget. Review and adjust it regularly to accommodate shifts in your financial situation, like a new job or unexpected expenses.

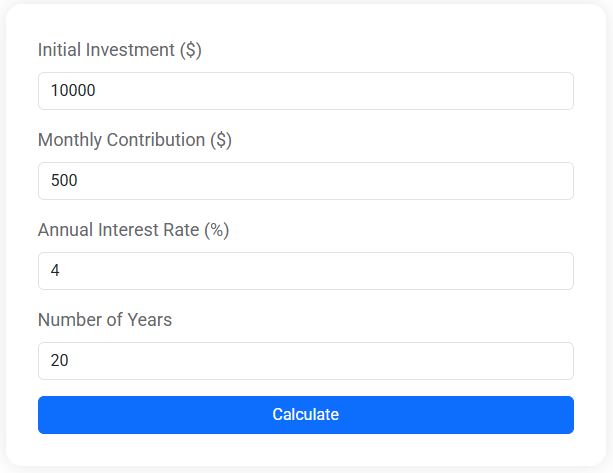

Compound Interest Calculator

Discover how your savings can grow with compound interest. Our free Compound Interest Calculator helps you estimate future investment value based on your initial deposit, monthly contributions, and expected interest rate. Whether you're saving for retirement, a house, or long-term goals, this tool gives you a clear view of your financial growth over time.

Building an Emergency Fund

An emergency fund is your financial safety net, cushioning you against life's inevitable surprises. Whether it's a medical emergency, car repair, or sudden job loss, having a stash of readily accessible cash can prevent you from plunging into debt. Financial advisors typically recommend saving three to six months' worth of living expenses, but this can vary based on your personal circumstances.

Start small if you need to. Even setting aside $500 can make a significant difference. Consider automating your savings to make this process easier; direct a portion of your paycheck into a separate savings account dedicated to emergencies. As Suze Orman, a well-known personal finance guru, advises, "People who automate their savings tend to save more because it's out of sight, out of mind."

Diversifying Your Investment Portfolio

When it comes to growing your wealth, diversification is key. Think of it as not putting all your eggs in one basket. By spreading your investments across different asset classes—such as stocks, bonds, real estate, and even alternative investments like peer-to-peer lending—you can reduce risk and improve your chances of earning a stable return.

According to a study by Vanguard, a well-diversified portfolio can help mitigate the impact of market volatility. Keep in mind, though, that diversification doesn't eliminate risk entirely, but it can make your investment journey smoother and less stressful. Consider your risk tolerance and investment horizon when choosing how to diversify. If you're unsure where to start, consulting with a financial advisor can provide personalized guidance tailored to your situation.

Seeking Professional Financial Advice

While many of us prefer to handle our finances independently, there's immense value in seeking professional financial advice. A skilled financial advisor can offer objective insights and strategies that you might not have considered. They can help you navigate complex financial products, optimize your tax situation, and ensure your investment portfolio aligns with your risk tolerance and goals.

According to a study by Morningstar, working with a financial advisor can add about 1.5% to 3% to your annual returns over time. This is often due to better investment decisions, tax efficiency, and behavioral coaching. When selecting an advisor, look for someone who is a fiduciary, meaning they're legally obligated to act in your best interest. Don't hesitate to ask questions and ensure they are a good fit for your needs and personality.

Financial planning isn't just about numbers; it's about creating a life that reflects your values and goals. By setting clear objectives, maintaining a flexible budget, building an emergency fund, diversifying your investments, and seeking professional advice, you're well on your way to unlocking your wealth potential. Remember, the journey to financial stability is a marathon, not a sprint. With patience, discipline, and the right strategies, you can achieve a financially secure future that supports your dreams.