Financial Freedom: Key Steps to Effective Financial Planning

Achieving financial freedom requires a strategic plan that includes understanding your current financial situation, setting clear and achievable goals, creating a realistic budget, building an emergency fund, and investing for the future. By regularly reviewing and adjusting your plan, you can effectively manage your finances and work towards long-term financial stability. This ongoing process helps you navigate life's unexpected events and stay on course toward your financial aspirations.

Achieving financial freedom is a goal many of us share. The idea of having enough resources to live comfortably, pursue passions, and weather life's uncertainties without financial stress is undeniably appealing. But getting there isn't just about earning more money; it requires a thoughtful, strategic approach to managing what you have. It's about creating a roadmap that guides you through your financial journey, with clear destinations and flexible pathways.

In this article, we'll explore the key steps to effective financial planning, each essential to reaching financial freedom. We'll delve into understanding your current financial situation, setting achievable goals, crafting a realistic budget, building an emergency fund, and investing wisely for the future. Remember, financial planning is not a one-time task but a continuous process that evolves as your life and circumstances change.

Understanding Your Current Financial Situation

Before you can map out a route to financial freedom, you need to know where you currently stand. This means taking a comprehensive look at your income, expenses, debts, and assets. Start by gathering all your financial statements, including bank accounts, credit cards, loans, and investment accounts. This will give you a clear picture of your cash flow and net worth.

One useful tool is a personal balance sheet, which lists what you own versus what you owe. According to financial experts, understanding this balance is crucial for identifying areas where you can cut back or need to invest more. For instance, if you find your debts outweigh your assets, it might be time to prioritize debt repayment to stabilize your financial footing.

It's also important to track your spending habits. You might be surprised to find where your money actually goes each month. Apps like Mint or YNAB (You Need a Budget) can help categorize expenses and highlight areas for potential savings. This awareness sets the foundation for the next steps in your financial planning journey.

Setting Clear and Achievable Goals

Once you have a solid understanding of your financial position, the next step is to set your financial goals. Goals give you direction and a sense of purpose, whether it’s buying a home, starting a business, retiring comfortably, or traveling the world. The key is to make these goals specific, measurable, achievable, relevant, and time-bound (SMART).

For example, instead of saying “I want to save more money,” a SMART goal would be “I will save $5,000 for a vacation by the end of the year by cutting back on dining out and reallocating that money to my savings account.” This gives you a clear target and a plan to achieve it.

As financial advisor Jane Smith suggests, it's beneficial to categorize your goals into short-term (less than 1 year), medium-term (1-5 years), and long-term (5+ years). This helps in prioritizing and allocating resources effectively. Remember, flexibility is key. Life happens, and your goals might need to shift, but having them in place helps keep you motivated and focused.

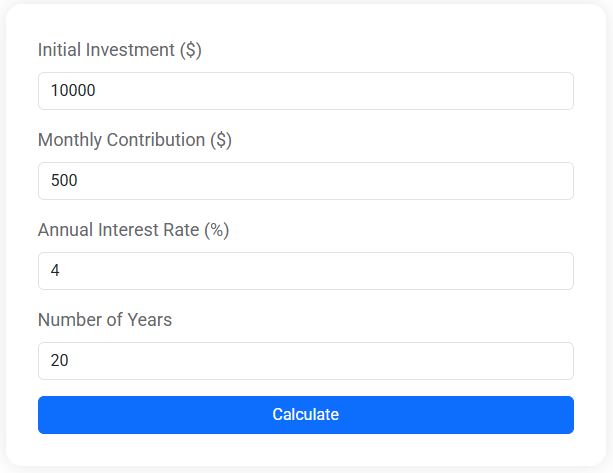

Compound Interest Calculator

Discover how your savings can grow with compound interest. Our free Compound Interest Calculator helps you estimate future investment value based on your initial deposit, monthly contributions, and expected interest rate. Whether you're saving for retirement, a house, or long-term goals, this tool gives you a clear view of your financial growth over time.

Creating a Realistic Budget

With your goals in place, it’s time to create a budget that aligns with them. A budget is essentially a financial blueprint that outlines your income and how you plan to spend it. The challenge is making it realistic enough to stick with yet stringent enough to meet your goals.

Start by listing all your sources of income and fixed expenses like rent, utilities, and loan payments. Then, estimate your variable expenses such as groceries, entertainment, and clothing. The 50/30/20 rule is a popular guideline, suggesting that 50% of your income goes to needs, 30% to wants, and 20% to savings and debt repayment. However, feel free to adjust these percentages based on your personal circumstances and goals.

An anecdote from a friend who successfully paid off her student loans might illustrate the power of budgeting. She set up automatic transfers to a savings account designated for loan payments, effectively treating it as a non-negotiable bill each month. This small adjustment in her budgeting approach helped her clear her debt faster than expected.

Building an Emergency Fund

Life is unpredictable, and having an emergency fund can be a financial lifesaver. It's a stash of money set aside to cover unexpected expenses like medical emergencies, car repairs, or sudden job loss. Ideally, an emergency fund should cover three to six months’ worth of living expenses.

Start building this fund by setting aside a small, manageable amount each month. Even $50 a month can add up over time. Consider keeping this fund in a high-yield savings account, where it can earn some interest but remains easily accessible.

According to CNBC, nearly 40% of Americans would struggle to cover an unexpected $400 expense. Having an emergency fund not only provides financial security but also peace of mind, allowing you to focus on your long-term goals without constant worry about unforeseen expenses derailing your plans.

Investing for the Future

Investing is a powerful way to grow your wealth and achieve financial freedom. It involves putting your money to work in assets like stocks, bonds, real estate, or mutual funds, with the hope of generating returns over time. However, investing can be intimidating, especially with the risks involved.

Start by educating yourself about different investment options and consider consulting a financial advisor to develop a strategy that matches your risk tolerance and goals. Diversification is key; spreading your investments across different asset classes helps mitigate risk.

Retirement accounts like 401(k)s or IRAs offer tax advantages and can be a great starting point for long-term investing. If your employer offers a 401(k) match, take full advantage of it—it's essentially free money. Remember, the earlier you start investing, the more time your money has to grow thanks to compound interest.

Regularly Reviewing and Adjusting Your Plan

Financial planning is not a set-it-and-forget-it deal. It requires regular reviews and adjustments to ensure you’re on track. Life changes—marriage, children, career shifts—can impact your financial situation and goals. Schedule a financial check-up at least once a year to reassess your situation and make necessary adjustments.

During these reviews, compare your current financial status with your goals. Are you saving as planned? Is your investment portfolio aligned with your risk tolerance? Adjust your budget, savings, and investment strategies as needed to stay on course.

According to financial planner Mark Johnson, “Flexibility and adaptability are the cornerstones of effective financial planning.” By staying proactive and open to change, you can navigate life's uncertainties and continue progressing toward financial freedom.

In conclusion, achieving financial freedom is a journey that requires understanding your current financial situation, setting clear goals, creating a realistic budget, building an emergency fund, and investing wisely. By regularly reviewing and adjusting your plan, you can stay on track and work toward a stable and fulfilling financial future. Remember, it's not about perfection but progress. With dedication and discipline, financial freedom is within reach.