Financial Wellness: Achieving Balance Through Effective Planning

Achieving financial wellness involves more than just earning a steady income; it requires a strategic approach that includes understanding your financial situation, setting SMART goals, creating and sticking to a budget, building an emergency fund, and investing for the future. By following these steps, individuals can secure a balanced and stress-free financial life, ultimately providing the freedom to pursue personal aspirations without financial constraints. This journey demands patience, discipline, and a proactive mindset to ensure a secure financial future.

When we think about wellness, our minds often jump to physical health or mental well-being, but financial wellness is an equally crucial piece of the puzzle. Achieving financial wellness isn't just about earning a healthy paycheck; it's a comprehensive approach to managing money that allows you to live comfortably, plan for the future, and pursue your dreams without being bogged down by financial stress. This process doesn't happen overnight; it requires deliberate planning, careful execution, and, perhaps most importantly, a mindset that's geared towards long-term success.

Financial wellness is akin to balancing on a tightrope — it demands a steady hand, focus, and a reliable plan. While the thought of financial planning might conjure images of spreadsheets and complex math, it doesn't have to be daunting. In fact, when broken down into manageable steps, the path to financial wellness is clear and achievable. With a little patience and discipline, you can set yourself on a course to financial freedom.

Understanding Your Financial Situation

The journey to financial wellness begins with a thorough understanding of your current financial situation. Imagine trying to navigate a foreign city without a map or GPS. It's possible, but you're likely to get lost along the way. Assessing your financial standing involves taking stock of your income, expenses, debts, and assets. This isn’t just about number-crunching; it’s about gaining clarity on where you stand financially.

Start by listing all your sources of income and tracking your monthly expenses. There are numerous apps and tools available today that can simplify this process. By seeing where your money goes each month, you can identify patterns and areas for improvement. As personal finance expert Dave Ramsey often emphasizes, "You must gain control over your money or the lack of it will forever control you."

Next, take a hard look at your debts. Whether it’s student loans, credit card debt, or a mortgage, understanding what you owe and to whom is crucial. This step might feel overwhelming, especially if your debts are substantial, but remember, knowledge is power. Once you have a clear picture, you can start crafting a plan to address these obligations.

Setting SMART Goals

Once you’ve assessed your financial situation, the next step is setting goals. But not just any goals — SMART goals. This acronym stands for Specific, Measurable, Achievable, Relevant, and Time-bound. Setting SMART goals ensures that your financial objectives are clear, realistic, and attainable.

For instance, instead of saying, "I want to save money," specify the amount and the timeline: "I want to save $5,000 for a vacation by next December." This goal is specific, measurable, and time-bound. It's also achievable and relevant, assuming you can allocate savings from your budget.

Goals can vary widely depending on personal circumstances — from buying a home to saving for retirement or even starting a business. The key is to align your goals with your values and life aspirations, making them personal and motivating. As financial coach Suze Orman advises, "People first, then money, then things."

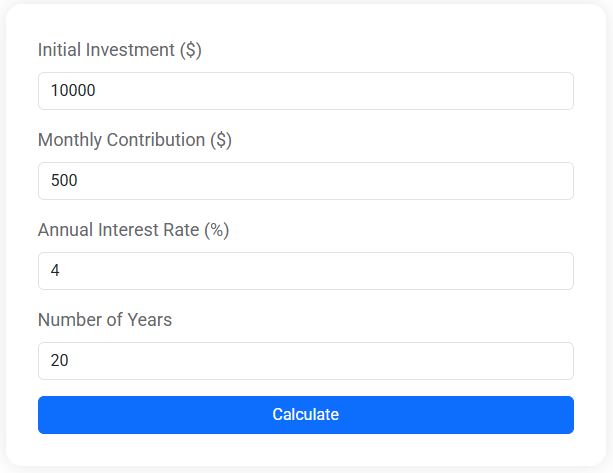

Compound Interest Calculator

Discover how your savings can grow with compound interest. Our free Compound Interest Calculator helps you estimate future investment value based on your initial deposit, monthly contributions, and expected interest rate. Whether you're saving for retirement, a house, or long-term goals, this tool gives you a clear view of your financial growth over time.

Creating and Sticking to a Budget

With your goals in place, a budget becomes your roadmap. It’s the tool that translates abstract goals into tangible actions. A budget outlines how much money comes in, how much goes out, and what's left to allocate towards your goals. The challenge isn't just creating a budget but sticking to it consistently.

Begin by categorizing your expenses into fixed (e.g., rent, utilities) and variable (e.g., dining out, entertainment) expenses. This distinction helps prioritize spending and identify areas for potential savings. A popular budgeting method is the 50/30/20 rule, which allocates 50% of income to needs, 30% to wants, and 20% to savings and debt repayment. However, feel free to adjust these percentages based on your unique situation.

Sticking to a budget requires discipline and sometimes tough choices, but it's a crucial step in achieving financial wellness. Consider it a living document that can be adjusted as your financial situation evolves. As the saying goes, "A budget is telling your money where to go instead of wondering where it went."

Building an Emergency Fund

Life is unpredictable, and an emergency fund is your financial safety net. It's a stash of money set aside for unforeseen expenses, such as medical emergencies, car repairs, or sudden job loss. Having an emergency fund can prevent a temporary setback from becoming a financial disaster.

Experts generally recommend saving three to six months' worth of living expenses in an easily accessible account. This might seem daunting, especially if you're just starting out, but remember that building an emergency fund is a marathon, not a sprint. Start with a small, manageable amount, like $500, and gradually build from there.

Consider automatic transfers to your emergency fund to ensure consistent savings. This approach leverages the power of automation, making saving a habit rather than a chore. According to a study by Bankrate, nearly 28% of Americans have no emergency savings, highlighting the importance of prioritizing this financial cushion.

Investing for the Future

Once you have a solid budget and an emergency fund in place, it's time to think about the future. Investing is a key component of financial wellness, as it allows your money to grow over time and helps you achieve long-term goals like retirement.

Investing can be intimidating, especially for beginners, but it doesn't have to be. Start by educating yourself on the basics, such as stocks, bonds, and mutual funds. Consider consulting a financial advisor to help tailor an investment strategy that aligns with your risk tolerance and objectives.

Remember, the sooner you start investing, the more you can benefit from compound interest, which Albert Einstein famously called the "eighth wonder of the world." Even small, regular contributions can grow significantly over time. As Warren Buffett, one of the most successful investors of all time, puts it, "The stock market is designed to transfer money from the Active to the Patient."

Fostering a Proactive Mindset

Finally, achieving financial wellness demands a proactive mindset. This mentality involves being vigilant about financial habits, continuously educating yourself, and adapting strategies as circumstances change. It's about being in control rather than reactive to financial situations.

Stay informed about personal finance trends and updates. Whether through books, podcasts, or financial news, continuous learning can empower you to make informed decisions. Surround yourself with a supportive community, whether that’s friends, family, or online groups, who can offer encouragement and advice.

Remember, financial wellness is a journey, not a destination. It requires ongoing effort and commitment, but the rewards — reduced stress, increased freedom, and the ability to pursue your passions — are well worth it. As you move forward, keep your goals in sight and remain patient and flexible. With determination and a solid plan, you can achieve the balanced financial life you desire.