Planning for Success: The Foundation of Financial Stability

Building financial stability is like constructing a house; it requires a solid foundation and thoughtful planning. Key steps include understanding your current financial situation, setting SMART goals, creating a realistic budget, building an emergency fund, and investing for the future. With dedication and discipline, these strategies can help secure a stable financial future and enable you to thrive.

Building financial stability isn't just a lofty goal; it's a necessity in today's fast-paced world. Imagine constructing a house. Would you start by picking out the drapes, or would you first ensure a solid foundation? Financial stability requires the same approach—thoughtful planning and a firm base to support growth and weather storms. While the journey to financial stability can seem daunting, breaking it down into manageable steps can make the process feel less overwhelming and more achievable.

A strong financial foundation allows you to handle life's unexpected challenges with grace, instead of panic. It empowers you to make choices based on goals and values, rather than fear or necessity. By understanding your current financial situation, setting SMART goals, creating a realistic budget, building an emergency fund, and investing wisely, you can secure a stable financial future. Let's explore these steps in detail.

Understanding Your Current Financial Situation

Before you can plan for success, it's crucial to know where you stand financially. This means taking a comprehensive look at your income, expenses, debts, and assets. Start by gathering all relevant financial documents—bank statements, pay stubs, credit card bills, and loan documents. This can seem tedious, but it's akin to drawing a blueprint before building a house.

Once you have a clear picture, calculate your net worth by subtracting liabilities from assets. This number serves as a snapshot of your financial health. According to a study by the Federal Reserve, the average American household's net worth varies widely based on age and income, highlighting the importance of this personalized assessment.

Additionally, track your cash flow to understand how money moves in and out of your accounts. Use apps like Mint or YNAB (You Need A Budget) to simplify this process. As financial advisor Jane Smith explains, "Knowing where your money goes each month is the first step in taking control of your finances."

Setting SMART Goals

Once you understand your financial situation, it's time to set goals—specifically, SMART goals. This acronym stands for Specific, Measurable, Achievable, Relevant, and Time-bound, a framework that transforms vague ambitions into actionable plans.

For example, instead of saying, "I want to save more money," a SMART goal would be, "I will save $5,000 for a vacation by December 2024 by setting aside $250 each month." This goal is specific and measurable, with a clear timeline and actionable steps. It’s also relevant to personal desires and realistically achievable for many.

Setting SMART goals provides clarity and motivation. As you achieve smaller goals, you'll gain confidence and momentum to tackle more significant financial challenges. Remember, goals can be both short-term, like saving for a new gadget, and long-term, such as retirement planning.

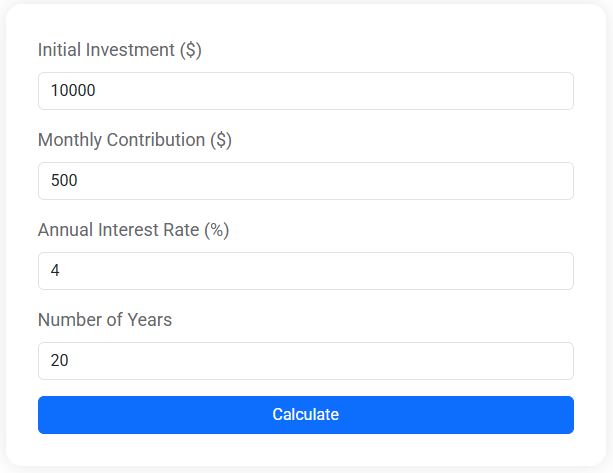

Compound Interest Calculator

Discover how your savings can grow with compound interest. Our free Compound Interest Calculator helps you estimate future investment value based on your initial deposit, monthly contributions, and expected interest rate. Whether you're saving for retirement, a house, or long-term goals, this tool gives you a clear view of your financial growth over time.

Creating a Realistic Budget

With goals in place, the next step is creating a budget that aligns with them. A well-crafted budget is the backbone of financial stability, guiding your spending and saving habits. Think of it as the framework of your financial house, ensuring everything stays in balance.

Begin by listing all sources of income and fixed expenses like rent or mortgage payments, utilities, and insurance. Then, account for variable expenses, such as groceries, entertainment, and dining out. Allocate funds towards your goals, ensuring that savings are treated as a non-negotiable expense.

Many people find the 50/30/20 rule a helpful guideline: allocate 50% of income to necessities, 30% to wants, and 20% to savings and debt repayment. However, this is not a one-size-fits-all solution. Adjust the percentages based on your circumstances and goals. As personal finance guru Dave Ramsey often emphasizes, “A budget is telling your money where to go instead of wondering where it went.”

Building an Emergency Fund

An emergency fund acts as a financial safety net, cushioning against unexpected expenses like medical emergencies, car repairs, or job loss. According to a 2023 report by Bankrate, 56% of Americans cannot cover a $1,000 emergency expense from savings, underscoring the importance of this financial buffer.

Aim to save three to six months' worth of living expenses in a separate, easily accessible account. Start small if necessary. Even setting aside $25 a week will accumulate over time, creating a habit of saving. Once you reach your initial target, you'll find it easier to continue saving.

Consider automating transfers to your emergency fund to ensure consistency. As Warren Buffett wisely noted, “Do not save what is left after spending, but spend what is left after saving.” Prioritizing savings is a cornerstone of financial resilience.

Investing for the Future

With a solid budget and emergency fund in place, it's time to look towards the future. Investing is a critical component of financial stability, enabling you to grow wealth over time and achieve long-term goals like retirement or children's education.

Start by educating yourself about different investment options—stocks, bonds, mutual funds, and real estate. Open a retirement account, such as a 401(k) or IRA, to benefit from tax advantages and compound interest. If your employer offers a 401(k) match, contribute enough to take full advantage of this "free money."

Diversification is key to minimizing risk. As the old adage goes, "Don’t put all your eggs in one basket." Consider your risk tolerance and investment timeline when building a portfolio. If you're unsure where to start, consulting a financial advisor can provide personalized guidance.

Maintaining Dedication and Discipline

Financial stability is not achieved overnight. It requires dedication, discipline, and adaptability. Monitor your progress regularly, adjusting your budget and goals as life circumstances change. Celebrate milestones to maintain motivation and remember that setbacks are part of the journey.

Engage with financial communities, either online or locally, for support and accountability. Sharing experiences and strategies with others can offer new perspectives and encouragement. As best-selling author and financial expert Suze Orman advises, “The key to making money is to stay invested.”

In your quest for financial stability, remember that perfection isn't the goal—progress is. By laying a strong foundation and following through with thoughtful planning, you're not just constructing a house; you're building a future where you can thrive.