Empower Your Finances: The Benefits of Sound Financial Planning

Financial planning serves as the foundation for long-term economic security by setting clear financial goals, assessing current finances, and developing strategies to achieve these objectives. It involves risk management, wealth protection, and investment strategies to safeguard against unforeseen events and maximize returns, ultimately providing financial confidence and peace of mind. By aligning financial decisions with life goals, individuals can avoid impulsive spending and maintain stability, as emphasized by financial experts like Dave Ramsey, Warren Buffet, and Suze Orman.

Imagine driving a car with no destination in mind. It might be a fun adventure at first, but eventually, the fuel runs low, and you'll find yourself stranded, unsure of where to go next. This scenario is remarkably similar to navigating life without a financial plan. Without clear financial goals, you might spend your hard-earned money on fleeting desires, only to find yourself financially lost down the road. Financial planning acts as the roadmap, guiding you toward long-term economic security and helping you make informed decisions that align with your life goals.

At its core, financial planning is about setting clear objectives, assessing your current financial situation, and developing strategies to achieve those goals. It’s not just about saving money or investing wisely; it’s about creating a comprehensive plan that takes into account risk management, wealth protection, and investment strategies. Financial experts like Dave Ramsey, Warren Buffet, and Suze Orman emphasize the importance of financial planning in providing confidence and peace of mind, allowing individuals to focus on what truly matters in life.

Understanding Financial Goals

Setting financial goals is the first step in any sound financial plan. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART). For example, instead of vaguely aiming to "save more money," a SMART goal would be to "save $10,000 for a down payment on a house within the next two years." This level of specificity not only clarifies your objectives but also provides a clear timeline to keep you on track.

Financial goals can be short-term, such as building an emergency fund, or long-term, like planning for retirement. By establishing these goals, you create a framework to guide your financial decisions. This helps avoid impulsive spending and ensures that your money is working towards something meaningful. As financial advisor Jane Smith explains, “Having clear financial goals is like setting a destination on your GPS; it helps you stay focused and avoid detours that could derail your financial journey.”

Assessing Your Financial Situation

Before embarking on a financial plan, it's crucial to assess your current financial situation. This involves taking a detailed inventory of your assets, liabilities, income, and expenses. Understanding where you stand financially gives you a solid foundation to build upon and helps identify areas that need improvement.

For instance, calculating your net worth by subtracting liabilities from assets can provide a snapshot of your financial health. It’s a simple yet powerful metric that can highlight whether you’re on track to meet your goals or need to make adjustments. Additionally, reviewing your cash flow helps identify spending habits and areas where you can cut back to increase savings. As Warren Buffet famously advises, “Do not save what is left after spending, but spend what is left after saving.”

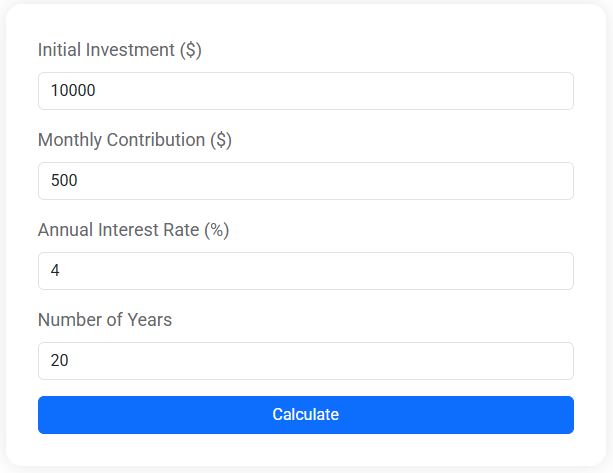

Compound Interest Calculator

Discover how your savings can grow with compound interest. Our free Compound Interest Calculator helps you estimate future investment value based on your initial deposit, monthly contributions, and expected interest rate. Whether you're saving for retirement, a house, or long-term goals, this tool gives you a clear view of your financial growth over time.

Developing a Strategy to Achieve Your Objectives

Once you have a clear picture of your finances and goals, it's time to develop a strategy to achieve them. This involves creating a budget, setting up automated savings, and exploring investment options that align with your risk tolerance and financial objectives. A well-crafted strategy acts as a blueprint, guiding your financial decisions and helping you stay disciplined over the long term.

For example, if your goal is to retire comfortably, you might explore retirement accounts like a 401(k) or IRA, which offer tax advantages and potential employer matches. Suze Orman suggests, “Invest in yourself and your future; it’s the best investment you can make.” By creating a diversified investment portfolio, you can maximize returns while mitigating risk, ensuring your money grows steadily over time.

Risk Management and Wealth Protection

Financial planning isn't just about growing wealth; it's also about protecting it. Risk management involves identifying potential risks to your financial well-being and developing strategies to mitigate them. This can include purchasing insurance, setting up an emergency fund, and regularly reviewing your financial plan to adapt to changing circumstances.

For instance, health insurance protects against unexpected medical expenses, while life insurance provides financial security for your loved ones in the event of your untimely passing. An emergency fund acts as a financial safety net, covering unexpected expenses like car repairs or job loss without derailing your financial plan. As CNBC highlights, “Having an emergency fund can be the difference between a minor setback and a financial disaster.”

Aligning Financial Decisions with Life Goals

One of the most significant benefits of sound financial planning is its ability to align financial decisions with life goals. It’s easy to get caught up in day-to-day expenses or succumb to the temptation of impulse purchases, but having a financial plan helps you stay focused on what truly matters.

By regularly reviewing your financial plan and adjusting it as necessary, you ensure that your financial decisions support your long-term objectives. Whether it's saving for your child's education, buying a dream home, or planning a retirement filled with travel and adventure, financial planning provides the framework to make these dreams a reality. Dave Ramsey often emphasizes the importance of living like no one else now, so later you can live like no one else, highlighting the payoff of disciplined financial planning.

Achieving Financial Confidence and Peace of Mind

Ultimately, the greatest benefit of sound financial planning is the confidence and peace of mind it provides. Knowing that you have a plan in place to achieve your goals and protect against unforeseen events allows you to focus on the present without constantly worrying about the future.

Financial planning empowers you to take control of your finances, make informed decisions, and navigate life's uncertainties with resilience. As you witness your financial goals come to fruition, you gain a sense of accomplishment and security, knowing that you're on the path to long-term economic well-being. In the words of financial expert Jane Smith, “Financial planning is not just about the numbers; it’s about creating a life that reflects your values and aspirations.”