Financial Planning Made Easy: Simple Steps to Get Started

Financial planning can be made approachable by breaking it into manageable steps, starting with assessing your financial situation and setting clear, achievable goals. Building an emergency fund, managing debt effectively, and investing wisely are key components of a solid financial strategy. Remember, financial planning is an ongoing process that benefits from regular review and adjustments to stay aligned with your goals.

Financial planning might sound like one of those daunting tasks that’s best left to the professionals, but it doesn’t have to be that way. Picture yourself having a laid-back coffee chat with a friend who just happens to know a thing or two about money. That's the vibe we’re aiming for here. By breaking down financial planning into bite-sized, manageable steps, you can transform it from an overwhelming chore into an empowering journey toward financial security and freedom.

Let’s start with the basics. Think of financial planning as a roadmap to your financial future. It’s about understanding where you are right now, deciding where you want to go, and figuring out how to get there. Like any good road trip, it's not just about the destination but also about enjoying the ride and being prepared for any detours along the way. So, grab your favorite mug, settle in, and let’s explore the simple steps to kick-start your financial planning journey.

Assess Your Current Financial Situation

The first step in any financial plan is to get a clear picture of your current situation. Think of it as taking inventory of your financial health. Start by listing all your assets, such as savings accounts, investments, and any property you own. Then, tally up your liabilities, including debts like student loans, credit cards, and mortgages. The goal is to understand your net worth, which is simply the difference between what you own and what you owe.

Don’t forget to track your income and expenses. This might sound tedious, but it’s crucial for identifying spending patterns and areas where you could cut back. Use budgeting apps like Mint or YNAB (You Need A Budget) to make this process easier. As the personal finance expert Dave Ramsey often says, "You must gain control over your money or the lack of it will forever control you."

Once you have a clear understanding of your financial position, you’ll be better equipped to set realistic and achievable goals. Remember, this is not a one-time exercise but an ongoing process. Regular check-ins will help you stay on track and adjust your plans as needed.

Set Clear, Achievable Goals

With a solid understanding of your financial standing, it’s time to dream big—or small, depending on your comfort level. Goal setting is about turning your dreams into actionable plans. Think about what you want to achieve in the short-term, medium-term, and long-term. Maybe it’s paying off a credit card, saving for a down payment on a house, or building a retirement nest egg.

Use the SMART criteria to guide your goal-setting process: Specific, Measurable, Achievable, Relevant, and Time-bound. For instance, instead of a vague goal like "save more money," aim for "save $5,000 for an emergency fund by the end of the year." This gives you a clear target to work towards and a deadline to keep you motivated.

Remember, your goals should be personal and reflective of your values and priorities. As financial advisor Jane Smith puts it, "Your financial goals should align with what truly matters to you, not what you think should matter based on societal pressures."

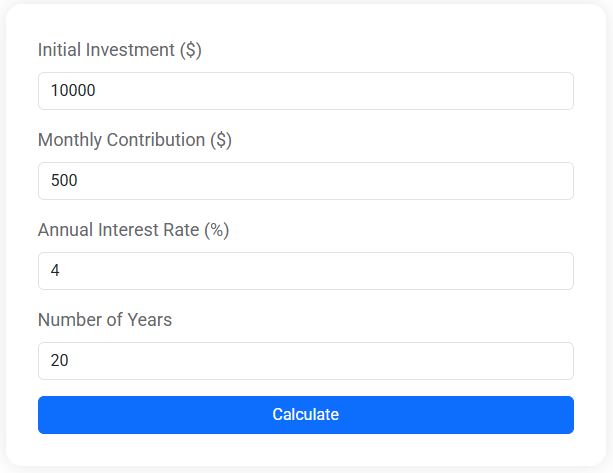

Compound Interest Calculator

Discover how your savings can grow with compound interest. Our free Compound Interest Calculator helps you estimate future investment value based on your initial deposit, monthly contributions, and expected interest rate. Whether you're saving for retirement, a house, or long-term goals, this tool gives you a clear view of your financial growth over time.

Build an Emergency Fund

An emergency fund is like a financial safety net. It provides peace of mind by covering unexpected expenses, such as car repairs or medical bills, without derailing your financial plan. Financial experts generally recommend having three to six months’ worth of living expenses saved up. However, this is just a guideline—your ideal amount may vary based on your personal circumstances, like job stability and family size.

Start small if you need to, even if it’s just $500 to begin with. The important thing is to get started. Automate your savings by setting up a direct deposit into a separate savings account each payday. This way, you won’t be tempted to spend the money elsewhere. CNBC reports that automated savings can significantly increase your chances of reaching your savings goals.

Building an emergency fund isn’t glamorous, but it’s a crucial step in financial planning. It’s like having an umbrella ready for a rainy day—you hope you won’t need it, but you’ll be glad you have it if you do.

Manage Debt Effectively

Debt can be a significant roadblock on your financial journey, but it doesn’t have to be a permanent fixture. The key is to develop a strategy to manage and eventually eliminate it. Start by listing all your debts, from smallest to largest, along with their interest rates. This will help you decide which debt repayment strategy works best for you.

One popular method is the debt snowball, where you focus on paying off the smallest debt first while making minimum payments on the others. This can provide a psychological boost as you see debts disappearing one by one. Alternatively, the debt avalanche method focuses on paying off the debt with the highest interest rate first, which can save you more money in the long run.

Whichever method you choose, consistency is key. Consider consolidating high-interest debts into a lower-interest loan to make repayments more manageable. As with everything in financial planning, the goal is to find a strategy that aligns with your personal situation and motivates you to stick with it.

Invest Wisely for the Future

Investing is a critical component of building wealth over time. While it might seem intimidating at first, it’s worth taking the time to understand the basics. Start by educating yourself on different types of investments, like stocks, bonds, and mutual funds. Online resources, podcasts, and books can be invaluable for this purpose.

Once you’re ready to dive in, consider starting with a retirement account like a 401(k) or an IRA. These accounts offer tax advantages, which can significantly boost your savings over time. If you’re new to investing, index funds or ETFs (Exchange-Traded Funds) can be a great way to start, as they offer diversification and generally lower risk.

Remember, the goal of investing is not to make a quick buck but to build wealth gradually. As Warren Buffett famously advises, "The stock market is designed to transfer money from the Active to the Patient." Stay the course and avoid the temptation to react to short-term market fluctuations.

Review and Adjust Your Plan Regularly

Financial planning isn’t a set-it-and-forget-it type of deal. Life changes, and so will your financial goals and needs. That’s why it’s crucial to review your financial plan regularly—at least once a year. This helps ensure you’re still on track to meet your goals and allows you to make adjustments as necessary.

Perhaps you’ve received a promotion, or your family has grown. These changes might necessitate a shift in your financial priorities. Regular reviews also help you catch any financial missteps early, giving you the chance to correct course before they become bigger issues.

Involving a trusted financial advisor can be beneficial, offering an external perspective and expert advice tailored to your unique situation. However, always remember that you are the captain of your financial ship. Your plan should reflect your aspirations and values.

In the end, financial planning is about empowerment. It’s not about restricting yourself but about making informed choices that align with your life goals. By following these simple steps and staying engaged with the process, you’re setting yourself up for a future of financial security and peace of mind. So, here’s to taking control of your financial future—one step at a time!