Financial Security 101: The Basics of Creating a Strong Plan

To achieve financial security, it's essential to understand your current financial situation, set clear, achievable goals, and create a budget that allocates your income effectively. Building an emergency fund and investing in diverse portfolios are also crucial steps to safeguard your future. By following these foundational strategies, you can establish a robust financial plan that leads to long-term security and peace of mind.

Picture this: you're sitting at your favorite coffee shop, your drink of choice in hand, pondering the big questions of life. One of those might just be, "How do I secure my financial future?" You're not alone. Financial security is a common goal, but achieving it requires more than just wishing for a winning lottery ticket. It involves understanding your current financial landscape, setting realistic goals, and crafting a plan that's as solid as your go-to java order. Let’s dive into the essentials of building a financial foundation that stands the test of time.

Financial security isn’t just about having money in the bank. It’s about peace of mind, knowing you’ve got a plan that can withstand life's curveballs. It’s about feeling confident that you can handle an unexpected car repair, medical bill, or even a job loss without breaking a sweat. To get there, you need a roadmap, and that's exactly what we're going to create together.

Understand Your Current Financial Situation

Before you can make any meaningful changes, you need to know where you stand. This means taking a detailed look at your finances—the good, the bad, and the ugly. Start by tracking your income and expenses for a month. Use a simple spreadsheet or a budgeting app; whatever makes you feel comfortable. The goal is to see exactly where your money is going and identify any leaks in your spending.

Once you have a clear picture of your cash flow, take stock of your assets and liabilities. Assets include everything you own that has value, like your home, car, and savings account. Liabilities, on the other hand, are your debts—credit cards, student loans, and any other obligations. By subtracting your liabilities from your assets, you’ll arrive at your net worth, which is a crucial number in understanding your financial health.

According to a study by the National Endowment for Financial Education, only about 40% of Americans track their spending. But those who do are more likely to feel confident about their finances. So make this step a priority. It’s your starting point to building a better financial future.

Set Clear, Achievable Goals

With a snapshot of your current situation in hand, it’s time to think about where you want to go. Setting financial goals is key to staying motivated and on track. Start by defining what financial security means to you. Is it being debt-free, having a robust retirement fund, or perhaps buying a home?

Break down your goals into short-term, medium-term, and long-term objectives. Short-term goals might include paying off a credit card or building a small emergency fund. Medium-term goals could be saving for a down payment on a house, while long-term goals often involve retirement planning. Ensure these goals are SMART—specific, measurable, achievable, relevant, and time-bound.

For instance, if one of your goals is to save for a vacation, specify how much you need, by when, and how you’ll save. Instead of saying, "I want to save for a trip," say, "I want to save $3,000 for a vacation in Italy by next year, so I’ll set aside $250 a month." This clarity makes goals tangible and attainable.

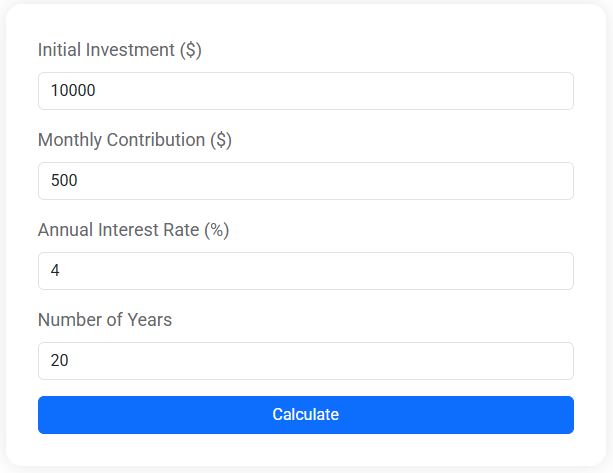

Compound Interest Calculator

Discover how your savings can grow with compound interest. Our free Compound Interest Calculator helps you estimate future investment value based on your initial deposit, monthly contributions, and expected interest rate. Whether you're saving for retirement, a house, or long-term goals, this tool gives you a clear view of your financial growth over time.

Create a Budget That Works for You

A budget is more than just a spreadsheet with numbers; it’s a tool that empowers you to make informed decisions about your money. Start by categorizing your expenses: fixed (rent, mortgage, utilities) and variable (groceries, entertainment). Then, allocate a percentage of your income to each category based on priorities and goals.

One popular method is the 50/30/20 rule, which suggests spending 50% of your income on needs, 30% on wants, and 20% on savings and debt repayment. However, this is a guideline, not a mandate. Tailor it to fit your lifestyle and goals. If paying off debt is a priority, you might adjust to 40/20/40 until you achieve your target.

Remember, a budget isn’t set in stone. Life changes, and so should your budget. Review it regularly and adjust as needed. The key is to stick with it and be honest about your spending habits. As financial advisor Jane Smith puts it, "A budget is a reflection of your values—it shows what you truly care about."

Build an Emergency Fund

Think of an emergency fund as your financial security blanket. It’s there to catch you when life throws unexpected surprises your way. Ideally, aim to save three to six months’ worth of living expenses, but even a small buffer can make a big difference.

Start small if you have to. Set a goal to save $500, then work your way up. Automatically transferring a set amount to a dedicated savings account each month is a painless way to build your fund over time. Keep this money accessible, but separate from your regular checking account to avoid temptation.

An emergency fund is not for vacations or impulse buys—it’s for genuine emergencies like a medical bill or car repair. As CNBC notes, having this fund can prevent you from going into debt when life happens, which is a cornerstone of financial security.

Invest in Diverse Portfolios

Once you've got a handle on your budget and emergency fund, it's time to think about investing. Investing is crucial for growing your wealth and achieving long-term financial security. But don't put all your eggs in one basket. Diversification is key to managing risk.

Your investment strategy should align with your risk tolerance and financial goals. Consider a mix of stocks, bonds, and other assets. Stocks generally offer higher returns but come with more risk, while bonds are more stable but offer lower returns. A balanced portfolio can provide both growth and stability.

If investing seems daunting, you're not alone. Many people feel overwhelmed by the jargon and complexity. Start with small investments in index funds or ETFs, which offer diversification and are less volatile. As you become more comfortable, you can adjust your strategy.

According to Warren Buffet, "Diversification is protection against ignorance." By spreading your investments, you protect yourself from market volatility and increase your chances of a positive return.

Conclusion: Crafting Your Path to Financial Security

Achieving financial security is a journey, not a destination. It requires patience, dedication, and a willingness to adapt. By understanding your current financial situation, setting clear goals, creating a workable budget, building an emergency fund, and investing wisely, you lay the groundwork for a secure financial future.

Remember, the road to financial security is uniquely yours. It's not about perfection, but about progress. Celebrate small victories along the way, and don't hesitate to seek guidance when needed. With each step you take, you're not just building wealth—you're crafting a life of peace and possibility. Here's to your financial freedom!