Maximizing Your Income: The Role of Financial Planning

Maximizing your income involves strategic financial planning, which includes budgeting, saving, tax planning, and investing wisely to align with your life goals. By setting clear financial goals and regularly reviewing your financial plan, you can ensure your money works harder for you, leading to financial success and stability. Remember, effective management and growth of your income are key to achieving a prosperous future.

Maximizing your income isn't just about earning more money. It's about making smart financial decisions that ensure your hard-earned cash is working as effectively as possible. Imagine your money as a team of employees—each dollar should have a specific job that aligns with your bigger life goals. Whether it's building an emergency fund, planning for retirement, or saving for a dream vacation, strategic financial planning is your game plan for success. But what exactly does this strategy look like in practice, and how can you create a financial plan that truly maximizes your income?

At its core, financial planning is about setting clear, achievable goals and devising a roadmap to reach them. This involves a mix of budgeting, saving, tax planning, and investing wisely. Let’s break down these components to see how each plays a role in getting the most out of your income.

Budgeting: The Foundation of Financial Planning

Budgeting is often touted as the cornerstone of financial planning, and for good reason. A well-crafted budget helps you understand exactly where your money goes every month, allowing you to make informed decisions about your spending. Start by tracking your income and expenses over a few months to get a clear picture of your financial habits. Tools like Mint or YNAB (You Need A Budget) can make this process less daunting.

Once you have a grasp of your spending patterns, categorize your expenses into needs, wants, and savings. This will help you identify areas where you can cut back and redirect funds towards more meaningful goals. For instance, if you notice you're spending $200 a month on dining out, consider cooking more meals at home and saving the difference. Over time, these small adjustments can significantly boost your savings.

Saving: Paying Yourself First

Saving is a crucial component of maximizing your income. The concept of "paying yourself first" involves setting aside a portion of your income for savings before spending on anything else. This approach ensures that your savings grow consistently, rather than being an afterthought at the end of the month.

Consider automating your savings to make this process effortless. Set up automatic transfers from your checking account to a high-yield savings account or an investment vehicle like a Roth IRA. By automating, you're less likely to skip a month or be tempted to spend that money elsewhere. Over time, this habit can lead to a substantial nest egg for future goals.

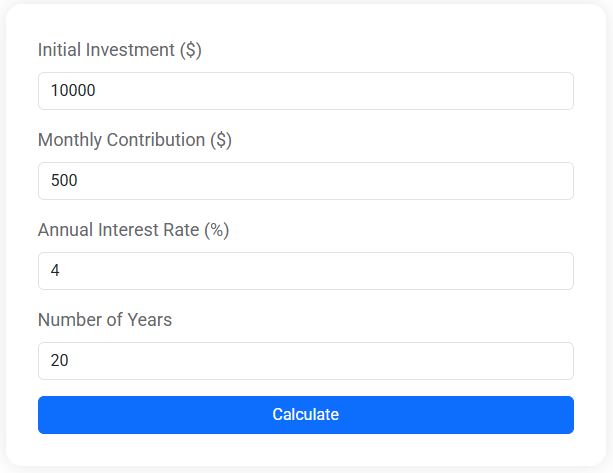

Compound Interest Calculator

Discover how your savings can grow with compound interest. Our free Compound Interest Calculator helps you estimate future investment value based on your initial deposit, monthly contributions, and expected interest rate. Whether you're saving for retirement, a house, or long-term goals, this tool gives you a clear view of your financial growth over time.

Tax Planning: Keeping More of What You Earn

Tax planning might not be the most exciting aspect of financial planning, but it's essential for maximizing your income. Understanding the tax implications of your financial decisions can help you minimize your tax liabilities and keep more of your hard-earned money.

For example, contributing to a retirement account such as a 401(k) or a traditional IRA can reduce your taxable income, potentially lowering your tax bracket. Additionally, if you're a homeowner, taking advantage of mortgage interest deductions can further reduce your tax burden. It's wise to consult with a tax advisor to ensure you're leveraging all available deductions and credits.

Investing: Growing Your Wealth

Investing is the powerhouse of financial planning, offering the potential for your money to grow exponentially over time. The key is to start early and remain consistent, even if you can only invest small amounts initially. As legendary investor Warren Buffett advises, "The best time to plant a tree was 20 years ago. The second-best time is now."

Diversification is crucial when it comes to investing. Spreading your investments across various asset classes—such as stocks, bonds, and real estate—can mitigate risk and improve your chances of steady returns. If you're new to investing, consider starting with low-cost index funds or exchange-traded funds (ETFs), which provide broad market exposure with minimal fees.

Aligning Financial Planning with Life Goals

Effective financial planning aligns with your unique life goals. Whether it's buying a home, starting a business, or retiring early, your financial plan should reflect these aspirations. Start by setting specific, measurable goals with clear timelines. For example, instead of saying, "I want to save for a house," set a goal like, "I want to save $50,000 for a house down payment in five years."

Regularly reviewing and adjusting your financial plan is just as important as setting it. Life circumstances change, and your financial strategy should adapt accordingly. Make it a habit to review your financial goals annually and adjust your budget, savings, and investment strategies as needed. This flexibility ensures that your plan remains relevant and effective.

Seeking Professional Guidance

While it's possible to manage your finances on your own, seeking professional guidance can provide additional insights and strategies. Financial planners and advisors can offer personalized advice tailored to your specific situation and help you navigate complex financial decisions. As certified financial planner Jane Smith suggests, "Think of a financial advisor as a coach who helps you stay accountable and on track towards your financial goals."

When choosing a financial advisor, look for someone with credible qualifications and experience. It's also crucial to find an advisor who takes the time to understand your goals and values, ensuring their advice aligns with your vision for the future.

Conclusion: Building a Prosperous Future

Maximizing your income through strategic financial planning isn't a one-time event; it's an ongoing process that requires attention, flexibility, and commitment. By focusing on budgeting, saving, tax planning, and investing, and aligning these strategies with your life goals, you can create a financial plan that works tirelessly for you. Remember, the ultimate goal is to achieve a prosperous future where financial stress is minimized, and your dreams are within reach. As you embark on this journey, know that every decision you make today paves the way for a more secure and fulfilling tomorrow.